As global markets react to rising U.S. Treasury yields and a tepid economic outlook, investors are increasingly seeking stability in dividend stocks, which can offer a reliable income stream even amid broader market volatility. In the current climate, characterized by cautious monetary policy adjustments and fluctuating economic indicators, dividend stocks with attractive yields may provide an appealing option for those looking to balance growth potential with income generation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.94% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Shanghai Zijiang Enterprise Group (SHSE:600210)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Zijiang Enterprise Group Co., Ltd. operates in the packaging industry and has a market capitalization of approximately CN¥9.02 billion.

Operations: Unfortunately, the provided text does not contain specific details about the revenue segments of Shanghai Zijiang Enterprise Group Co., Ltd. Please provide more information on their revenue segments for a detailed summary.

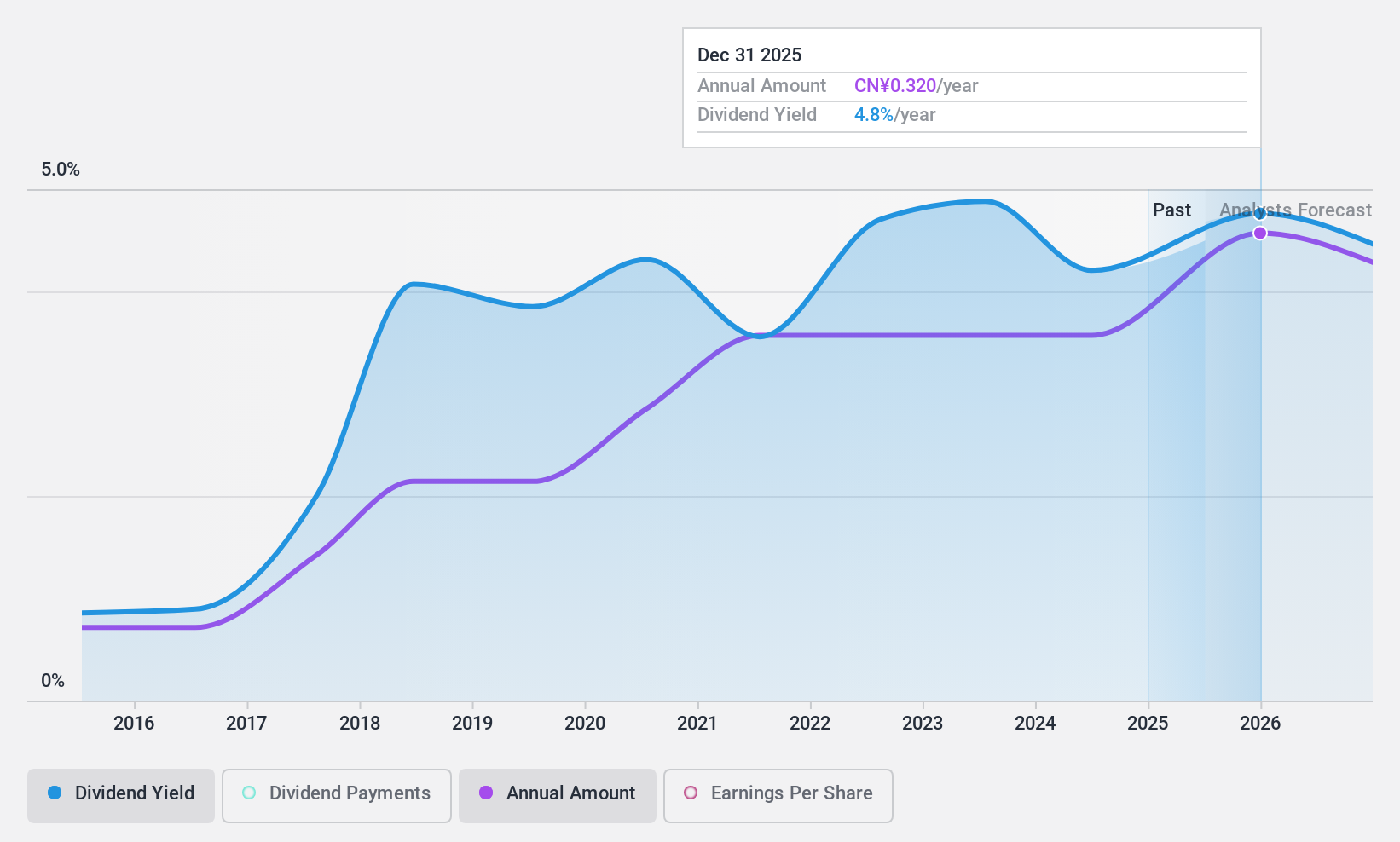

Dividend Yield: 4.1%

Shanghai Zijiang Enterprise Group's dividend payments are well-supported by cash flows with a low cash payout ratio of 23.2%, and earnings coverage is reasonable at 59.5%. Despite being in the top 25% of CN market dividend payers, its dividends have been volatile over the past decade. The company trades below its estimated fair value and has shown recent earnings growth, reporting net income of CNY 527.56 million for the nine months ending September 2024, an increase from CNY 450.96 million a year ago.

- Navigate through the intricacies of Shanghai Zijiang Enterprise Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Shanghai Zijiang Enterprise Group's current price could be quite moderate.

Zhongman Petroleum and Natural Gas GroupLtd (SHSE:603619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhongman Petroleum and Natural Gas Group Corp., Ltd. is an oil and gas company involved in drilling and completion engineering services as well as petroleum equipment manufacturing, with a market cap of approximately CN¥9.28 billion.

Operations: Zhongman Petroleum and Natural Gas Group Corp., Ltd. generates revenue through its operations in drilling and completion engineering services and the manufacturing of petroleum equipment.

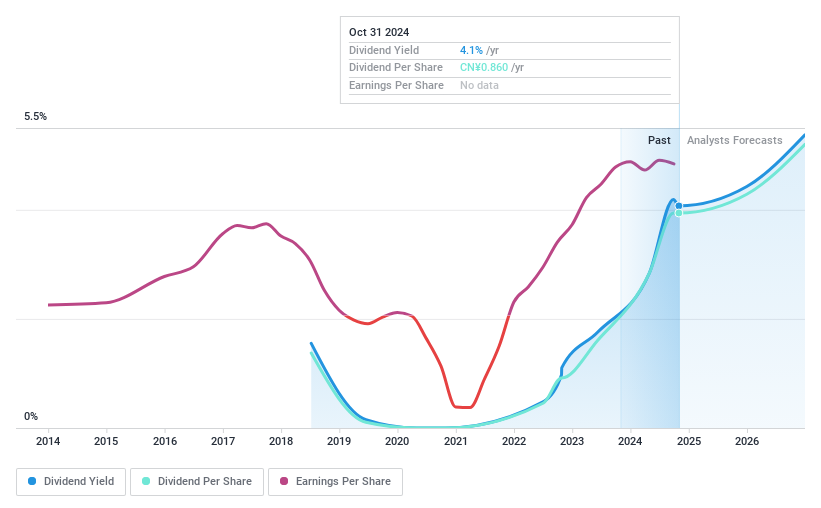

Dividend Yield: 4.1%

Zhongman Petroleum and Natural Gas Group's dividend yield is among the top 25% in China, with a payout ratio of 30.7%, indicating dividends are well-covered by earnings. However, its dividend history is volatile, having been paid for less than ten years. Recent earnings growth to CNY 668.49 million for the nine months ending September 2024 supports its dividend payments, though past shareholder dilution may concern some investors despite good relative value compared to peers.

- Click here to discover the nuances of Zhongman Petroleum and Natural Gas GroupLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Zhongman Petroleum and Natural Gas GroupLtd is trading behind its estimated value.

JAFCO Group (TSE:8595)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JAFCO Group Co., Ltd. is a Japanese venture capital firm with a market cap of ¥1.12 billion, focusing on investments in startups and growth-stage companies.

Operations: JAFCO Group Co., Ltd. generates its revenue primarily from the management of funds, amounting to ¥31.81 billion.

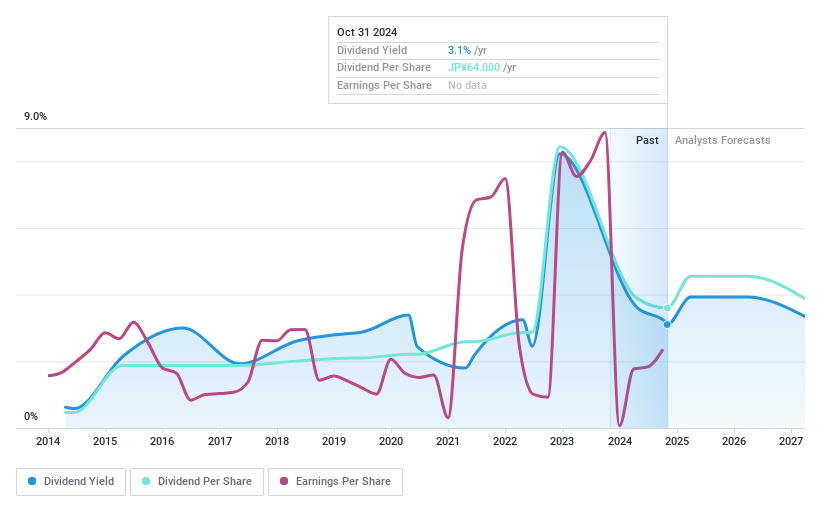

Dividend Yield: 3.1%

JAFCO Group's recent approval of a ¥32 per share interim dividend aligns with its policy of distributing the greater of 3% of shareholders' equity or 50% of net income. Despite a volatile dividend history, current payouts are covered by earnings and cash flows, with payout ratios at 55.7% and 22%, respectively. However, its dividend yield is lower than top-tier Japanese payers, and earnings are projected to decline over the next three years.

- Get an in-depth perspective on JAFCO Group's performance by reading our dividend report here.

- Our valuation report here indicates JAFCO Group may be undervalued.

Next Steps

- Unlock our comprehensive list of 2013 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600210

Shanghai Zijiang Enterprise Group

Shanghai Zijiang Enterprise Group Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.