As global markets continue to reach new heights, buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence, small-cap stocks have been somewhat overshadowed despite their potential for growth. In this environment of heightened investor sentiment and economic shifts, identifying undiscovered gems within the small-cap sector requires a keen eye for companies that demonstrate resilience and innovation amidst broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhongmin Energy (SHSE:600163)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongmin Energy Co., Ltd. specializes in the development and construction of power generation projects in China, with a market capitalization of CN¥10.49 billion.

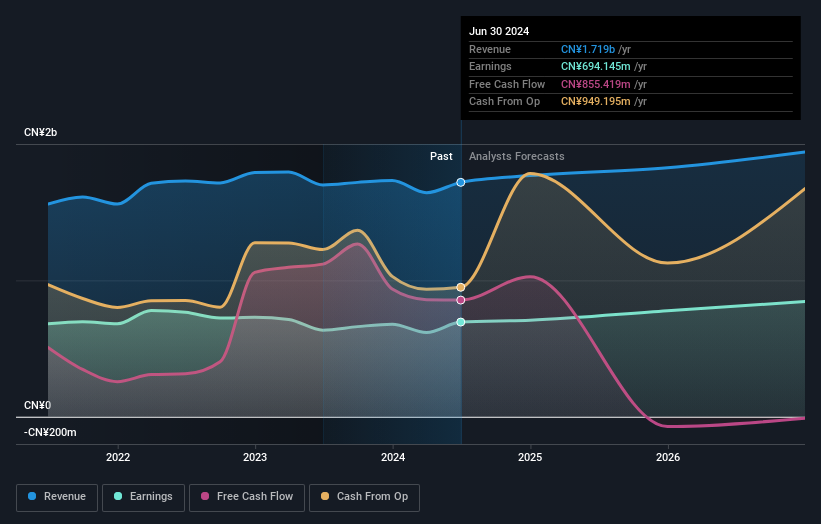

Operations: Zhongmin Energy generates revenue primarily from its electricity segment, amounting to CN¥1.72 billion.

Zhongmin Energy, a smaller player in the renewable energy sector, shows a promising yet mixed financial landscape. Over the past five years, its earnings have grown by 18.2% annually, reflecting robust performance. However, recent earnings growth of 6.4% fell short of the industry average of 6.8%. The company trades at an attractive valuation, being 88.5% below estimated fair value while maintaining a satisfactory net debt to equity ratio of 33.6%. For the first nine months of 2024, Zhongmin reported net income of CNY 409 million with basic earnings per share rising to CNY 0.215 from CNY 0.2022 last year.

- Take a closer look at Zhongmin Energy's potential here in our health report.

Review our historical performance report to gain insights into Zhongmin Energy's's past performance.

Maruha Nichiro (TSE:1333)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Maruha Nichiro Corporation operates in the fishing, fish farming, food processing, trading, meat products, and distribution sectors both in Japan and internationally with a market cap of ¥149.14 billion.

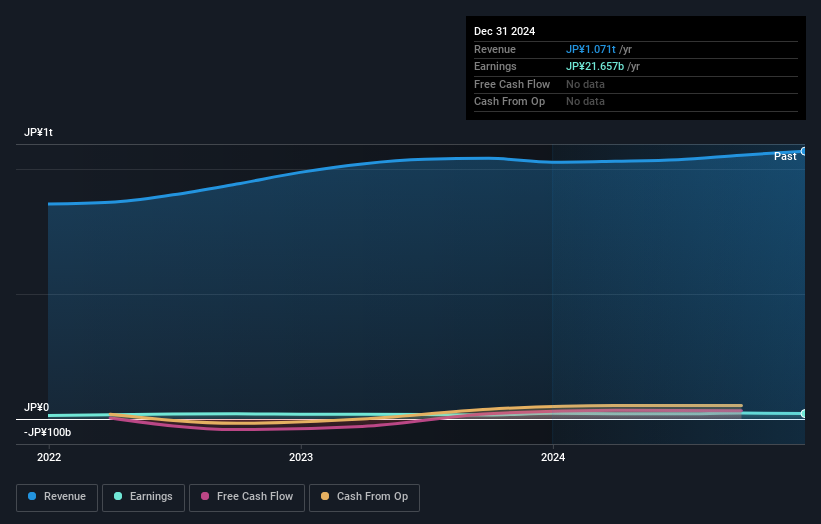

Operations: The company generates revenue from its diverse operations in fishing, fish farming, food processing, trading, meat products, and distribution. The net profit margin is a key financial metric to consider.

Maruha Nichiro, a noteworthy player in the food sector, has demonstrated robust earnings growth of 45% over the past year, outpacing the industry average of 20%. The company’s debt to equity ratio has impressively decreased from 175% to 108% over five years. However, its net debt to equity remains high at 92%, suggesting leverage concerns. A notable ¥15 billion one-off gain impacted recent financial results, hinting at non-recurring income influences. Despite these factors, Maruha Nichiro trades significantly below estimated fair value and maintains strong interest coverage with EBIT covering interest payments by nearly eleven times.

- Delve into the full analysis health report here for a deeper understanding of Maruha Nichiro.

Examine Maruha Nichiro's past performance report to understand how it has performed in the past.

Dai-Dan (TSE:1980)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dai-Dan Co., Ltd. specializes in the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities works in Japan with a market cap of ¥153.75 billion.

Operations: Dai-Dan generates revenue primarily from its construction services in electrical, air conditioning, plumbing and sanitary, and firefighting facilities. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

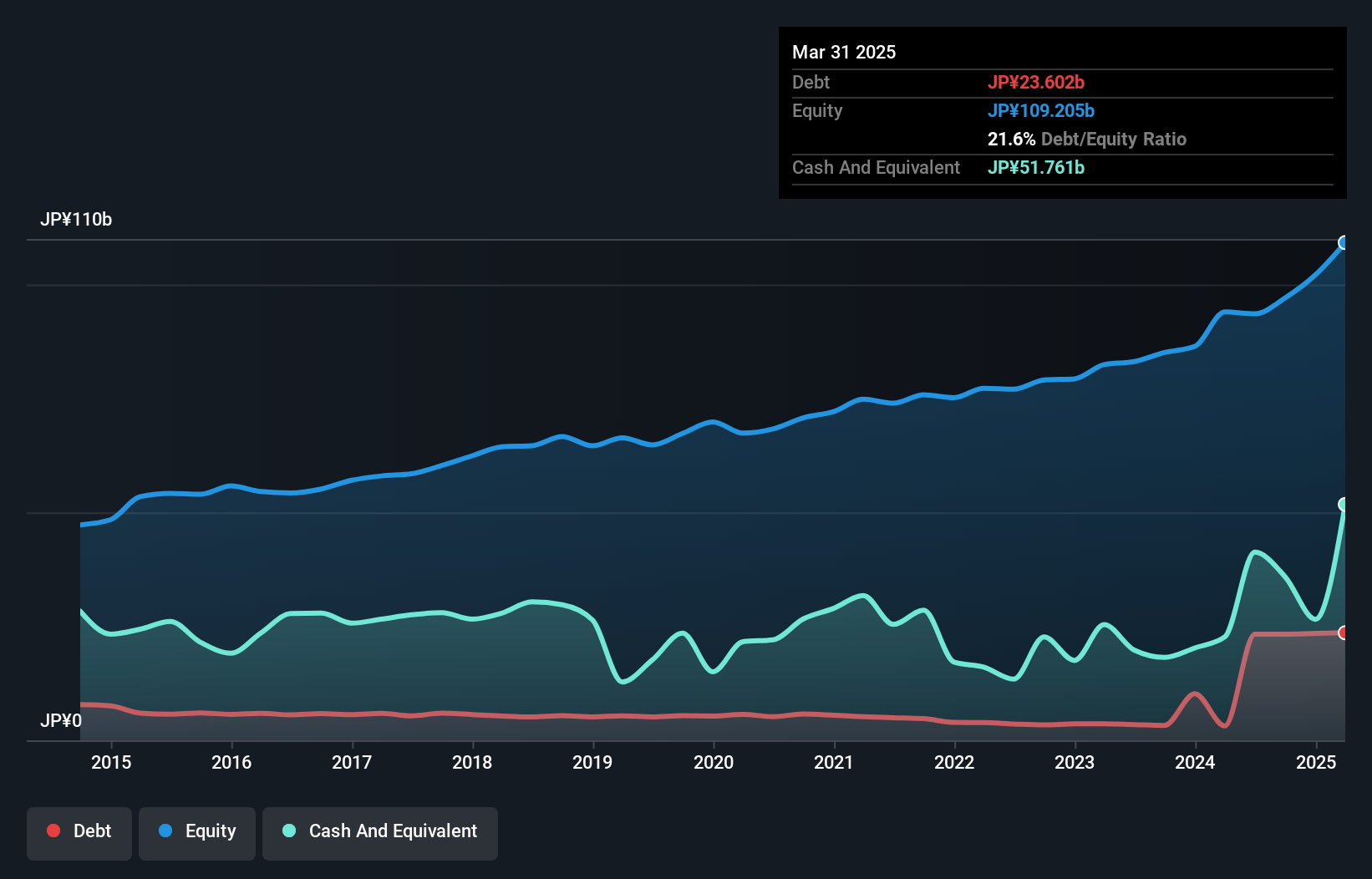

Dai-Dan, a smaller player in the construction sector, has shown impressive earnings growth of 102% over the past year, outpacing its industry peers. Despite an increase in its debt to equity ratio from 8% to 24% over five years, it holds more cash than total debt and comfortably covers interest payments. Trading at about 38% below estimated fair value suggests potential upside. Recent guidance forecasts net sales of ¥250 billion and operating profit of ¥17.5 billion for fiscal year ending March 2025. Additionally, dividends have increased significantly to ¥71 per share from last year's ¥48 per share.

- Click here and access our complete health analysis report to understand the dynamics of Dai-Dan.

Gain insights into Dai-Dan's past trends and performance with our Past report.

Taking Advantage

- Navigate through the entire inventory of 4670 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Maruha Nichiro, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1333

Maruha Nichiro

Engages in the fishing, fish farming, food processing, trading, meat products, and distribution businesses in Japan and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives