- Japan

- /

- Metals and Mining

- /

- TSE:5857

Undiscovered Gems With Strong Fundamentals To Explore December 2024

Reviewed by Simply Wall St

As global markets grapple with cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have notably underperformed, reflecting broader investor apprehension. Despite these challenges, the U.S. economy's robust growth and rising consumer spending highlight opportunities for discerning investors to identify stocks with strong fundamentals that may be overlooked in the current market environment. In such times, focusing on companies with solid financial health and resilience can uncover potential gems amidst the volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Galata Wind Enerji (IBSE:GWIND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Galata Wind Enerji A.S. operates and rents electric power plants in Turkey with a market capitalization of TRY16.79 billion.

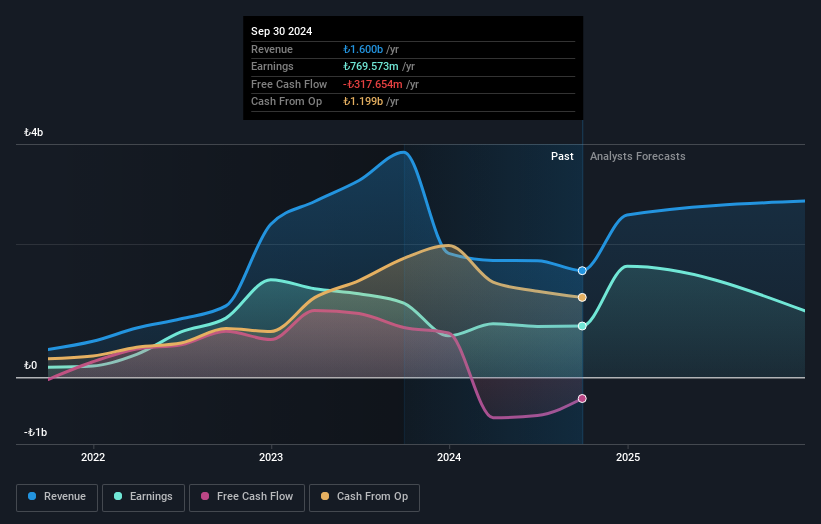

Operations: Galata Wind Enerji generates revenue primarily from electricity generation, amounting to TRY1.60 billion. The company's financial performance can be analyzed through its net profit margin, which provides insights into profitability trends over time.

Galata Wind Enerji, a notable player in the renewable energy sector, has shown resilience despite recent challenges. The company's net debt to equity ratio stands at a satisfactory 6.5%, having significantly decreased from 52.4% over five years, indicating improved financial stability. While earnings growth was negative at -30.9% last year, revenue is expected to grow by 29% annually moving forward. Recent reports show third-quarter sales of TRY 617 million with a net income of TRY 151 million, slightly up from the previous year’s TRY 146 million, reflecting high-quality earnings amidst industry headwinds and forecasted earnings decline of about 5%.

- Navigate through the intricacies of Galata Wind Enerji with our comprehensive health report here.

Assess Galata Wind Enerji's past performance with our detailed historical performance reports.

WELLNEO SUGAR (TSE:2117)

Simply Wall St Value Rating: ★★★★★☆

Overview: WELLNEO SUGAR Co., Ltd. is a company that manufactures and sells sugar and other food products primarily in Japan, with a market cap of ¥73.03 billion.

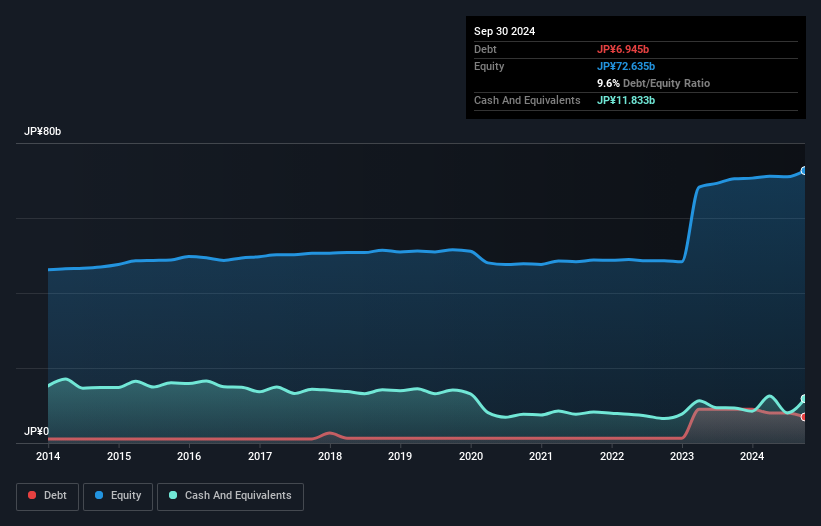

Operations: WELLNEO SUGAR generates revenue primarily through the sale of sugar and food products in Japan. The company has a market capitalization of ¥73.03 billion.

WELLNEO SUGAR has been making waves with a notable earnings growth of 58.8% over the past year, outpacing its industry peers by a significant margin. Despite an increase in its debt-to-equity ratio from 2.5 to 9.6 over five years, the company holds more cash than total debt, suggesting financial stability. Trading at an impressive 94.5% below estimated fair value, it presents potential for substantial upside. Recent board meetings focused on retiring treasury shares and increasing dividends to JPY 56 per share for fiscal year-end March 2025, reflecting confidence in its financial health and prospects for future growth.

- Dive into the specifics of WELLNEO SUGAR here with our thorough health report.

Understand WELLNEO SUGAR's track record by examining our Past report.

ARE Holdings (TSE:5857)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ARE Holdings, Inc. specializes in recycling and selling precious and rare metals across Japan, the rest of Asia, and North America with a market cap of ¥131.39 billion.

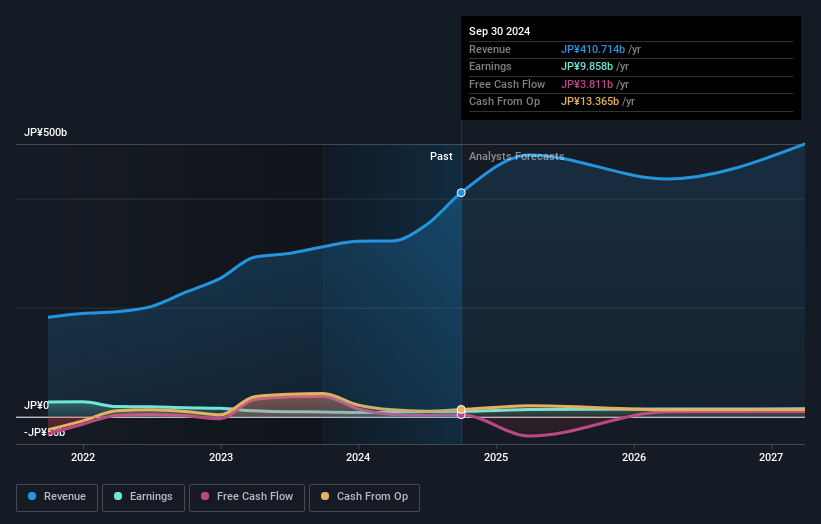

Operations: ARE Holdings generates revenue primarily from recycling and selling precious and rare metals across multiple regions. The company's net profit margin has shown variability, reflecting changes in operational efficiency or market conditions.

ARE Holdings, a player in the metals and mining sector, has shown impressive earnings growth of 10.8% over the past year, outpacing the industry's -13.1%. The company boasts high-quality earnings and has its interest payments well covered by EBIT at an astounding 2711 times. Despite this strength, its net debt to equity ratio remains high at 136%, indicating potential leverage concerns. Recent corporate guidance revisions suggest optimism with expected revenue of ¥480 billion for the full year ending March 2025. However, dividends have decreased from ¥45 to ¥40 per share compared to last year’s second quarter payout.

- Get an in-depth perspective on ARE Holdings' performance by reading our health report here.

Evaluate ARE Holdings' historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock our comprehensive list of 4627 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5857

ARE Holdings

Engages in recycling and selling precious and rare metals in Japan, rest of Asia, and North America.

Adequate balance sheet average dividend payer.