- Japan

- /

- Oil and Gas

- /

- TSE:2734

SALA (TSE:2734) Earnings Growth Surpasses Five-Year Average, Underscoring Value Narrative

Reviewed by Simply Wall St

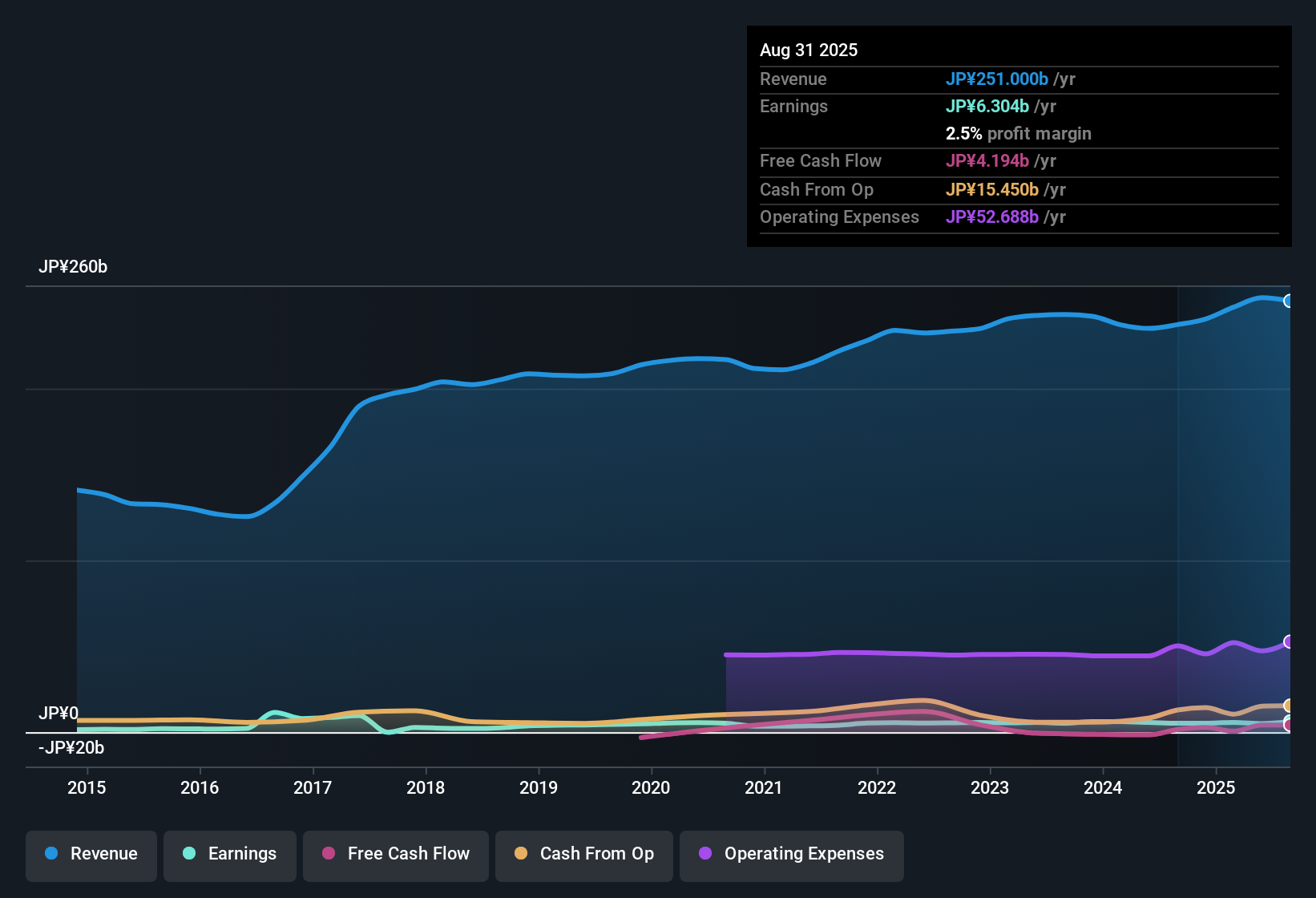

SALA (TSE:2734) delivered earnings growth of 21.8% over the past year, outpacing its five-year average increase of 6.7% per year. Net profit margins edged up to 2.5% from 2.2% a year ago. The company’s shares are currently trading at a P/E of 11.1x, which is lower than both the peer average of 15.6x and the Asian Oil and Gas industry average of 12.9x. This combination of steady margin improvement and ongoing profit growth puts SALA’s latest results into a favorable light for value-focused investors.

See our full analysis for SALA.Next, we will put these results side by side with the major narratives shaping market sentiment to see which investor assumptions stand up and which might need reconsideration.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Trend Higher at 2.5%

- Net profit margins improved to 2.5%, up from last year’s 2.2%, reflecting a modest but notable gain in operational efficiency.

- What is surprising is that, despite this margin lift, the prevailing market view sees little investor excitement due to the lack of headline-grabbing catalysts.

- Stable sector dynamics and the absence of major news may keep trading interest in check even as profitability edges higher.

- Any unexpected announcement or shift in sector performance could quickly make these gradual improvements more significant for market watchers.

Five-Year Growth Beats Consistency

- SALA has maintained a solid 6.7% annual earnings growth rate over five years, showing a disciplined ability to deliver profit improvements over time.

- The prevailing market view favors companies showing consistency, with steady growth trends seen as a mark of durable earnings quality.

- This pattern appeals to long-term investors who prioritize resilience and reliability over hype or rapid shifts in performance.

- However, lacking major growth surprises or volatility, SALA may stay under the radar until a new catalyst emerges.

P/E Ratio Undercuts Industry at 11.1x

- Shares trade on a price-to-earnings ratio of 11.1x, materially below both the peer average (15.6x) and the Asian Oil and Gas industry average (12.9x).

- This gap highlights the prevailing market view that SALA may be attractively valued for value-focused investors, but potentially overlooked by those seeking fast-moving names.

- The discounted multiple makes SALA stand out to buyers looking for stable fundamentals at a bargain valuation.

- However, unless broader market sentiment warms or the company unveils compelling growth initiatives, this value opportunity could remain unnoticed by mainstream investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SALA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While SALA shows steady earnings growth and margin improvement, it lacks excitement or major catalysts to spark renewed market interest and remains under the radar.

If you want to focus on companies delivering consistent performance with visible growth momentum, check out stable growth stocks screener for candidates that have established steady results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2734

SALA

Through its subsidiaries, engages in the energy supply and solution business in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives