- Japan

- /

- Industrials

- /

- TSE:7744

Discovering Hidden Gems in Japan for September 2024

Reviewed by Simply Wall St

As Japan's stock markets rise, buoyed by a weakening yen and supportive monetary policies, investors are increasingly looking for opportunities in the small-cap sector. With this favorable backdrop, now is an opportune time to explore some of the lesser-known yet promising stocks that could offer substantial growth potential. In such a dynamic environment, identifying good stocks often involves looking at companies with strong fundamentals and unique market positions that can capitalize on current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Totech | 16.86% | 5.13% | 11.52% | ★★★★★★ |

| Techno Quartz | 18.64% | 16.15% | 22.17% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥225.07 billion.

Operations: MODEC, Inc. generates revenue primarily through the engineering, procurement, construction, and installation of floating production systems. The company has a market cap of ¥225.07 billion.

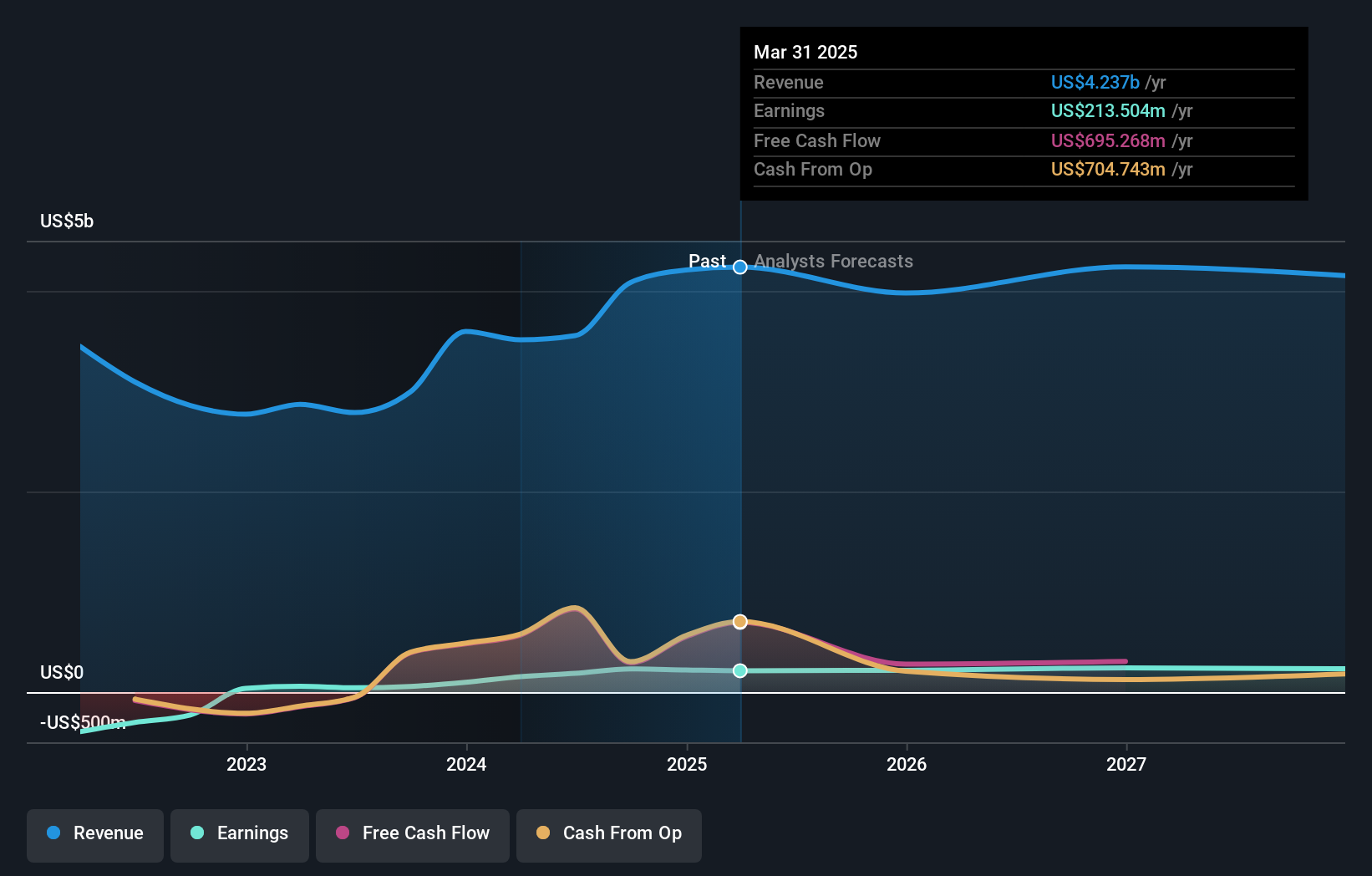

MODEC, a small-cap energy services company, has shown impressive earnings growth of 375.8% over the past year and is trading at 98.8% below its estimated fair value. Recently, MODEC raised its interim dividend to ¥30 per share and revised its revenue forecast for 2024 to US$4.3 million from US$3.9 million. Additionally, the company entered a strategic R&D agreement with Terra Drone to enhance drone inspections for FPSOs, aiming to triple inspection efficiency and reduce costs significantly.

- Take a closer look at MODEC's potential here in our health report.

Review our historical performance report to gain insights into MODEC's's past performance.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Value Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd. and its subsidiaries offer a range of financial products and services in Japan, with a market cap of ¥198.95 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue primarily through the provision of financial products and services in Japan. The company reported a market cap of ¥198.95 billion.

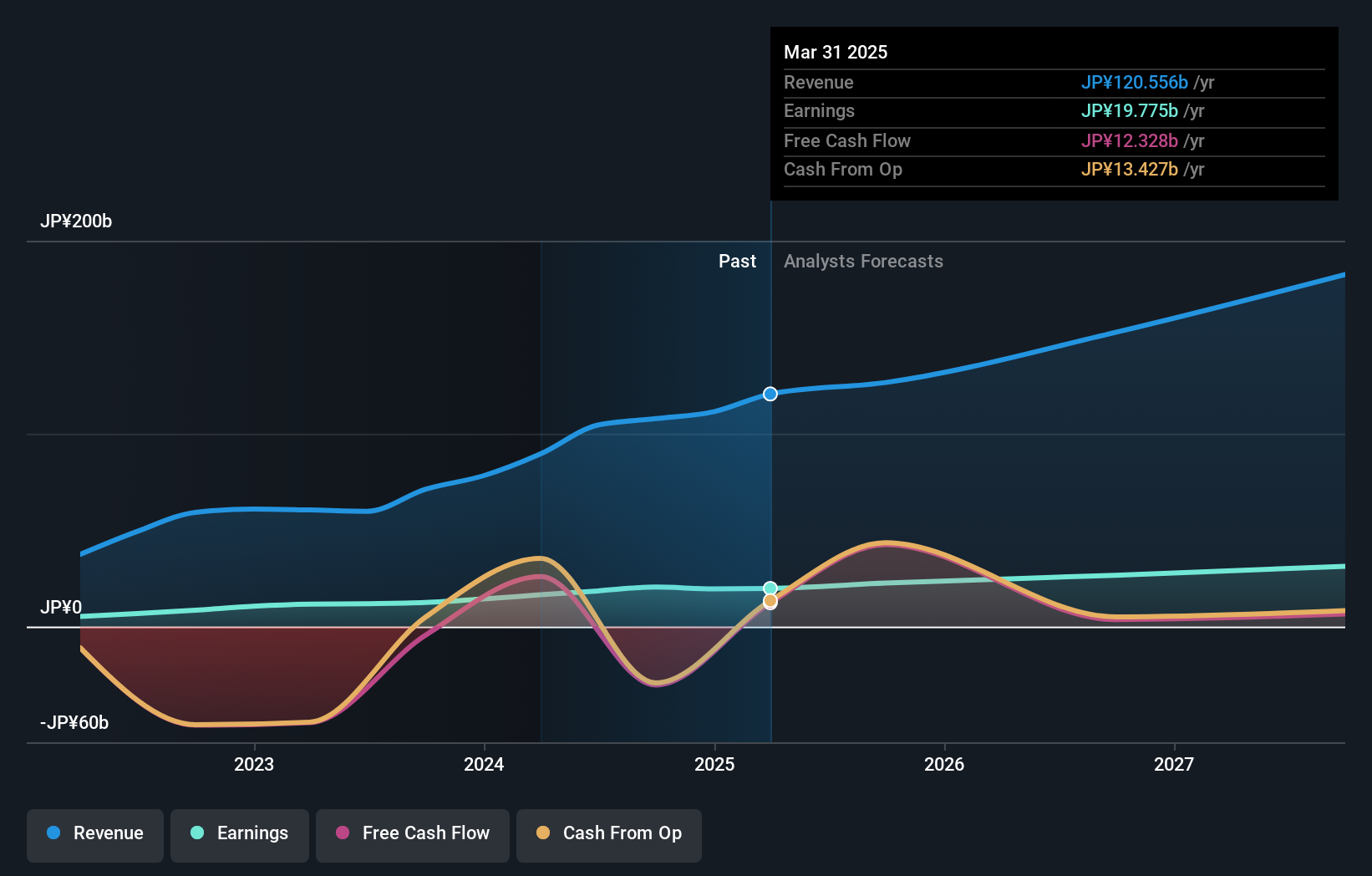

Financial Partners Group Ltd. has shown impressive growth, with earnings increasing by 55.9% over the past year, outpacing the Diversified Financial industry’s 24.9%. The company trades at a favorable P/E ratio of 10.8x compared to the JP market’s 13.4x and is free cash flow positive. Despite having a high net debt to equity ratio of 228.7%, it has managed to reduce this from 309.6% over five years, indicating improved financial management and stability in its operations.

Noritsu Koki (TSE:7744)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritsu Koki Co., Ltd. manufactures and sells audio equipment and peripheral products in Japan, with a market cap of ¥162.08 billion.

Operations: Noritsu Koki generates revenue primarily from manufacturing audio equipment and peripherals, which contributed ¥90.21 billion, and parts/materials manufacturing, adding ¥11.82 billion. The company's net profit margin is 10%.

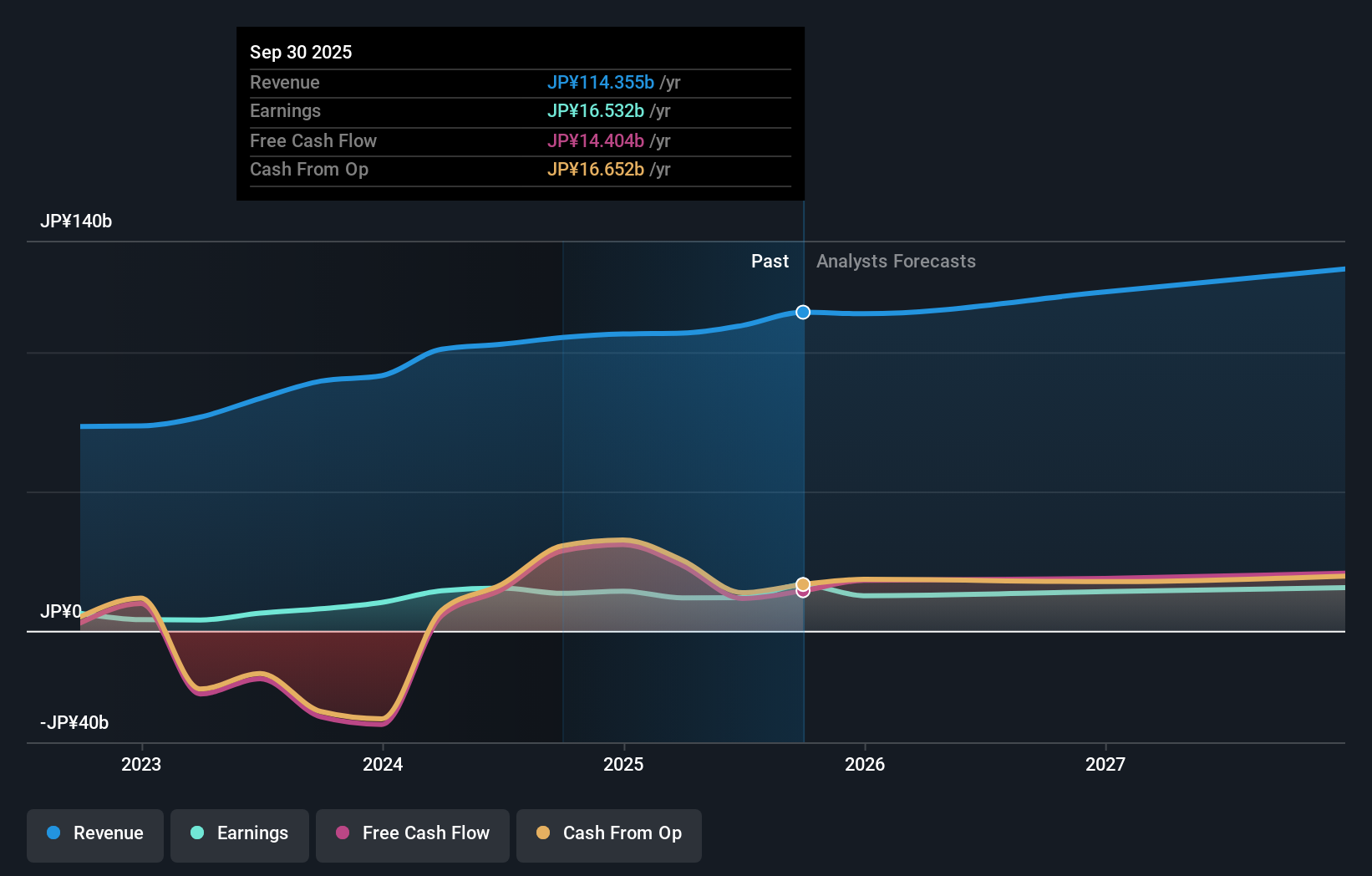

Noritsu Koki has shown impressive earnings growth of 142.2% over the past year, significantly outpacing the Industrials industry’s 38.4%. Their debt to equity ratio has improved from 44.7% to 16.4% in five years, indicating strong financial health. Despite a forecasted earnings decline of 7.5% annually for the next three years, the company trades at a notable discount—53.1% below its estimated fair value—making it an intriguing prospect for investors seeking undervalued opportunities in Japan's market.

- Unlock comprehensive insights into our analysis of Noritsu Koki stock in this health report.

Gain insights into Noritsu Koki's historical performance by reviewing our past performance report.

Seize The Opportunity

- Get an in-depth perspective on all 755 Japanese Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noritsu Koki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7744

Noritsu Koki

Manufactures and sells audio equipment and peripheral products in Japan.

Flawless balance sheet with solid track record and pays a dividend.