- Japan

- /

- Energy Services

- /

- TSE:6269

MODEC (TSE:6269) Is Up 44.7% After Raising Its 2025 Earnings and Dividend Guidance—What’s Changed

Reviewed by Sasha Jovanovic

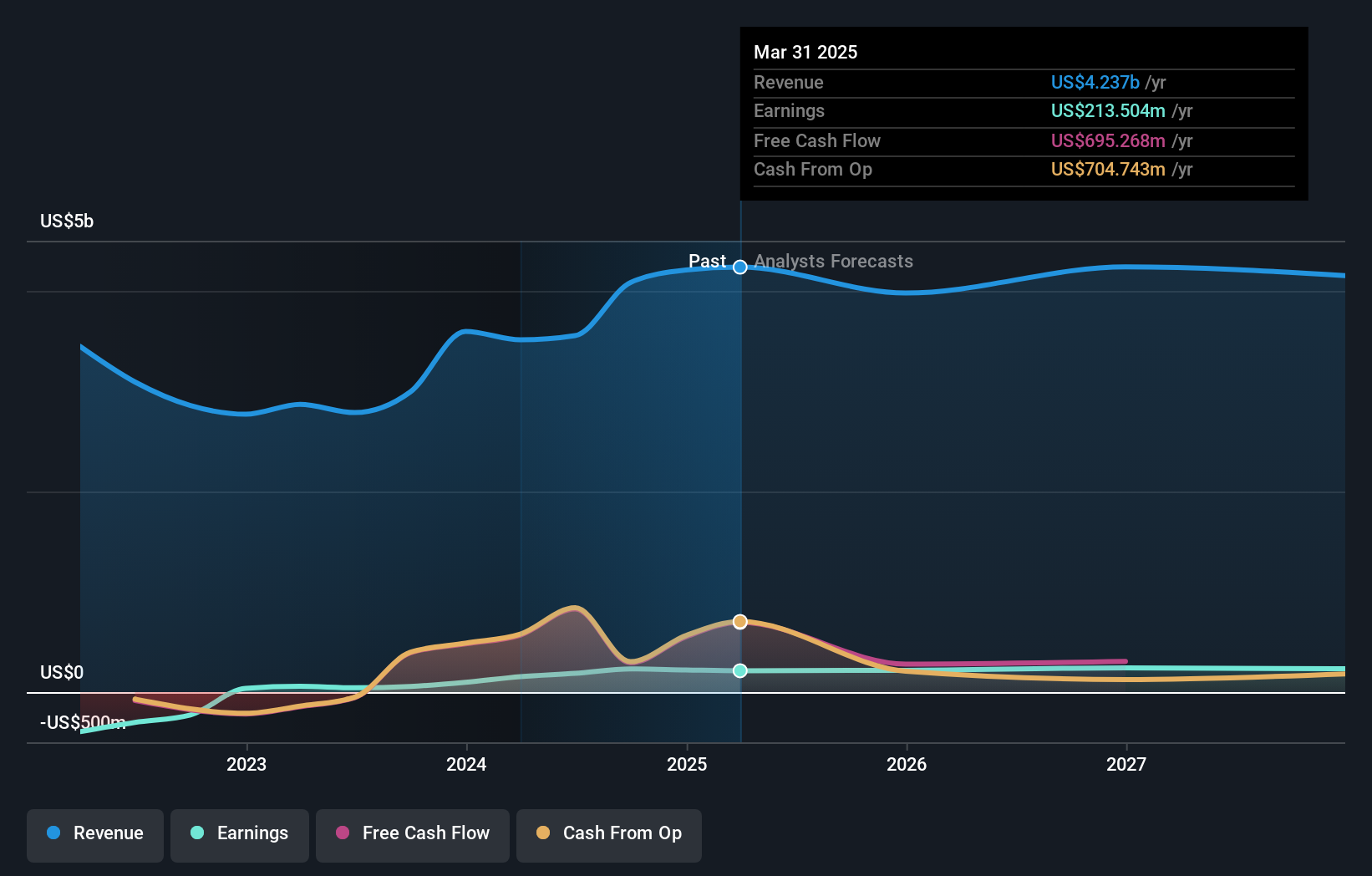

- MODEC, Inc. recently announced an upward revision to its full-year 2025 earnings and dividend forecast, projecting a dividend of ¥80.00 per share and raising profit guidance to US$350 million following strong nine-month financial results.

- This adjustment reflects steady progress in engineering and construction projects as well as improved operational performance from MODEC’s existing floating production systems in the offshore oil and gas sector.

- We’ll explore how MODEC’s raised earnings and dividend outlook, underpinned by project execution, influences its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is MODEC's Investment Narrative?

Owners of MODEC stock typically need to believe in the company’s ability to consistently deliver on complex offshore oil and gas projects, sustain robust operational performance, and return capital to shareholders, despite a sector characterized by earnings volatility and project risk. The recent upward revision of MODEC’s full-year profit outlook and an increased dividend forecast send a clear signal of confidence from management, and could act as a strong short-term catalyst by reinforcing sentiment after a period of impressive share price gains. While these upgrades reflect successful project execution, especially after MODEC secured contracts like Shell’s Gato do Mato FPSO, some risks have shifted: revenue guidance was reduced even as profit rose, highlighting potential margin improvements but also the specter of fewer contract awards or delays in new projects. Board turnover and management inexperience remain underlying concerns, especially for those focused on long-term stability.

However, questions around management experience and board changes are also worth closer attention for investors.

MODEC's shares have been on the rise but are still potentially undervalued by 33%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on MODEC - why the stock might be worth as much as ¥11267!

Build Your Own MODEC Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MODEC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MODEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MODEC's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6269

MODEC

Operates as engineering, procurement, construction and installation (EPCI) general contractor of floating production systems in Brazil, Guyana, Senegal, Cote d' Ivoire, Ghana, Mexico, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives