- Japan

- /

- Oil and Gas

- /

- TSE:5010

Some Nippon Seiro Co., Ltd. (TSE:5010) Shareholders Look For Exit As Shares Take 25% Pounding

The Nippon Seiro Co., Ltd. (TSE:5010) share price has fared very poorly over the last month, falling by a substantial 25%. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

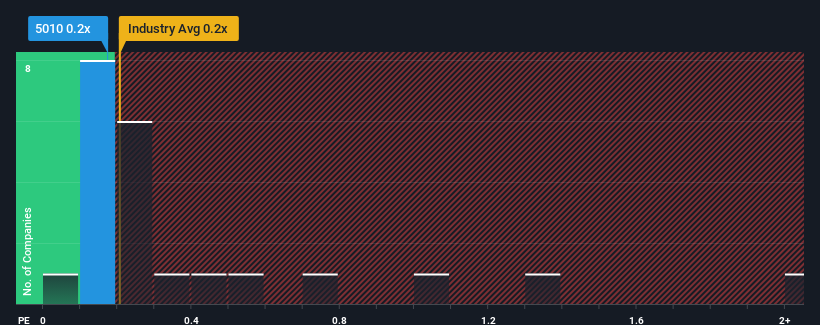

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Nippon Seiro's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Oil and Gas industry in Japan is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Nippon Seiro

How Has Nippon Seiro Performed Recently?

We'd have to say that with no tangible growth over the last year, Nippon Seiro's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nippon Seiro's earnings, revenue and cash flow.How Is Nippon Seiro's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Nippon Seiro's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 21% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 3.6% shows the industry is more attractive on an annualised basis regardless.

With this information, it's perhaps strange that Nippon Seiro is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Nippon Seiro's P/S

Nippon Seiro's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Nippon Seiro revealed its sharp three-year contraction in revenue isn't impacting its P/S as much as we would have predicted, given the industry is set to shrink less severely. When we see below average revenue, we suspect the share price is at risk of declining, sending the moderate P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

Having said that, be aware Nippon Seiro is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nippon Seiro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5010

Nippon Seiro

Manufactures, processes, and sells petroleum waxes, physically and chemically converted wax products, and fuel oil in Japan, North America, rest of Asia, and internationally.

Good value with acceptable track record.

Market Insights

Community Narratives