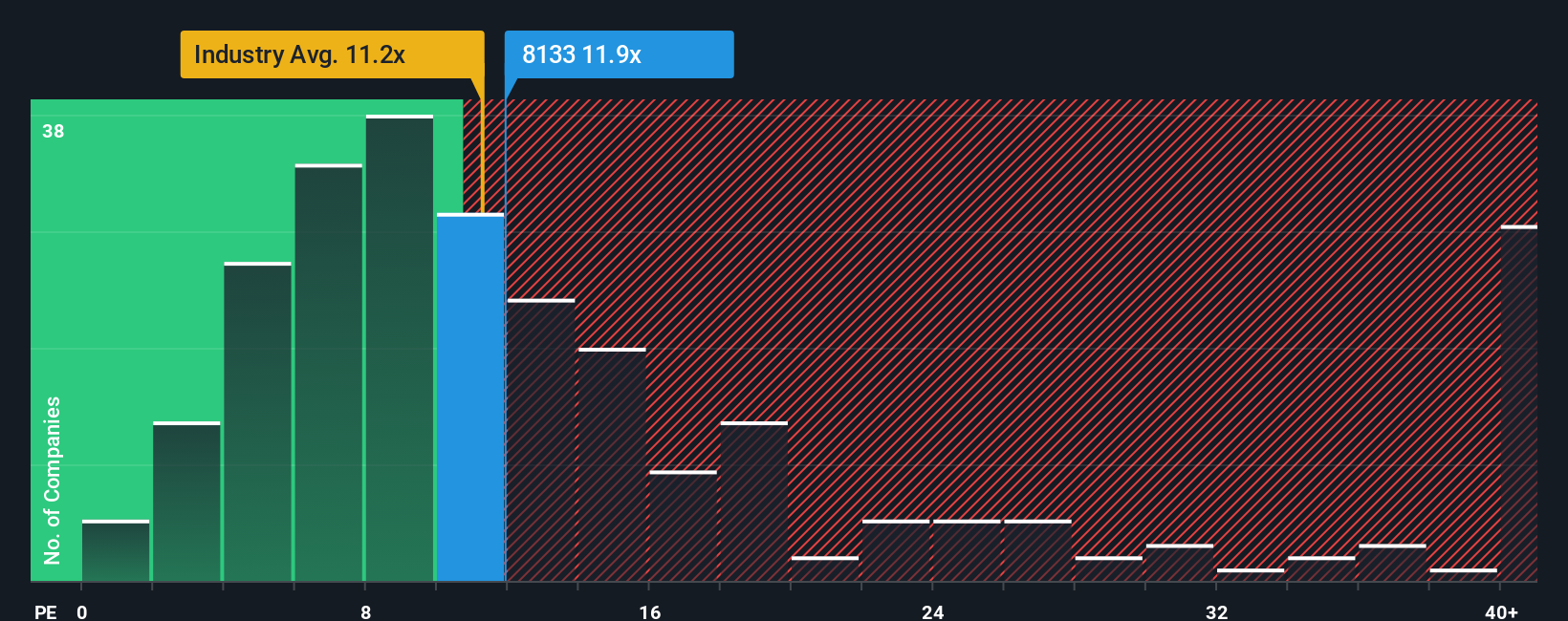

There wouldn't be many who think Itochu Enex Co.,Ltd.'s (TSE:8133) price-to-earnings (or "P/E") ratio of 11.9x is worth a mention when the median P/E in Japan is similar at about 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The earnings growth achieved at Itochu EnexLtd over the last year would be more than acceptable for most companies. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for Itochu EnexLtd

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Itochu EnexLtd would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. EPS has also lifted 30% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 7.8% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we can see why Itochu EnexLtd is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From Itochu EnexLtd's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Itochu EnexLtd maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Itochu EnexLtd with six simple checks on some of these key factors.

You might be able to find a better investment than Itochu EnexLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8133

Itochu EnexLtd

Engages in the sale of petroleum products and liquefied petroleum gas (LPG), electricity, heat supply, vehicle sales in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success