- Japan

- /

- Capital Markets

- /

- TSE:8742

Optimistic Investors Push Kobayashi Yoko Co., Ltd. (TSE:8742) Shares Up 44% But Growth Is Lacking

Despite an already strong run, Kobayashi Yoko Co., Ltd. (TSE:8742) shares have been powering on, with a gain of 44% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 63% in the last year.

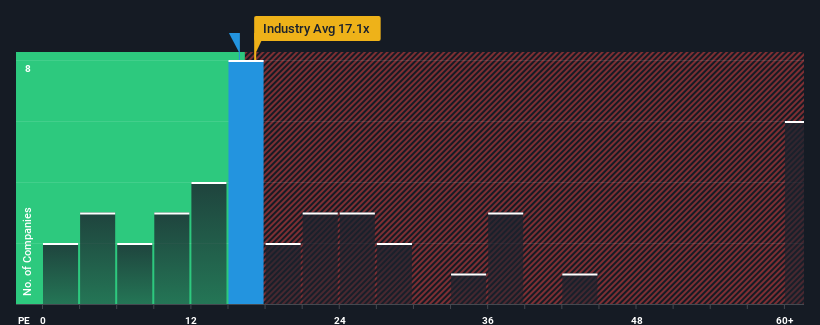

Even after such a large jump in price, there still wouldn't be many who think Kobayashi Yoko's price-to-earnings (or "P/E") ratio of 15.8x is worth a mention when the median P/E in Japan is similar at about 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Kobayashi Yoko certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Kobayashi Yoko

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Kobayashi Yoko's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 101% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Kobayashi Yoko is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Kobayashi Yoko's P/E?

Kobayashi Yoko's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Kobayashi Yoko revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Kobayashi Yoko that you need to be mindful of.

Of course, you might also be able to find a better stock than Kobayashi Yoko. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Kobayashi Yoko, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kobayashi Yoko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8742

Kobayashi Yoko

Engages in the investment and financial services business in Japan.

Flawless balance sheet and fair value.

Market Insights

Community Narratives