- China

- /

- Healthcare Services

- /

- SHSE:603368

Uncovering Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of political developments and economic shifts, major indices like the S&P 500 have reached record highs, buoyed by optimism around potential trade deals and technological advancements. While large-cap stocks have generally outperformed their smaller counterparts, small-cap companies remain a fertile ground for uncovering lesser-known opportunities that may benefit from these broader market trends. In this dynamic environment, identifying promising small-cap stocks involves looking for those with strong fundamentals and unique growth drivers that align with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 46.58% | 6.59% | 23.75% | ★★★★★★ |

| Korea Ratings | NA | 0.84% | 0.92% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 7.52% | 53.96% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Guangxi LiuYao Group (SHSE:603368)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi LiuYao Group Co., Ltd is involved in the wholesale and retail of pharmaceutical products in China, with a market cap of CN¥7.00 billion.

Operations: The company generates revenue primarily through its pharmaceutical wholesale and retail operations in China. It has a market capitalization of CN¥7.00 billion.

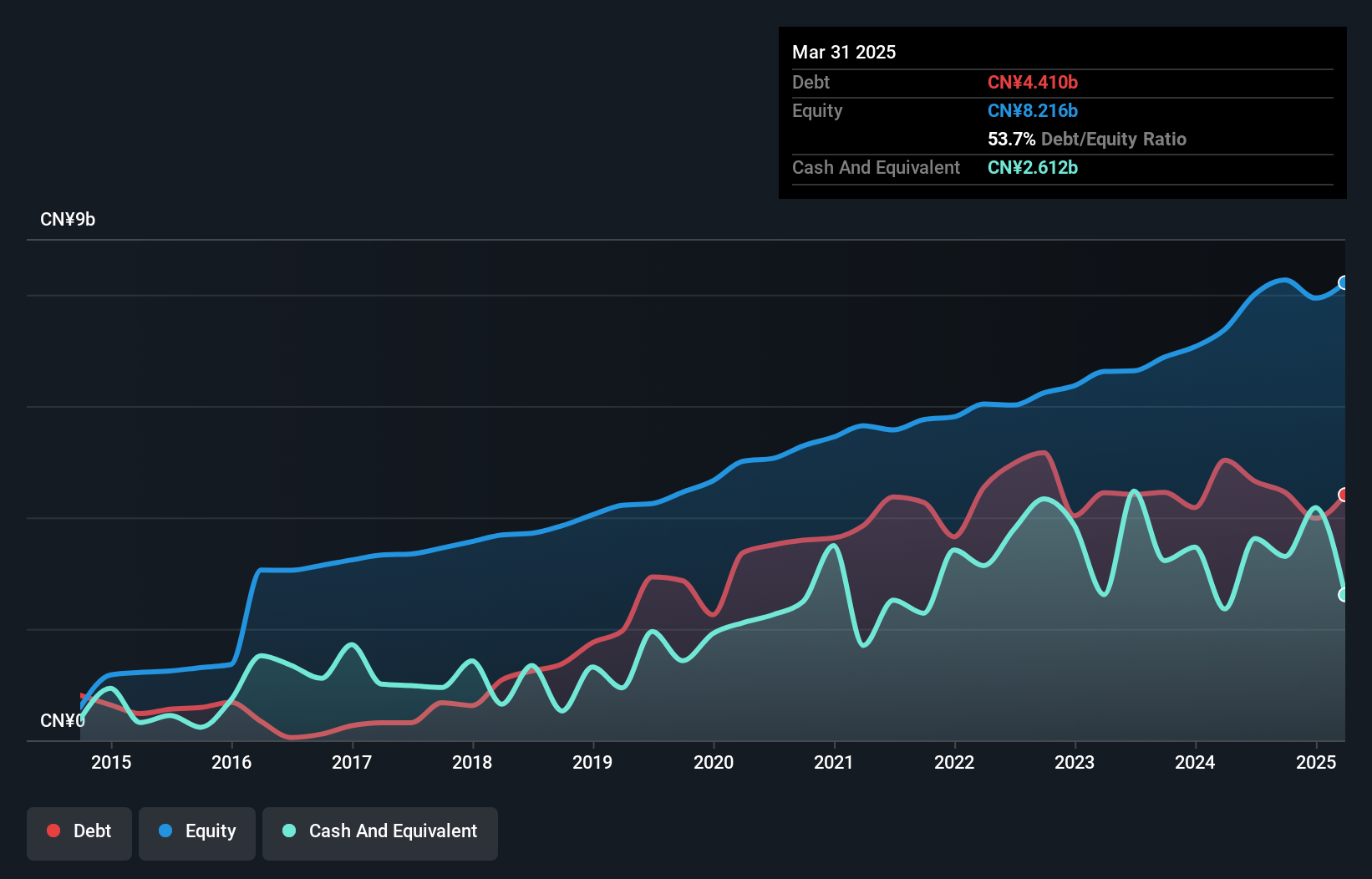

Guangxi LiuYao Group, a notable player in the healthcare sector, showcases strong financial health with a net debt to equity ratio of 13.9%, considered satisfactory. Its earnings surged by 11% over the past year, outperforming the broader industry which saw a -5.7% change. The company's price-to-earnings ratio stands at 7.9x, significantly lower than China's market average of 34.7x, indicating good value relative to peers and industry standards. With high-quality earnings and positive free cash flow, Guangxi LiuYao seems well-positioned for future growth as it forecasts an annual earnings increase of 16%.

Nippn (TSE:2001)

Simply Wall St Value Rating: ★★★★★★

Overview: Nippn Corporation operates in the flour milling and food sectors both within Japan and internationally, with a market capitalization of ¥168.67 billion.

Operations: Nippn generates revenue primarily from its Food Business, which contributes ¥234.41 billion, followed by the Flour Milling Business at ¥126.16 billion.

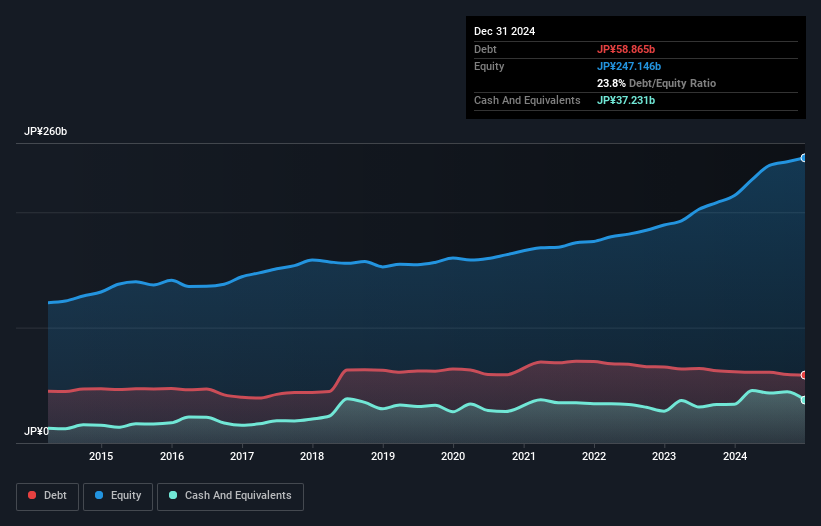

Nippn, a relatively small player in the food industry, has demonstrated impressive earnings growth of 131.5% over the past year, outpacing the industry's 20.3%. Despite this surge, a ¥21.7B one-off gain significantly impacted recent financial results through September 2024. The company's debt profile is sound with a net debt to equity ratio of 6.1%, deemed satisfactory and reduced from 39.8% five years ago to 24.3%. However, while trading at an attractive value—72.8% below estimated fair value—future earnings are projected to decline by an average of 20.8% annually over the next three years.

- Get an in-depth perspective on Nippn's performance by reading our health report here.

Explore historical data to track Nippn's performance over time in our Past section.

Kiyo Bank (TSE:8370)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Kiyo Bank, Ltd. operates as a provider of diverse banking products and services for individuals, corporates, and business clients in Japan with a market capitalization of ¥141.84 billion.

Operations: Kiyo Bank generates revenue primarily from its banking segment, amounting to ¥73.12 billion.

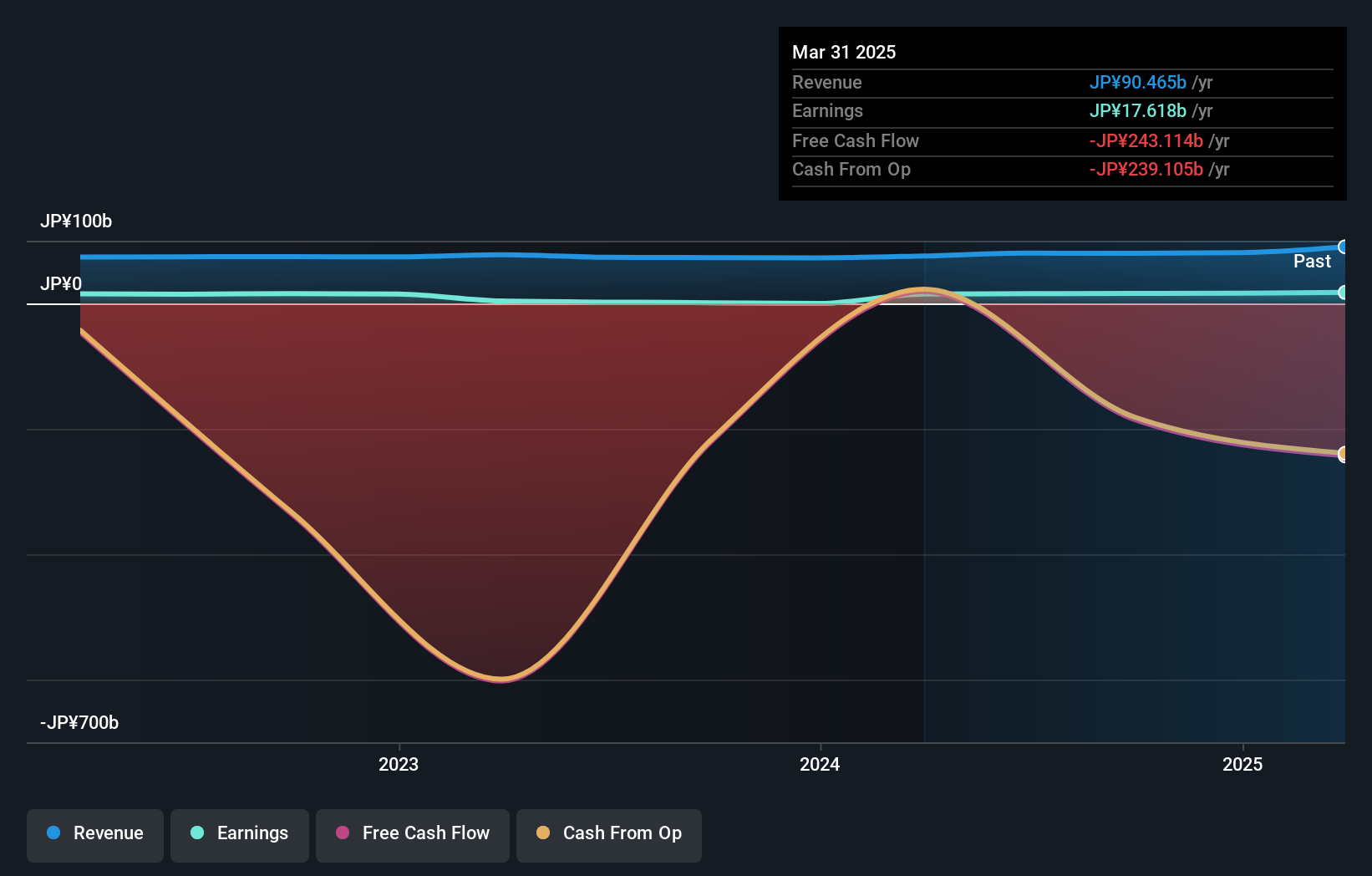

Kiyo Bank, with total assets of ¥5,805.5 billion and equity of ¥240.3 billion, is a financial institution that has seen its earnings grow by an impressive 1300% over the past year, outpacing the industry average of 22.6%. Despite trading at 43.6% below its estimated fair value and having high-quality past earnings, the bank faces challenges with insufficient bad loan allowances at 1.6% of total loans and a net interest margin of just 0.9%. Recently, Kiyo completed a share buyback program repurchasing approximately 2.54% for ¥2,999 million between October and November 2024.

- Dive into the specifics of Kiyo Bank here with our thorough health report.

Understand Kiyo Bank's track record by examining our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4667 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603368

Guangxi LiuYao Group

Engages in the wholesale and retail of pharmaceutical products in China.

6 star dividend payer and undervalued.

Market Insights

Community Narratives