- Japan

- /

- Energy Services

- /

- TSE:6269

Discovering Undiscovered Gems In January 2025

Reviewed by Simply Wall St

As we enter January 2025, the global markets are navigating a landscape marked by fluctuating consumer confidence and mixed economic indicators. Despite these challenges, major stock indices have shown resilience with moderate gains, driven in part by large-cap growth stocks, although small-cap stocks continue to face headwinds from declining manufacturing orders and rising unemployment claims. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate strong fundamentals and the potential to thrive amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Silvery Dragon Prestressed MaterialsLTD Tianjin (SHSE:603969)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Silvery Dragon Prestressed Materials Co., LTD Tianjin manufactures and sells prestressed steel products in China, with a market capitalization of CN¥5.90 billion.

Operations: Silvery Dragon generates revenue primarily from its metal processors and fabrication segment, amounting to CN¥2.93 billion. The company has a notable focus on cost management, which influences its overall profitability metrics.

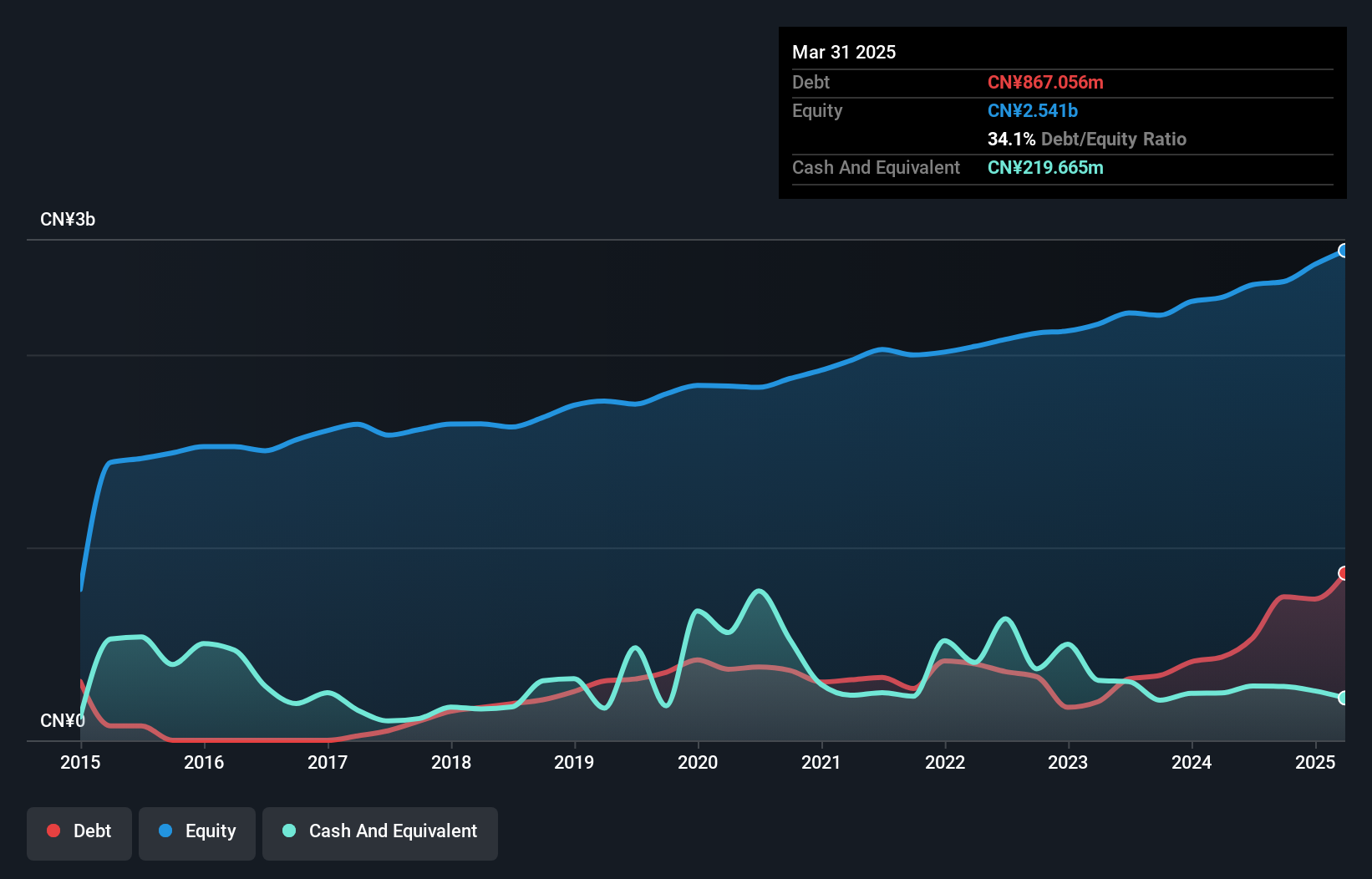

Silvery Dragon, operating in the metals and mining sector, shows promising potential with its recent earnings growth of 76.4%, significantly outpacing the industry average of -2.3%. The company's net income rose to CNY 168.66 million from CNY 118.1 million last year, reflecting robust financial health despite a debt-to-equity ratio increase from 19.6% to 31.3% over five years. With a price-to-earnings ratio at 26.6x below the CN market's average of 34.8x, it appears attractively valued for investors seeking opportunities in smaller companies with high-quality earnings and well-covered interest obligations (30.1x EBIT coverage).

LuxNet (TPEX:4979)

Simply Wall St Value Rating: ★★★★★★

Overview: LuxNet Corporation, along with its subsidiaries, is engaged in the manufacturing, processing, and sale of electric and optical communication components in Taiwan with a market capitalization of NT$26.90 billion.

Operations: LuxNet generates revenue primarily from its Optical Communication System Active Components segment, which accounts for NT$3.41 billion. The company's market capitalization stands at NT$26.90 billion.

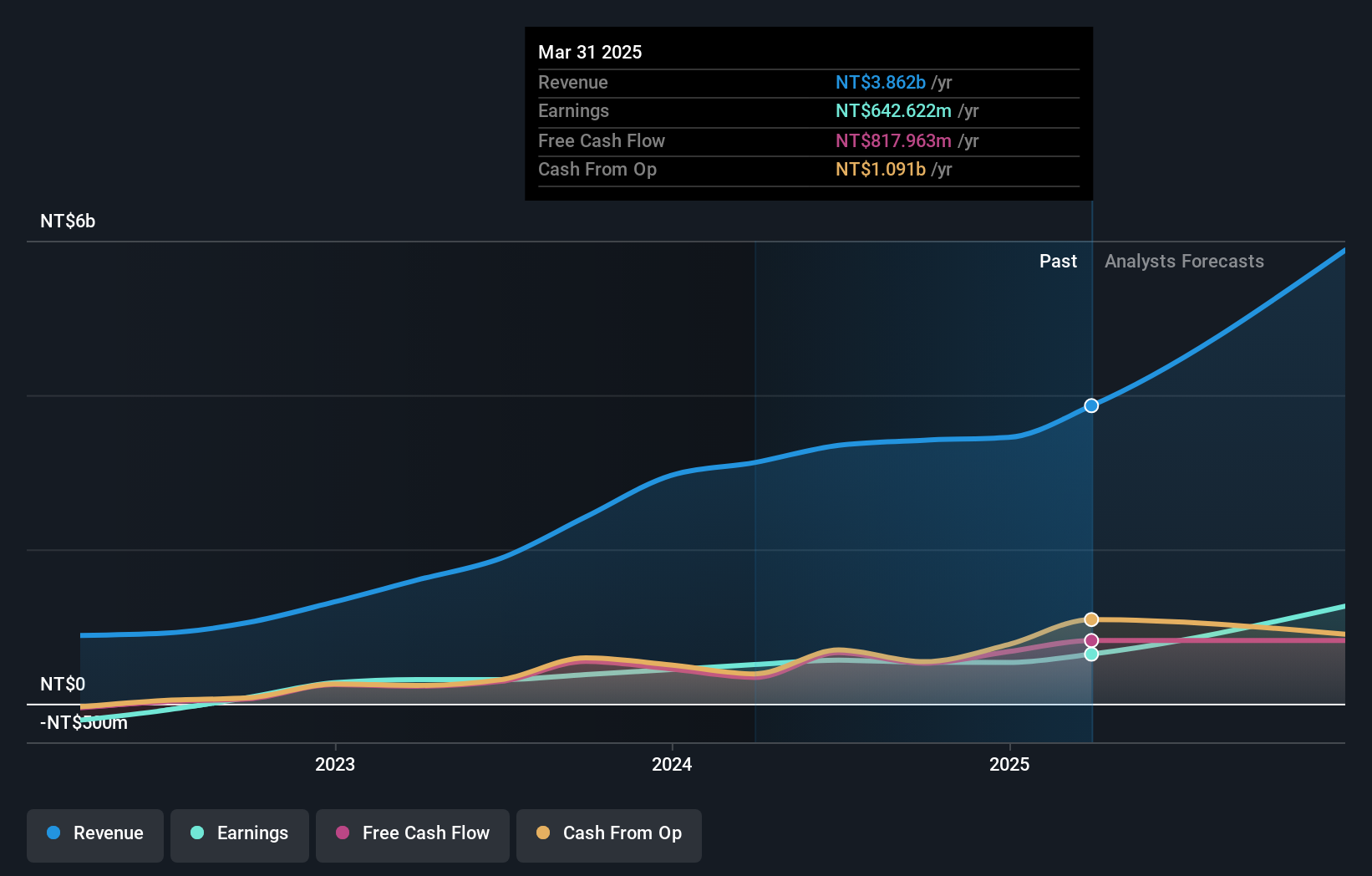

LuxNet's recent performance showcases its potential as a promising investment. The company reported third-quarter sales of TWD 945.63 million, up from TWD 879.88 million last year, though net income dipped to TWD 137.87 million from TWD 164.9 million. Despite this, the nine-month figures paint a brighter picture with sales climbing to TWD 2,402.93 million and net income rising significantly to TWD 381.37 million from the previous year's TWD 287.14 million. LuxNet is debt-free, enhancing its financial flexibility and reducing risk exposure in volatile markets while maintaining high-quality earnings that outpace industry growth rates by a wide margin of over 50%.

- Click here and access our complete health analysis report to understand the dynamics of LuxNet.

Gain insights into LuxNet's past trends and performance with our Past report.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor that specializes in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥228.49 billion.

Operations: The primary revenue stream for MODEC, Inc. is the construction of floating oil production facilities and related services, generating $4.08 billion.

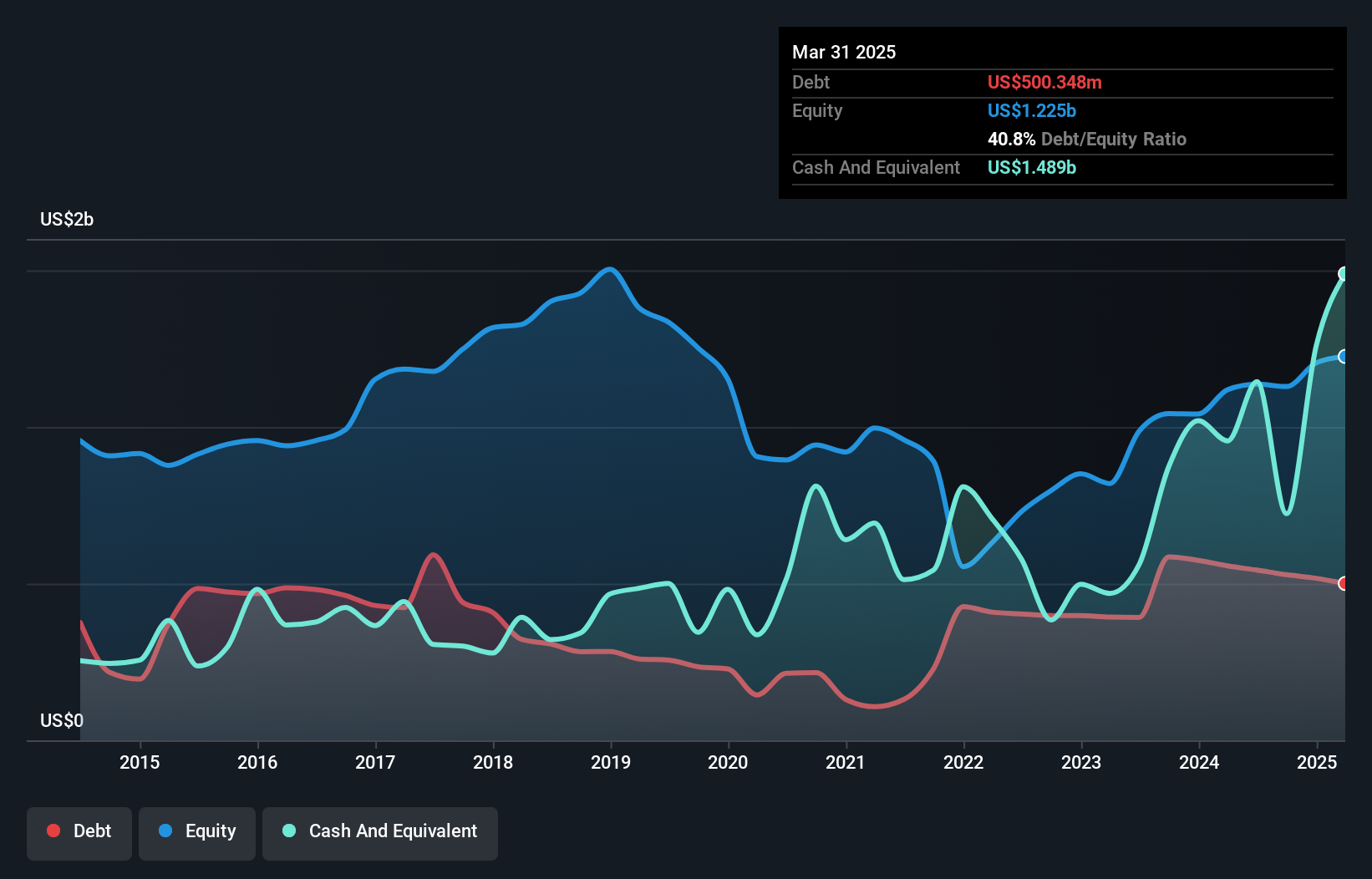

In the energy services sector, MODEC stands out with its impressive earnings growth of 309.8% over the past year, significantly outpacing the industry's 21.6%. The company seems to be in a strong financial position, boasting more cash than its total debt and maintaining high-quality earnings. Despite trading at 43.6% below estimated fair value, which suggests potential undervaluation, it's important to note that MODEC's debt-to-equity ratio has risen from 18.8% to 46.8% over five years. Future prospects may face challenges as earnings are forecasted to decline by an average of 5% annually over the next three years.

- Click to explore a detailed breakdown of our findings in MODEC's health report.

Review our historical performance report to gain insights into MODEC's's past performance.

Make It Happen

- Access the full spectrum of 4647 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6269

MODEC

A general contractor, engages in the engineering, procurement, construction, and installation of floating production systems worldwide.

Outstanding track record and good value.