- Japan

- /

- Professional Services

- /

- TSE:2168

Maruha Nichiro Plus 2 Other Small Cap Gems with Robust Metrics

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced heightened volatility, with indices like the S&P 600 experiencing notable declines amid cautious Federal Reserve commentary and political uncertainties. Despite these challenges, certain small-cap companies continue to demonstrate robust financial metrics that can make them attractive in a turbulent environment. Identifying such stocks involves focusing on strong fundamentals and resilience to macroeconomic pressures, as exemplified by Maruha Nichiro and two other promising small-cap gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Maruha Nichiro (TSE:1333)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Maruha Nichiro Corporation operates in the fishing, fish farming, food processing, trading, meat products, and distribution sectors both in Japan and internationally with a market cap of ¥1.49 billion.

Operations: Maruha Nichiro generates revenue primarily from its diverse operations across fishing, fish farming, food processing, trading, meat products, and distribution sectors. The company's net profit margin reflects its financial efficiency in managing costs relative to its total revenue. With a market cap of ¥148.69 billion, it plays a significant role in the global seafood and food production industry.

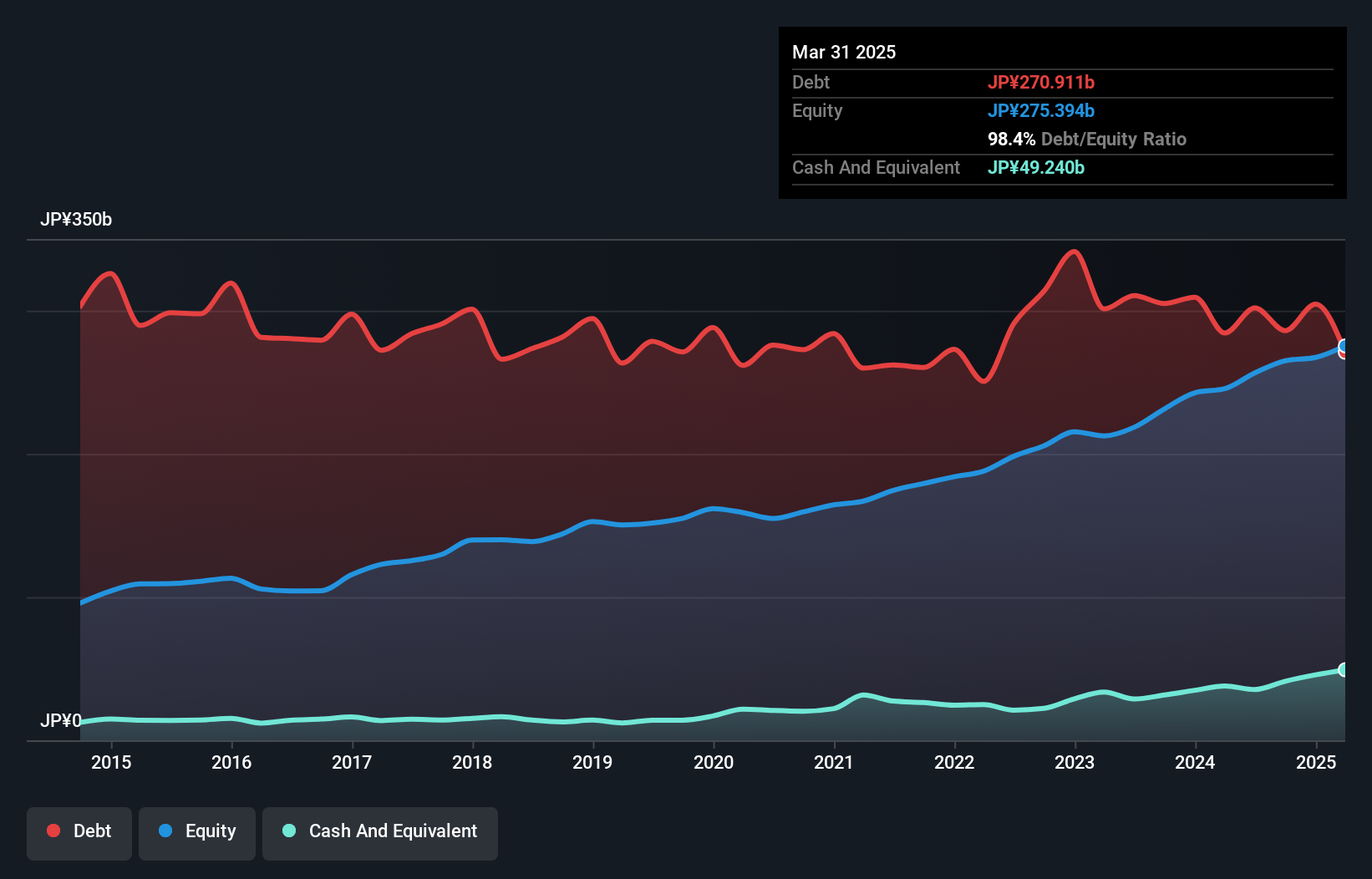

Maruha Nichiro, a smaller player in the food industry, has shown impressive financial resilience. Over the past year, its earnings surged by 45%, outpacing the industry's 19.5% growth rate. The company achieved a significant one-off gain of ¥15 billion, which likely boosted its recent financial results. Despite a high net debt to equity ratio of 92%, interest payments are well covered with EBIT at 10.8 times coverage, indicating solid operational efficiency. Trading at nearly 91% below estimated fair value suggests potential undervaluation for investors seeking hidden opportunities in this sector.

- Click here to discover the nuances of Maruha Nichiro with our detailed analytical health report.

Review our historical performance report to gain insights into Maruha Nichiro's's past performance.

Pasona Group (TSE:2168)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pasona Group Inc. operates in Japan, offering human resources, temporary staffing, and outsourcing services through its subsidiaries, with a market cap of ¥78.39 billion.

Operations: Pasona Group derives its revenue primarily from HR Solution - Expert Service, BPO Services, Others segment amounting to ¥292.34 billion and HR Solutions - Career Solutions at ¥13.01 billion. The company also generates income from Life Solutions and Regional Revitalization Solutions segments, contributing ¥7.92 billion and ¥6.33 billion respectively.

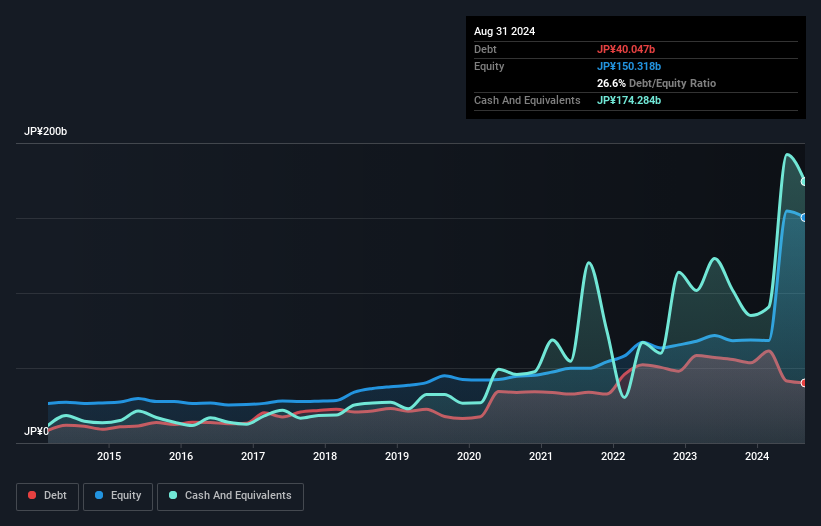

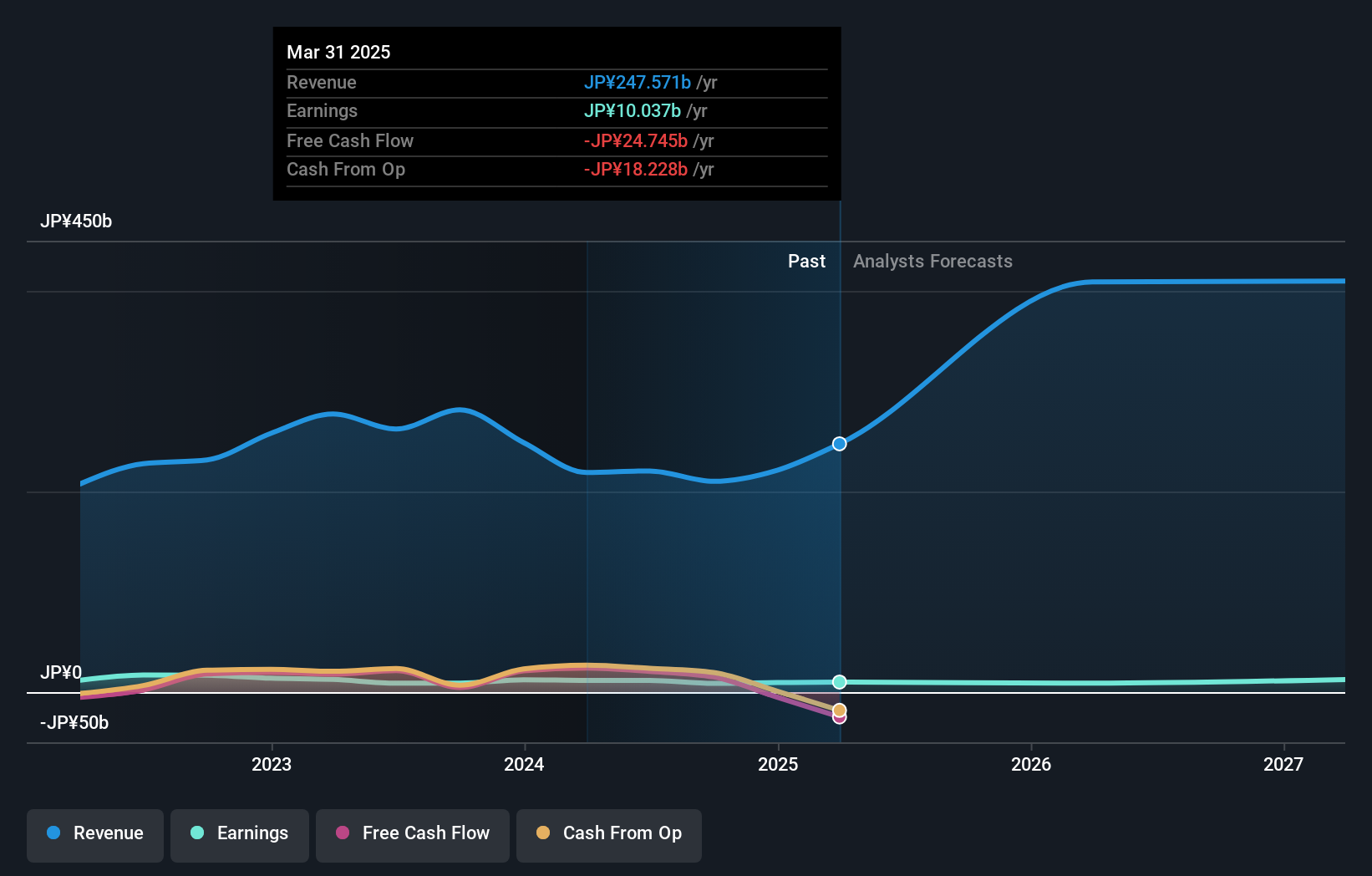

Pasona Group's financial landscape highlights a compelling narrative. With earnings skyrocketing by 1792.9% over the past year, it outpaced its industry peers significantly. The debt to equity ratio has improved from 39.5% to 26.6% over five years, indicating prudent financial management. Despite the impressive growth, a ¥99.2 billion one-off gain skews recent results, suggesting caution in interpreting these figures as sustainable performance indicators. Trading at a price-to-earnings ratio of 0.9x compared to the JP market average of 13.5x suggests good relative value, though future earnings are expected to decline substantially by an average of 152.3% per year for three years ahead.

- Click to explore a detailed breakdown of our findings in Pasona Group's health report.

Gain insights into Pasona Group's historical performance by reviewing our past performance report.

Hosiden (TSE:6804)

Simply Wall St Value Rating: ★★★★★★

Overview: Hosiden Corporation develops, manufactures, and sells electronic components in Japan and internationally with a market cap of ¥117.98 billion.

Operations: The primary revenue streams for Hosiden Corporation include Mechanical Parts and Audio Parts, generating ¥174.75 billion and ¥21.72 billion respectively. Display Parts contribute a smaller portion with revenues of ¥2.61 billion, while Composite Parts and Others add ¥11.09 billion to the total revenue mix.

Hosiden, a notable player in the electronics sector, presents an intriguing profile. Recently, it completed a share repurchase of 1.25 million shares for ¥2.99 billion to enhance shareholder returns and capital efficiency. The company's debt-to-equity ratio significantly improved from 13% to 0.8% over five years, indicating robust financial management. Despite negative earnings growth of -3% last year compared to the industry's -2%, Hosiden's forecasted annual earnings growth is pegged at an impressive 32%. Trading at 54% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space.

- Delve into the full analysis health report here for a deeper understanding of Hosiden.

Examine Hosiden's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Investigate our full lineup of 4628 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2168

Pasona Group

Engages in the provision of human resources, temporary staffing, and contracting and outsourcing services in Japan.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives