- Japan

- /

- Oil and Gas

- /

- TSE:8097

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic signals. While U.S. stocks faced downward pressure due to tariff announcements, European indices showed resilience, and China's market benefited from strong consumer spending during the Lunar New Year holiday. In this environment, dividend stocks can offer investors a measure of stability and income potential, especially as they seek reliable returns amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

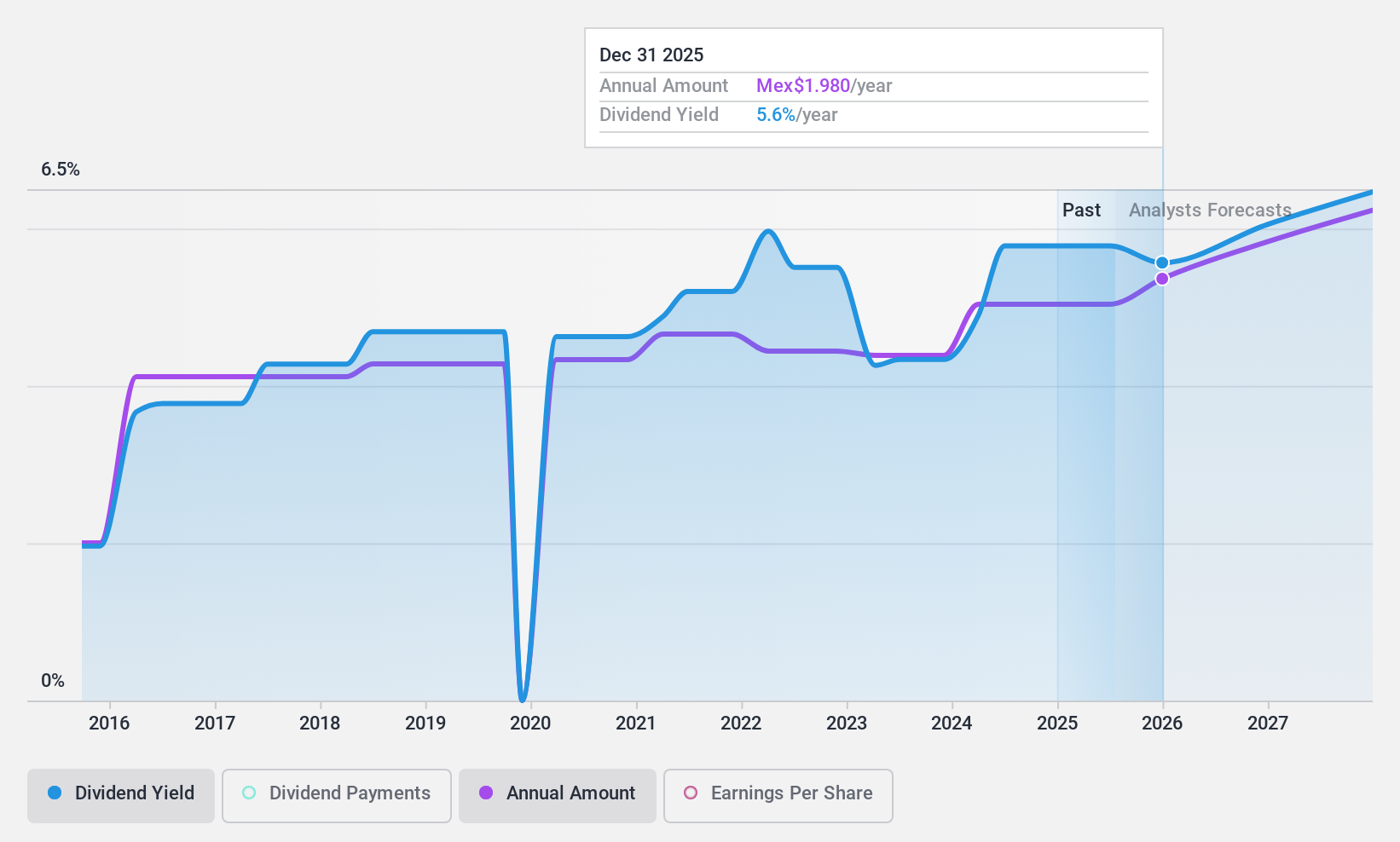

Kimberly-Clark de México S. A. B. de C. V (BMV:KIMBER A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kimberly-Clark de México, S. A. B. de C. V., along with its subsidiaries, manufactures, distributes, and sells disposable products in Mexico with a market cap of MX$91 billion.

Operations: Kimberly-Clark de México S. A. B. de C. V.'s revenue segments include Consumer Products at MX$44 billion, Professional at MX$5.55 billion, and Export at MX$4.83 billion.

Dividend Yield: 5.8%

Kimberly-Clark de México S. A. B. de C. V.'s dividend yield of 5.84% is below the top quartile in the MX market, but its dividends are covered by earnings and cash flows with payout ratios of 71.8% and 64.1%, respectively, suggesting sustainability despite a high debt level and volatile history over the past decade. The stock trades at a discount to its estimated fair value, while recent earnings growth of 22.5% may support future payouts amidst analyst optimism for price appreciation.

- Dive into the specifics of Kimberly-Clark de México S. A. B. de C. V here with our thorough dividend report.

- The analysis detailed in our Kimberly-Clark de México S. A. B. de C. V valuation report hints at an deflated share price compared to its estimated value.

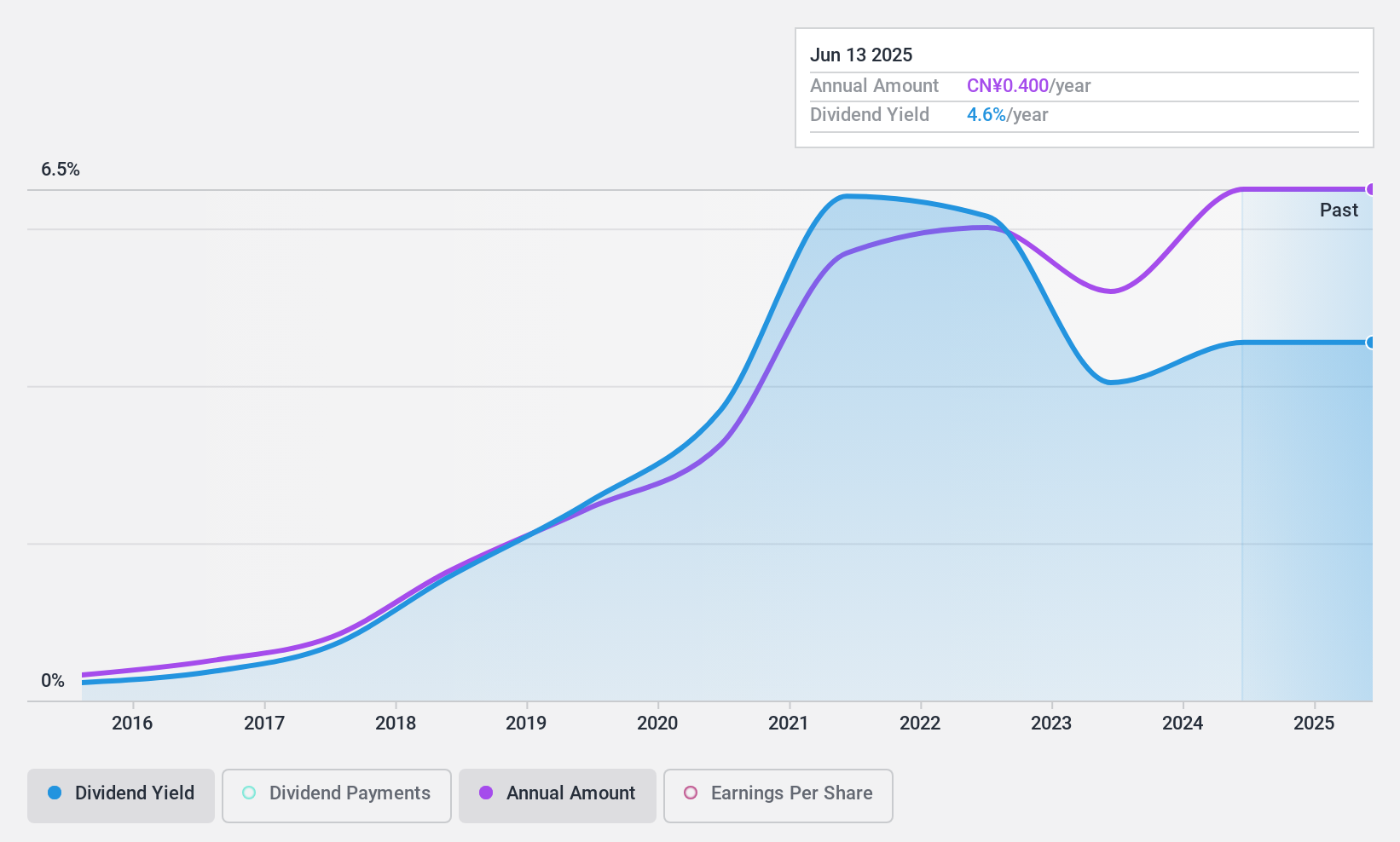

Changjiang Publishing & MediaLtd (SHSE:600757)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Changjiang Publishing & Media Co., Ltd is a publishing company operating in China with a market cap of CN¥11.08 billion.

Operations: Changjiang Publishing & Media Co., Ltd generates its revenue from various segments within the publishing industry in China.

Dividend Yield: 4.4%

Changjiang Publishing & Media's dividend yield of 4.38% ranks in the top 25% of CN market payers. While its dividends have been stable and growing over the past decade, they are not well covered by free cash flows due to a high cash payout ratio of 173.7%. However, with a reasonable earnings payout ratio of 55.6%, dividends are supported by earnings despite concerns about sustainability from cash flow coverage. The stock trades at good value compared to peers and industry averages.

- Click here to discover the nuances of Changjiang Publishing & MediaLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Changjiang Publishing & MediaLtd is trading behind its estimated value.

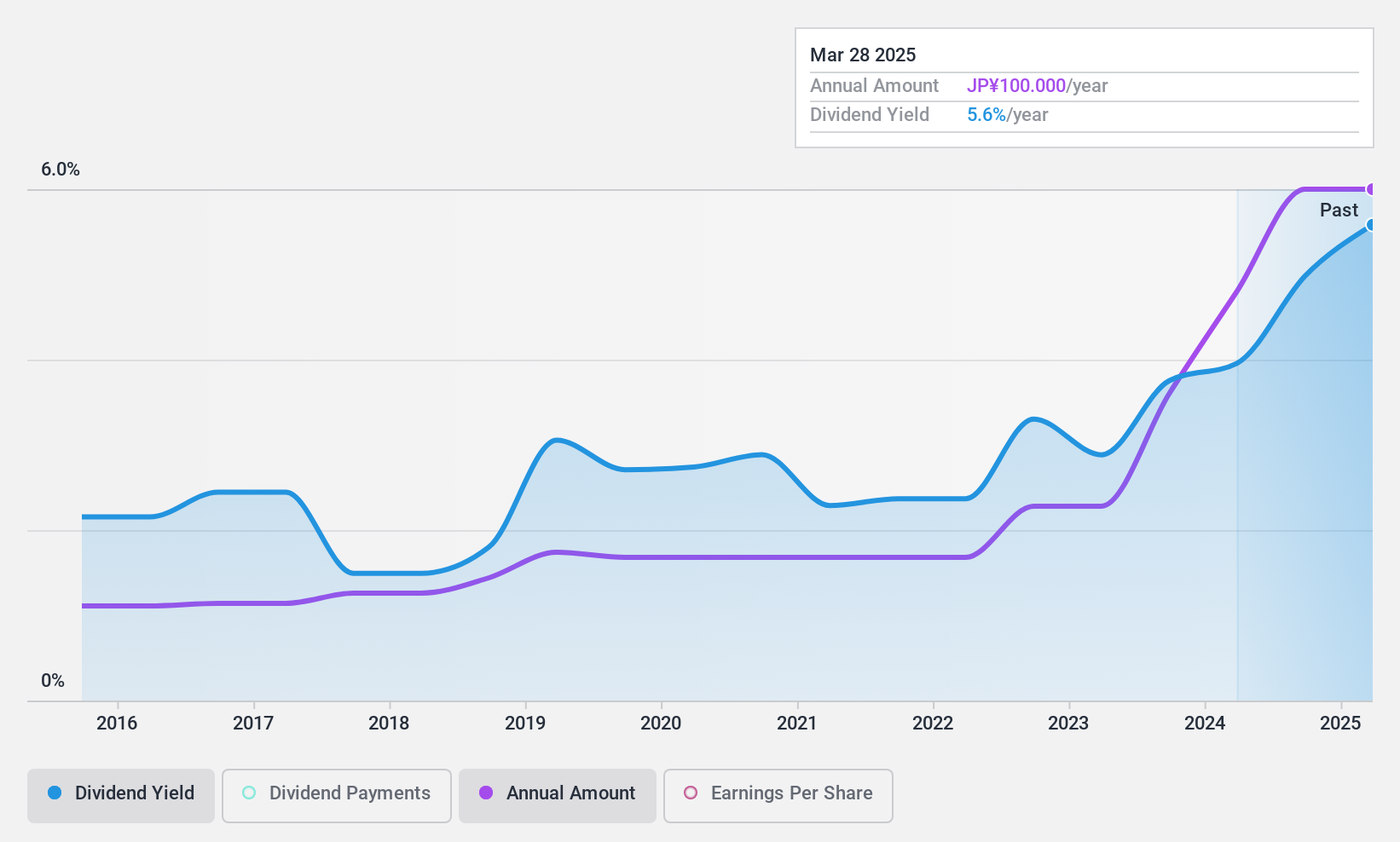

San-Ai Obbli (TSE:8097)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: San-Ai Obbli Co., Ltd. operates in the wholesale and retail sectors for petroleum products and liquefied petroleum gas, with a market cap of ¥113.68 billion.

Operations: San-Ai Obbli Co., Ltd.'s revenue segments include Petroleum Related Business at ¥555.94 billion, Gas Related Business at ¥59.04 billion, Aviation-Related Business at ¥17.06 billion, and Chemicals-Related Business at ¥12.80 billion.

Dividend Yield: 5.5%

San-Ai Obbli's dividend yield of 5.48% is among the top 25% in Japan, with stable and growing payments over the past decade. However, dividends are not covered by free cash flows despite a reasonable earnings payout ratio of 63.9%. The stock offers good value with a price-to-earnings ratio of 11.3x, below the market average. Recent share buybacks indicate a flexible capital policy but do not directly impact dividend sustainability concerns.

- Take a closer look at San-Ai Obbli's potential here in our dividend report.

- The analysis detailed in our San-Ai Obbli valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Investigate our full lineup of 1969 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8097

San-Ai Obbli

Engages in the wholesale and retail of petroleum products and liquefied petroleum (LP) gas.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives