- Japan

- /

- Capital Markets

- /

- TSE:8789

Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are eyeing potential impacts on growth and inflation amid policy shifts. In this dynamic environment, dividend stocks can offer a measure of stability and income, making them an attractive consideration for those looking to navigate these evolving market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

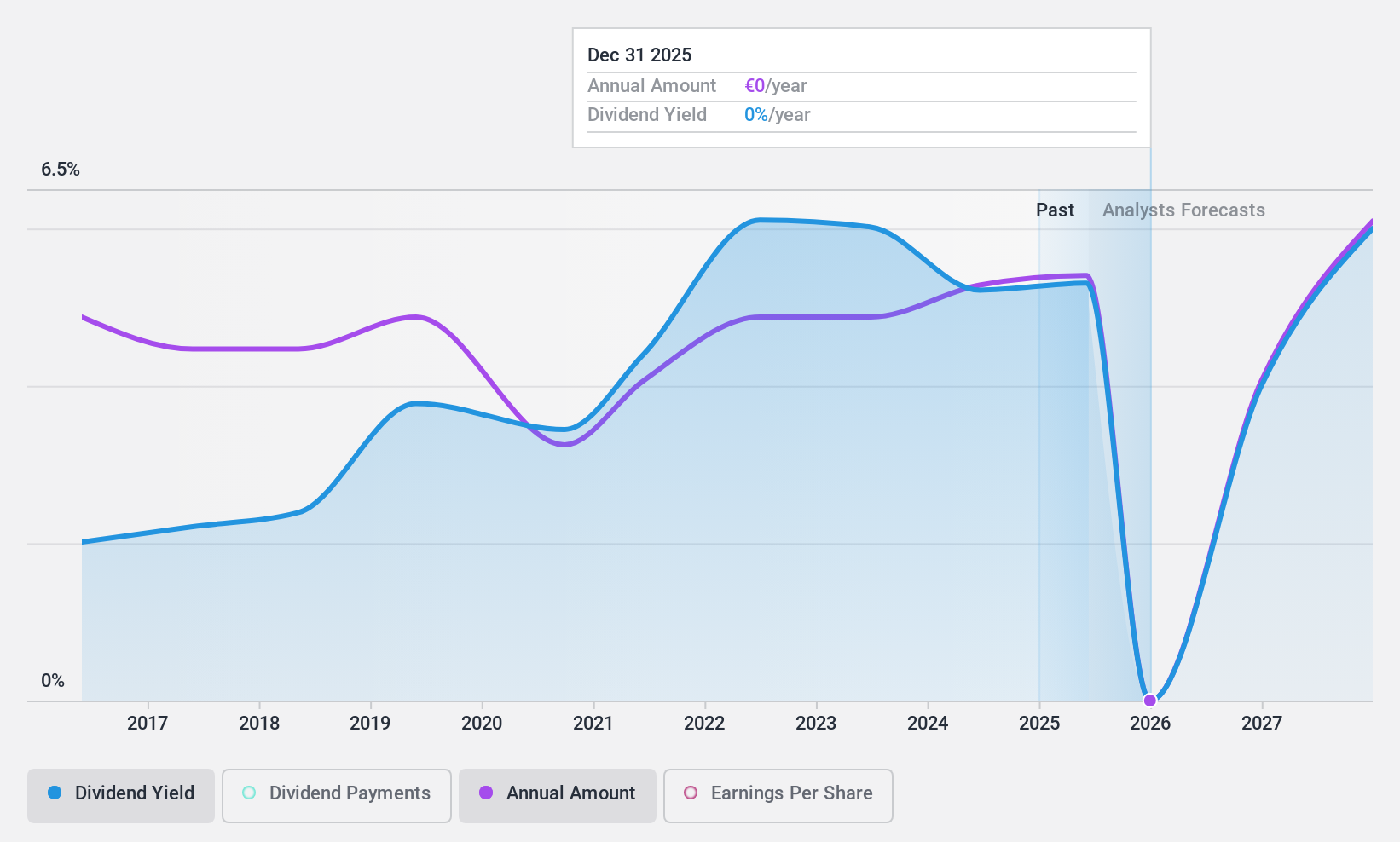

Fleury Michon (ENXTPA:ALFLE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleury Michon SA is a company that produces and sells food products both in France and internationally, with a market cap of €99.29 million.

Operations: Fleury Michon's revenue is primarily derived from its Division GMS France segment at €679.59 million and its International Division at €91.20 million.

Dividend Yield: 5.4%

Fleury Michon's dividend payments have been volatile over the past decade, with significant annual drops. Despite this, dividends have grown overall during that period and are well-covered by earnings and cash flows, with payout ratios of 34.1% and 12.6%, respectively. Recent financials show a substantial increase in net income to €46.7 million for the first half of 2024, although sales declined to €399.1 million from €422.3 million year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of Fleury Michon.

- Upon reviewing our latest valuation report, Fleury Michon's share price might be too pessimistic.

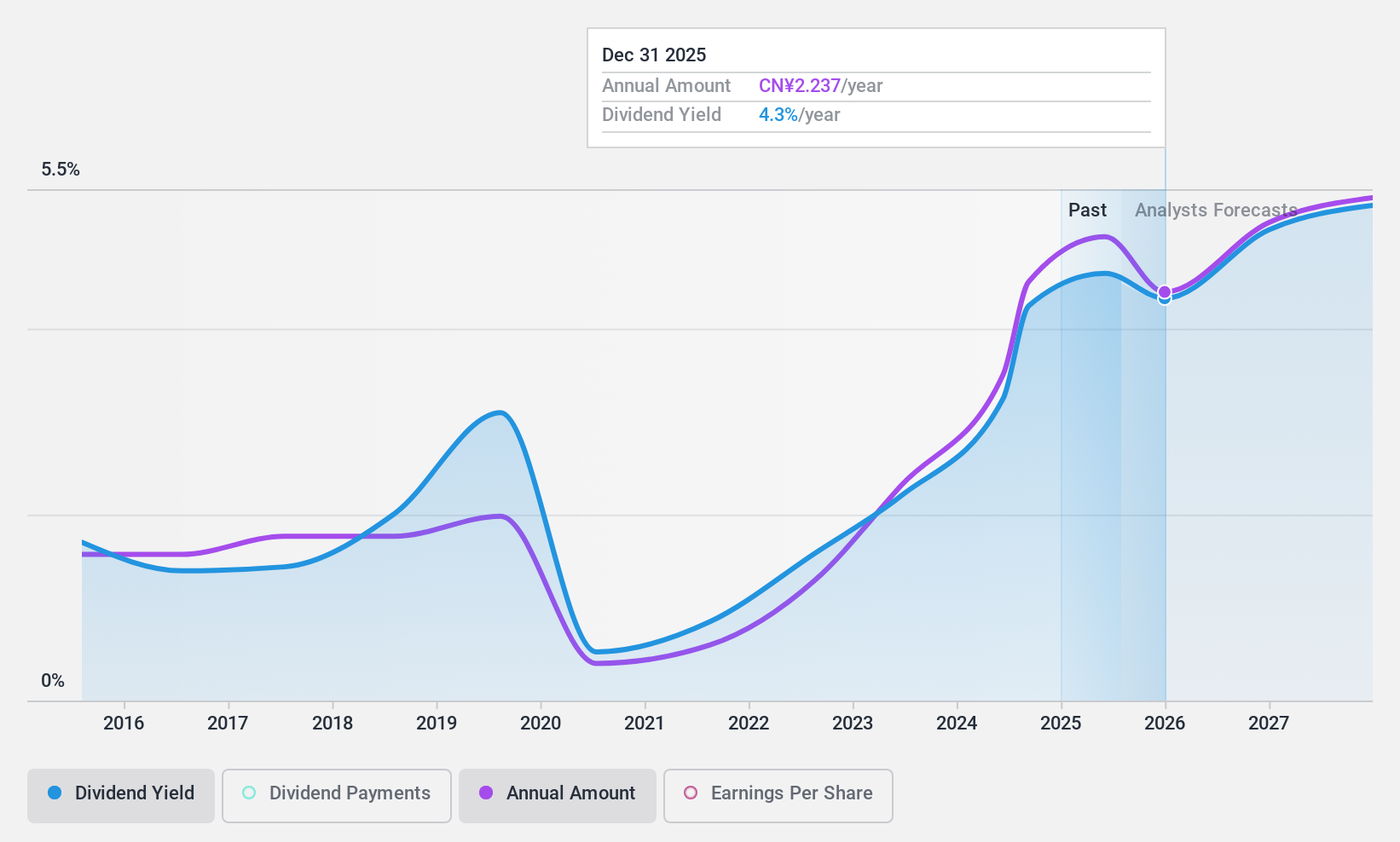

Dong-E-E-JiaoLtd (SZSE:000423)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong-E-E-Jiao Co., Ltd. is involved in the research, development, production, and sale of Ejiao along with Chinese patent medicines and health foods, with a market cap of CN¥38.30 billion.

Operations: Dong-E-E-Jiao Co., Ltd. generates revenue from the operation of Ejiao and its related products, amounting to CN¥5.62 billion.

Dividend Yield: 3.8%

Dong-E-E-Jiao Ltd. offers a dividend yield of 3.85%, ranking in the top 25% of CN market payers, but its sustainability is questionable due to a high payout ratio of 123.8%. Despite this, dividends have grown over the past decade, though they remain volatile and unreliable. Recent earnings show strong growth with net income rising to CNY 1.15 billion for the first nine months of 2024, reflecting robust revenue increases from CNY 3.43 billion to CNY 4.33 billion year-on-year.

- Navigate through the intricacies of Dong-E-E-JiaoLtd with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Dong-E-E-JiaoLtd's current price could be quite moderate.

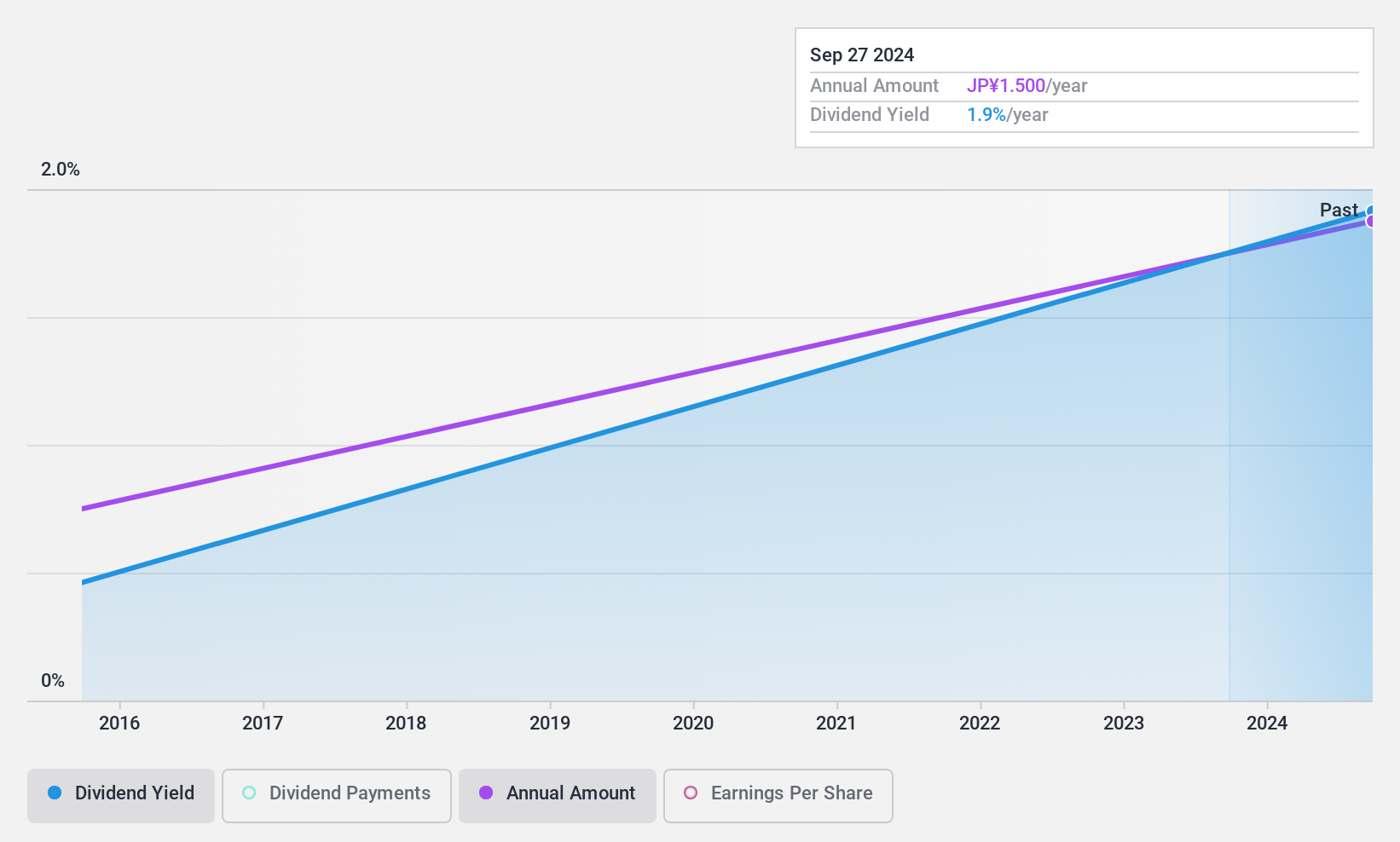

FinTech Global (TSE:8789)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FinTech Global Incorporated offers a range of financial services in Japan and has a market capitalization of approximately ¥17.24 billion.

Operations: FinTech Global Incorporated's revenue is primarily derived from its Investment Banking segment, which generated ¥11.34 billion, supplemented by its Entertainment Service Business at ¥2.46 billion and Public Management Consulting at ¥452.07 million.

Dividend Yield: 3.4%

FinTech Global's dividend payments are well-covered, with a low payout ratio of 17.8% and cash payout ratio of 18.6%, indicating sustainability despite a historically volatile track record. The company recently increased its dividend guidance to JPY 3.00 per share for fiscal year ending September 2025 from JPY 1.50 previously, signaling potential growth in dividends. However, its current yield of 3.41% remains below the top quartile in Japan's market, and share price volatility persists.

- Dive into the specifics of FinTech Global here with our thorough dividend report.

- Our valuation report unveils the possibility FinTech Global's shares may be trading at a premium.

Taking Advantage

- Click here to access our complete index of 1940 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8789

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives