- Japan

- /

- Capital Markets

- /

- TSE:8707

IwaiCosmo Holdings (TSE:8707) Margins Climb to 30.1%, Challenging Bearish Earnings Narratives

Reviewed by Simply Wall St

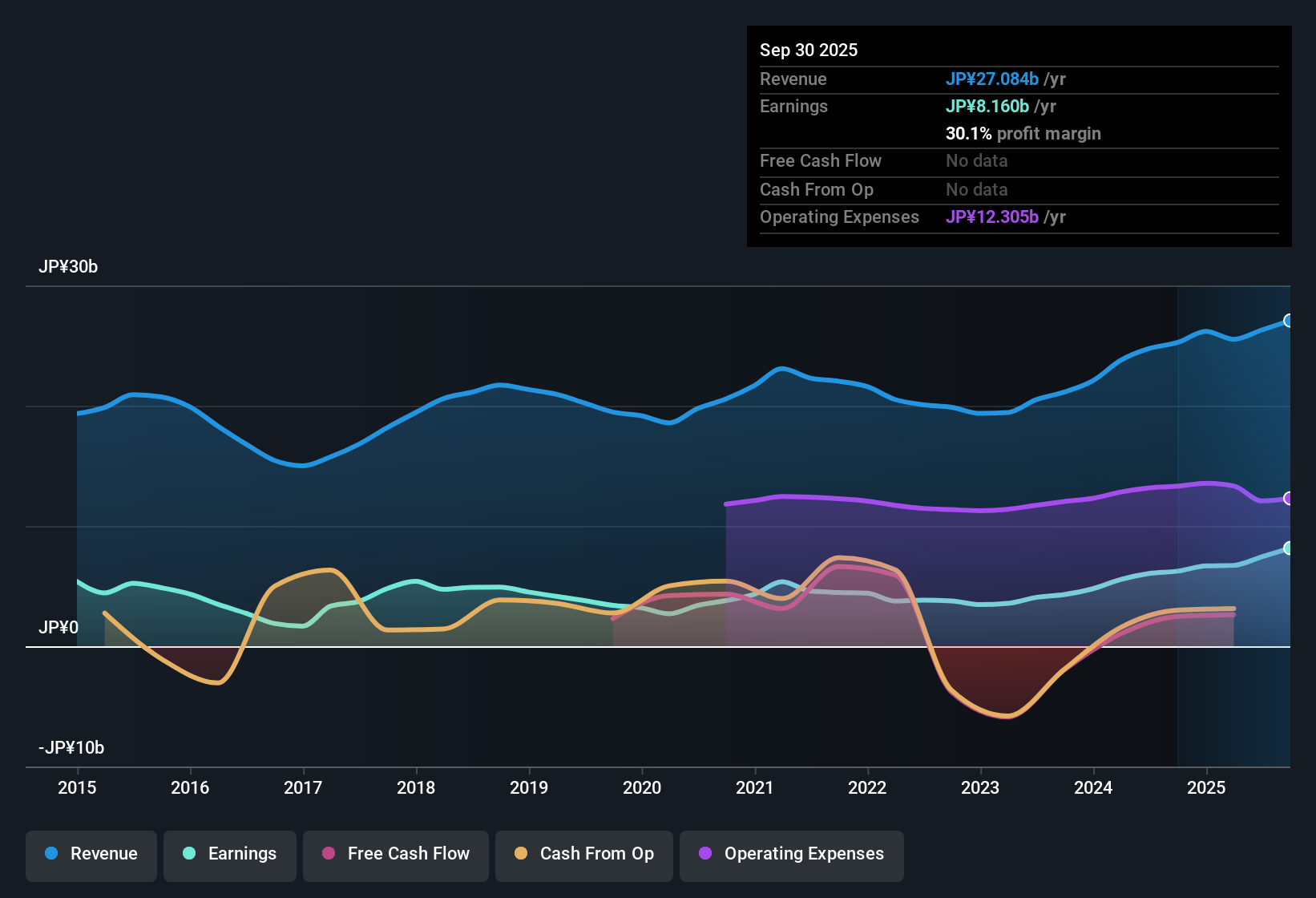

IwaiCosmo Holdings (TSE:8707) reported net profit margins of 30.1%, surpassing last year’s 24.7%. Annual earnings growth has averaged 12.9% over the past five years, with the most recent period delivering a standout 30.7% jump in earnings. Margins have clearly expanded, but forecasts now see revenue and earnings declining over the next three years. Investors are likely weighing historical strength against a more uncertain outlook.

See our full analysis for IwaiCosmo Holdings.Next up, we’ll see how these headline results compare to the dominant narratives from the market and community. Some assumptions may get confirmed, while others could be thrown into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Declining Revenue Offset by Five-Year Growth Track

- Revenue is forecast to fall by 0.7% per year over the next three years, which contrasts with the company’s strong five-year annual earnings growth rate of 12.9%.

- What is surprising is that despite expectations for shrinking top-line results, the company delivered a notable 30.7% earnings increase in the most recent year.

- This performance highlights that operational gains can still occur even as forward revenue guidance trends negative.

- This dynamic shows how historical profit expansion forms a buffer, but does not fully insulate against future slowdowns.

Profit Margins Reach 30.1% as Analyst Concerns Loom

- Net profit margin has climbed to 30.1%, a clear improvement over last year’s 24.7%, indicating greater operational efficiency amid challenging forecasts.

- Critics highlight that even as margins expanded, projected annual earnings are set to decline by 5.9% through the next three years.

- This raises questions about whether these strong margins are sustainable moving forward or simply mark a peak after recent growth.

- Concerns remain around the sustainability of dividend payouts as profits begin to trend downward, suggesting fresh operational pressure ahead.

Share Price Trades at a Deep Discount to DCF Fair Value

- The company’s current share price of ¥2,784 sits well below its DCF fair value estimate of ¥3,633.74, and a Price-to-Earnings Ratio of 8x is less than half the industry average of 16.2x.

- What stands out is that these valuation gaps signal the market’s skepticism toward IwaiCosmo’s ability to repeat its historical earnings momentum.

- Investors may see value opportunities compared to peers, but the discount also reflects uncertainty about sustained profitability and expected declines in revenue and earnings.

- The sharp departure from industry multiples can be appealing to bargain hunters, yet it underlines the need to weigh short-term risks against long-term upside.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on IwaiCosmo Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite recent margin expansion, IwaiCosmo faces a projected decline in revenue and earnings. This raises concerns about its ability to sustain long-term growth and payouts.

If you want more reliable upside, focus on stable growth stocks screener (2095 results) to discover companies that deliver consistent earnings and sales no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8707

IwaiCosmo Holdings

Provides financial services using information technology in Japan.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives