Amidst heightened global trade tensions and economic uncertainties, Asian markets have faced significant volatility, with many indices experiencing notable declines. In such a challenging environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.94% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.75% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.65% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.17% | ★★★★★★ |

| Torigoe (TSE:2009) | 5.34% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.64% | ★★★★★★ |

Click here to see the full list of 1220 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

Nitto Fuji Flour MillingLtd (TSE:2003)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nitto Fuji Flour Milling Co., Ltd. manufactures and sells flour products in Japan with a market cap of ¥61.64 billion.

Operations: Nitto Fuji Flour Milling Co., Ltd. generates revenue through its Flour Milling and Food Business, which accounts for ¥60.24 billion, along with contributions from its Restaurant Business at ¥11.42 billion and Transportation Business at ¥2.00 billion.

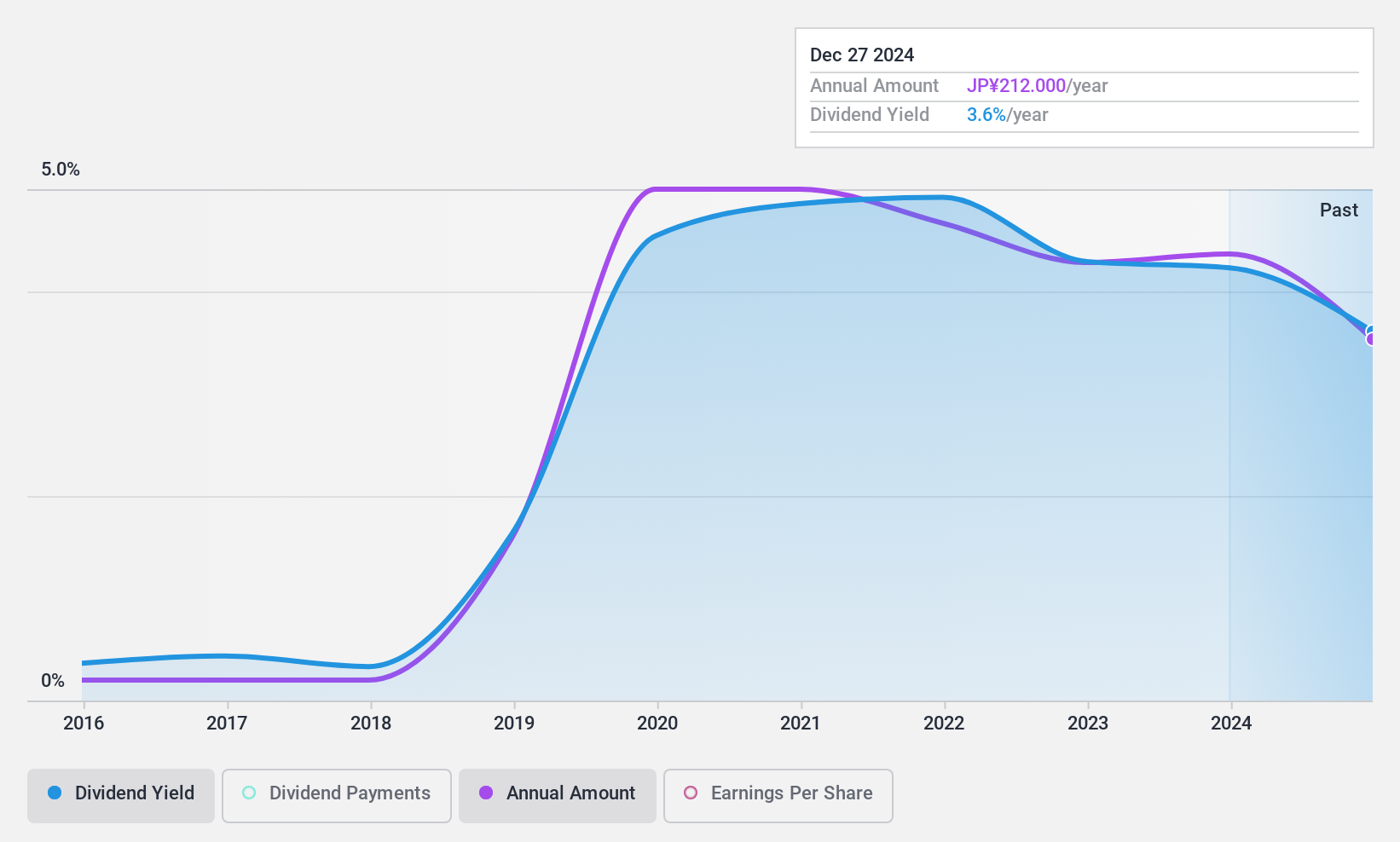

Dividend Yield: 4.1%

Nitto Fuji Flour Milling Ltd. offers a dividend yield of 4.14%, which is slightly below the top quartile in Japan's market. Despite a volatile dividend history, recent payments have been covered by earnings and cash flows with payout ratios of 60.2% and 58.6%, respectively, indicating sustainability. The stock trades at a significant discount to its estimated fair value, while earnings have grown at an annual rate of 4.3% over the past five years, supporting future dividend potential.

- Click here to discover the nuances of Nitto Fuji Flour MillingLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Nitto Fuji Flour MillingLtd is trading behind its estimated value.

Nakano RefrigeratorsLtd (TSE:6411)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nakano Refrigerators Co., Ltd. designs, manufactures, sells, installs, and provides after-sales services for refrigerated showcases, refrigerators, freezers, and related products in Japan with a market cap of ¥26.60 billion.

Operations: Nakano Refrigerators Co., Ltd. generates revenue through the design, manufacturing, sales, installation, and after-sales services of refrigerated showcases, refrigerators, freezers, and related products in Japan.

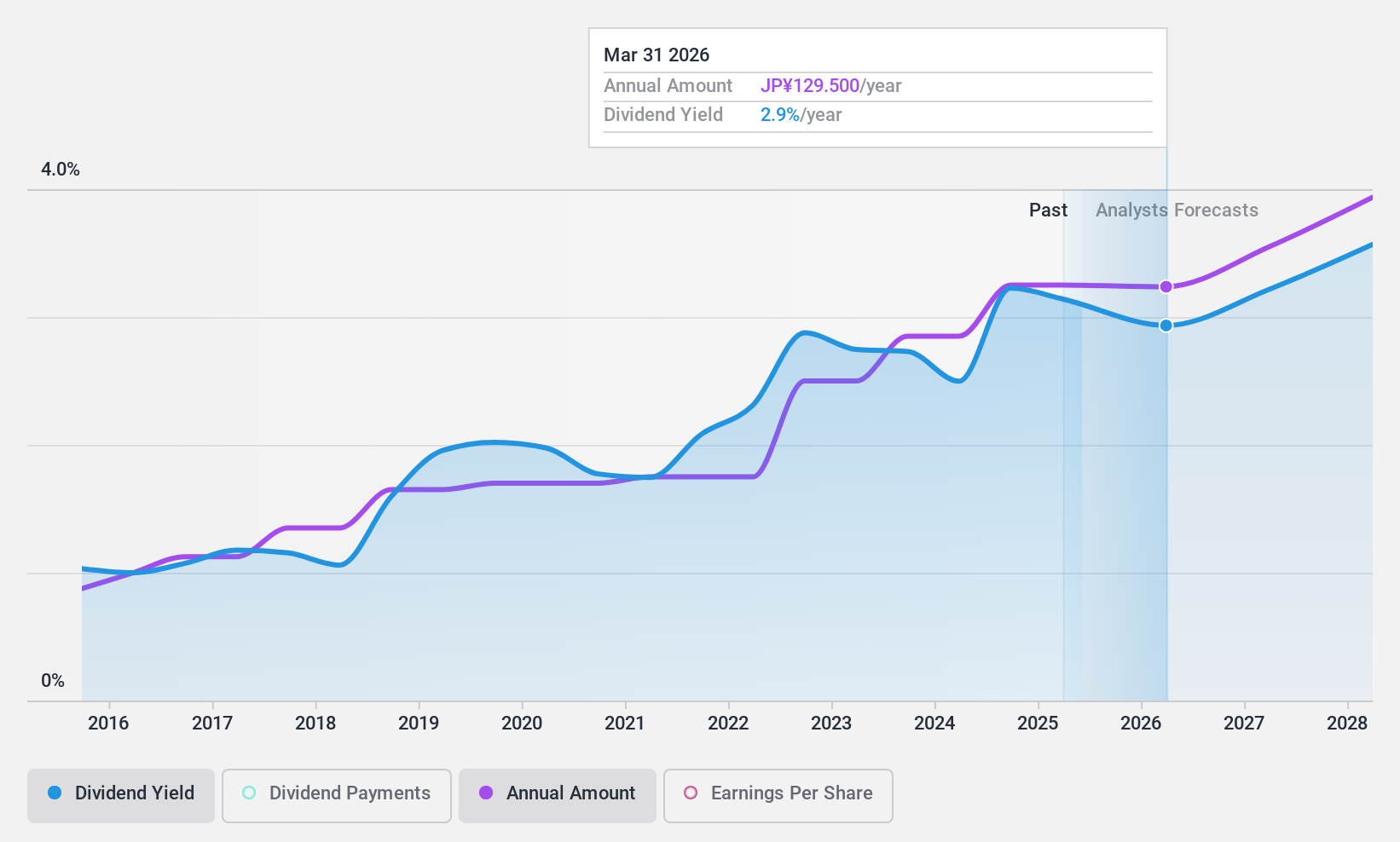

Dividend Yield: 3.9%

Nakano Refrigerators Ltd.'s dividend yield of 3.9% falls short of Japan's top quartile. Despite a decade-long increase in dividends, payments have been volatile and unreliable. The current payout ratio of 79% suggests earnings can cover dividends, while a cash payout ratio of 27.5% indicates strong cash flow support. Trading at a significant discount to its fair value, the company saw earnings grow by 13.1% last year, which could bolster future dividends.

- Navigate through the intricacies of Nakano RefrigeratorsLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that Nakano RefrigeratorsLtd's share price might be on the expensive side.

SundrugLtd (TSE:9989)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sundrug Co., Ltd. operates and manages drug stores and dispensing pharmacies in Japan, with a market cap of ¥496.76 billion.

Operations: Sundrug Co., Ltd. generates revenue through its operations of drug stores and dispensing pharmacies in Japan.

Dividend Yield: 3.1%

Sundrug Ltd. offers a dividend yield of 3.06%, below Japan's top quartile, with stable and reliable payments over the past decade. Despite a low payout ratio of 22.1% indicating earnings coverage, the high cash payout ratio of 746.5% suggests dividends aren't well-supported by free cash flow, raising sustainability concerns. Recent developments include an absorption-type merger with its subsidiary SUNDRUG Saketen LLC, potentially impacting future financials and dividend capacity.

- Delve into the full analysis dividend report here for a deeper understanding of SundrugLtd.

- Upon reviewing our latest valuation report, SundrugLtd's share price might be too optimistic.

Seize The Opportunity

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1217 more companies for you to explore.Click here to unveil our expertly curated list of 1220 Top Asian Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Fuji Flour MillingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2003

Nitto Fuji Flour MillingLtd

Manufactures and sells flour products in Japan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives