- Japan

- /

- Energy Services

- /

- TSE:6269

Undiscovered Gems And 2 Other Hidden Stocks With Strong Potential

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and mixed economic signals, small-cap stocks have shown resilience compared to their larger counterparts, with the Russell 2000 Index edging higher despite broader market declines. Amid this backdrop of cautious optimism and strategic positioning, investors are increasingly on the lookout for lesser-known opportunities that could offer robust potential in an uncertain environment. In such conditions, identifying promising stocks involves assessing companies with strong fundamentals that can withstand economic fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sebang Global Battery Co., Ltd. is a company that, along with its subsidiaries, specializes in the production and sale of lead acid batteries both domestically in South Korea and internationally, with a market capitalization of approximately ₩952.87 billion.

Operations: Sebang Global Battery generates revenue primarily from manufacturing and selling automotive and industrial storage batteries, amounting to approximately ₩1.90 trillion.

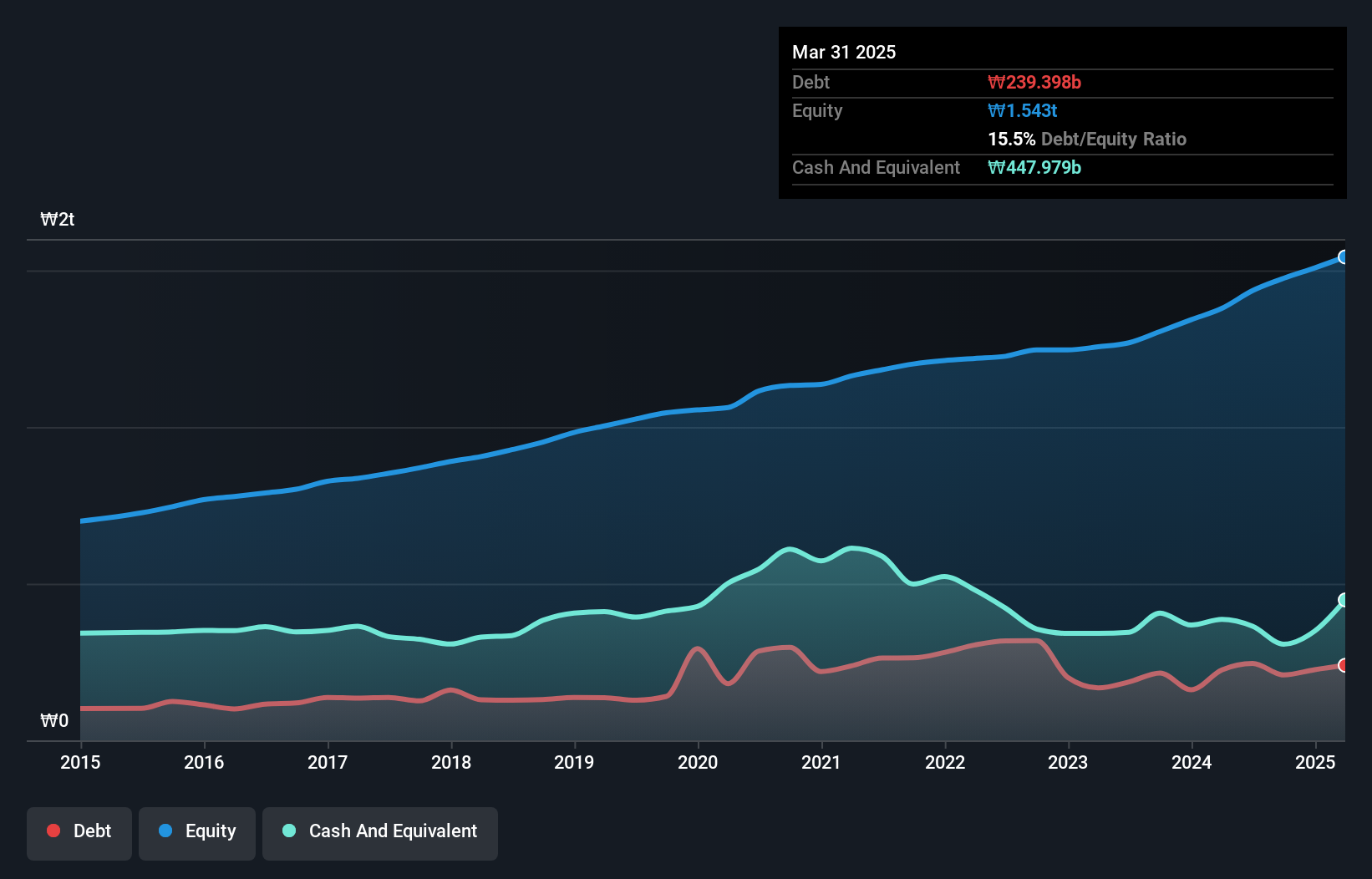

Sebang Global Battery is making waves with its robust earnings growth of 190.8% over the past year, outpacing the Auto Components industry's 20.8%. The company holds more cash than its total debt, suggesting a strong financial position, while trading at a significant discount—77% below estimated fair value—indicating potential undervaluation. Despite an increase in the debt-to-equity ratio from 12.5% to 17.1% over five years, Sebang's high-quality earnings and positive free cash flow signal resilience and potential for future growth in the competitive battery sector.

- Unlock comprehensive insights into our analysis of Sebang Global Battery stock in this health report.

Explore historical data to track Sebang Global Battery's performance over time in our Past section.

Sunvim GroupLtd (SZSE:002083)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sunvim Group Co., Ltd is engaged in the manufacturing and sale of home textile products across various regions including China, Asia, Europe, the Americas, Australia, and the Middle East with a market capitalization of CN¥4.40 billion.

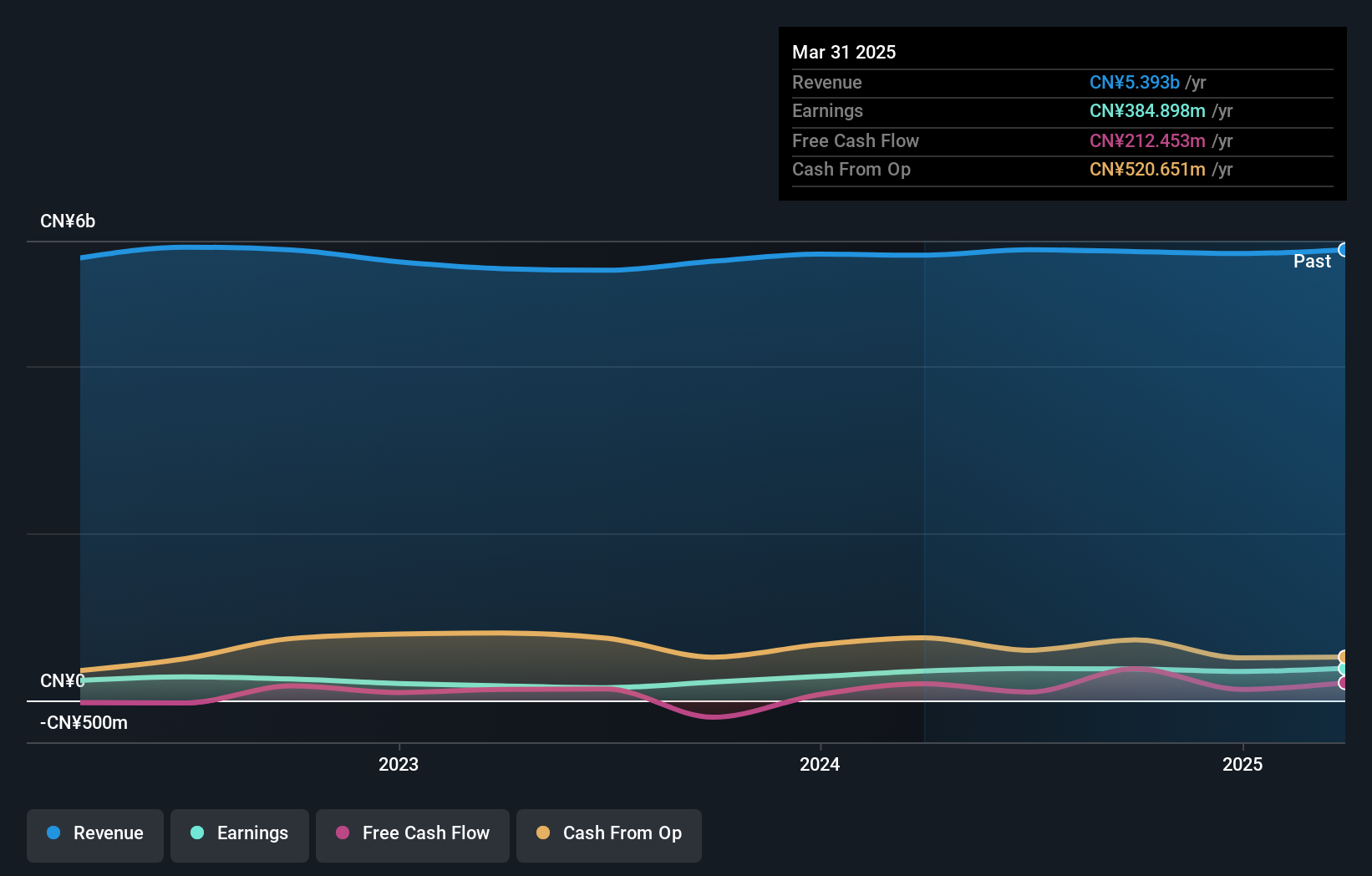

Operations: Sunvim Group Co., Ltd generates revenue primarily through the sale of home textile products across multiple international markets. The company's financial performance can be assessed by examining its net profit margin, which stands at 4.5%.

Sunvim Group, a noteworthy player in its sector, recently reported earnings growth of 71.4% over the past year, outpacing the Luxury industry's 3.3%. Despite a high net debt to equity ratio of 44.7%, the company has improved from 81.6% to 65.9% over five years and maintains profitability with well-covered interest payments at an EBIT coverage ratio of 12.7x. Its P/E ratio stands attractively low at 11.7x compared to the CN market's average of 35.4x, indicating potential value for investors amidst its ongoing share repurchase program worth up to CNY200 million aimed at boosting investor confidence and reducing capital registration.

- Navigate through the intricacies of Sunvim GroupLtd with our comprehensive health report here.

Assess Sunvim GroupLtd's past performance with our detailed historical performance reports.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥228.49 billion.

Operations: MODEC generates revenue primarily through its engineering, procurement, construction, and installation services for floating production systems. The company's cost structure is influenced by project-specific expenses related to these complex operations. Net profit margin trends are a key focus for financial analysis.

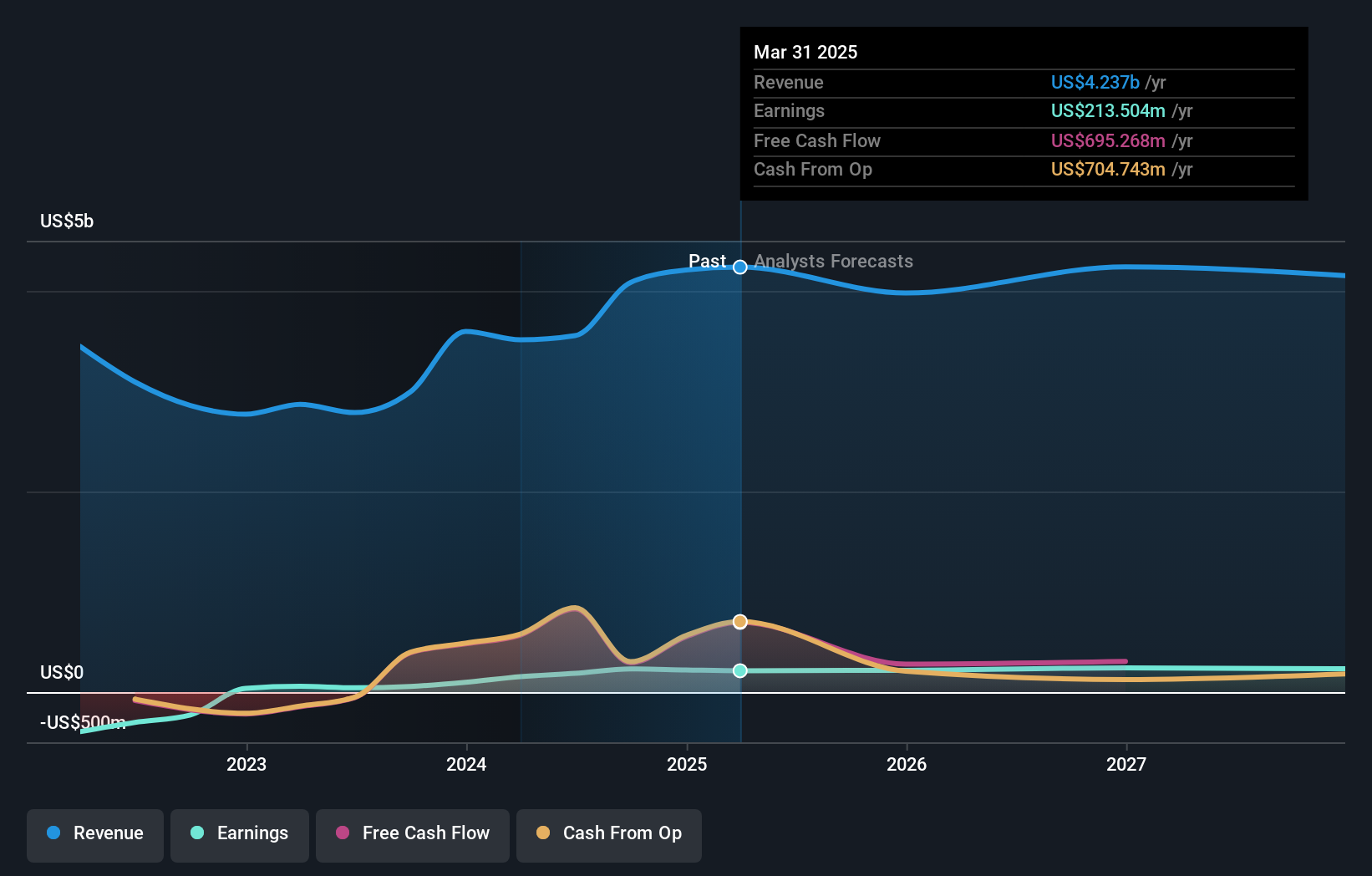

MODEC's recent performance paints a compelling picture, with earnings surging by 376% last year, outpacing the broader Energy Services sector's 27%. The company revised its annual guidance upward, anticipating revenue of US$4.3 million and an operating profit of US$290,000. Despite this growth spurt, MODEC faces a forecasted average earnings dip of 0.9% annually over the next three years. Its price-to-earnings ratio stands attractively at 7.8x against Japan's market average of 13.2x. Although profitable with positive free cash flow and sufficient interest coverage, MODEC’s debt-to-equity ratio has climbed from 19% to nearly 48% over five years.

- Take a closer look at MODEC's potential here in our health report.

Understand MODEC's track record by examining our Past report.

Seize The Opportunity

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4718 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6269

MODEC

Operates as engineering, procurement, construction and installation (EPCI) general contractor of floating production systems in Brazil, Guyana, Senegal, Cote d' Ivoire, Ghana, Mexico, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)