- Japan

- /

- Capital Markets

- /

- TSE:8628

Did FTSE All-World Index Removal Just Shift Matsui Securities' (TSE:8628) Investment Narrative?

Reviewed by Sasha Jovanovic

- Matsui Securities Co., Ltd. (TSE:8628) was removed from the FTSE All-World Index (USD), following a recent index review announcement by FTSE Russell.

- This removal holds significance because inclusion in major indices often underpins trading by passive funds and institutional investors.

- Given the index removal's potential to prompt changes in ownership by index-tracking funds, we examine implications for Matsui Securities' investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Matsui Securities' Investment Narrative?

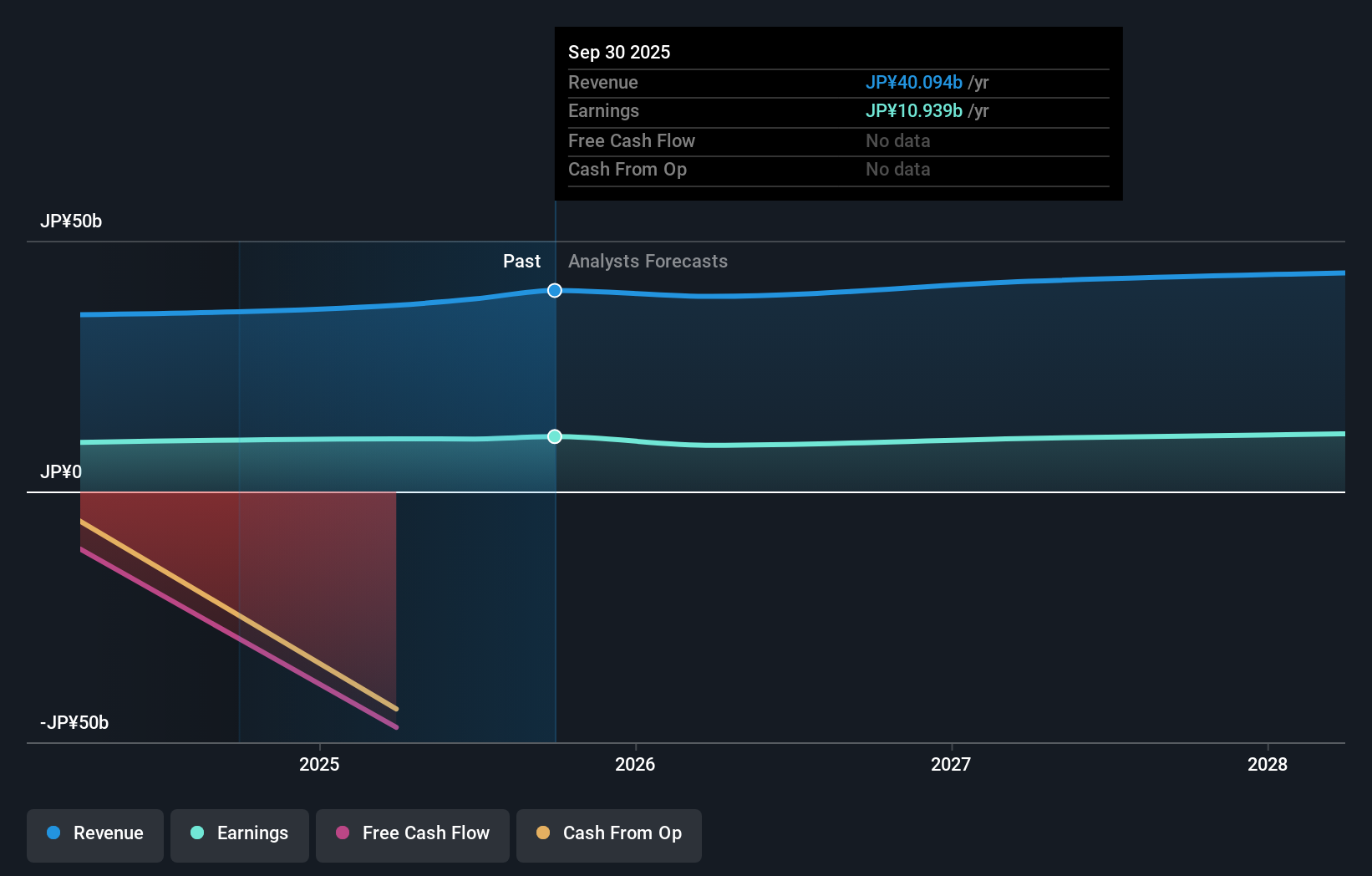

To be a shareholder in Matsui Securities today, you have to believe in the ongoing demand for digital financial services in Japan and Matsui’s ability to remain competitive despite recent structural headwinds. The company has delivered steady growth in earnings and revenue, though at a pace behind the broader Japanese market and industry peers, while maintaining a relatively high dividend yield and an experienced board. The recent removal from the FTSE All-World Index, hot on the heels of last year’s Nikkei 225 exclusion, is likely to trigger some near-term flows out of the stock from passive tracker funds, but recent price moves suggest the news has not materially altered the market’s overall view of Matsui. This event could reinforce concerns about liquidity and perceived relevance among institutional investors, potentially amplifying scrutiny on two long-standing risks: muted profit growth relative to peers and modest return on equity. The most important short-term catalysts remain quarterly earnings and dividend announcements, but the risk of further shrinking institutional support should not be overlooked.

In contrast, potential changes in institutional ownership could have implications for longer-term stability.

Exploring Other Perspectives

Explore 2 other fair value estimates on Matsui Securities - why the stock might be worth 9% less than the current price!

Build Your Own Matsui Securities Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matsui Securities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Matsui Securities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matsui Securities' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8628

Matsui Securities

Provides online securities brokerage services to retail investors in Japan.

Mediocre balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion