- China

- /

- Construction

- /

- SHSE:603098

Discovering Hidden Treasures Three Promising Stocks From None Exchange

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, with large-cap stocks faring better than their small-cap counterparts amid a cautious economic outlook. As investors navigate these challenging conditions, identifying promising opportunities in lesser-known stocks can be key to capitalizing on potential growth areas that may not yet be reflected in broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Center International GroupLtd (SHSE:603098)

Simply Wall St Value Rating: ★★★★★★

Overview: Center International Group Co., Ltd. offers building metal enclosure systems solutions in China with a market capitalization of CN¥5.19 billion.

Operations: Center International Group Co., Ltd. generates revenue primarily from its building metal enclosure systems solutions in China. The company's market capitalization is CN¥5.19 billion.

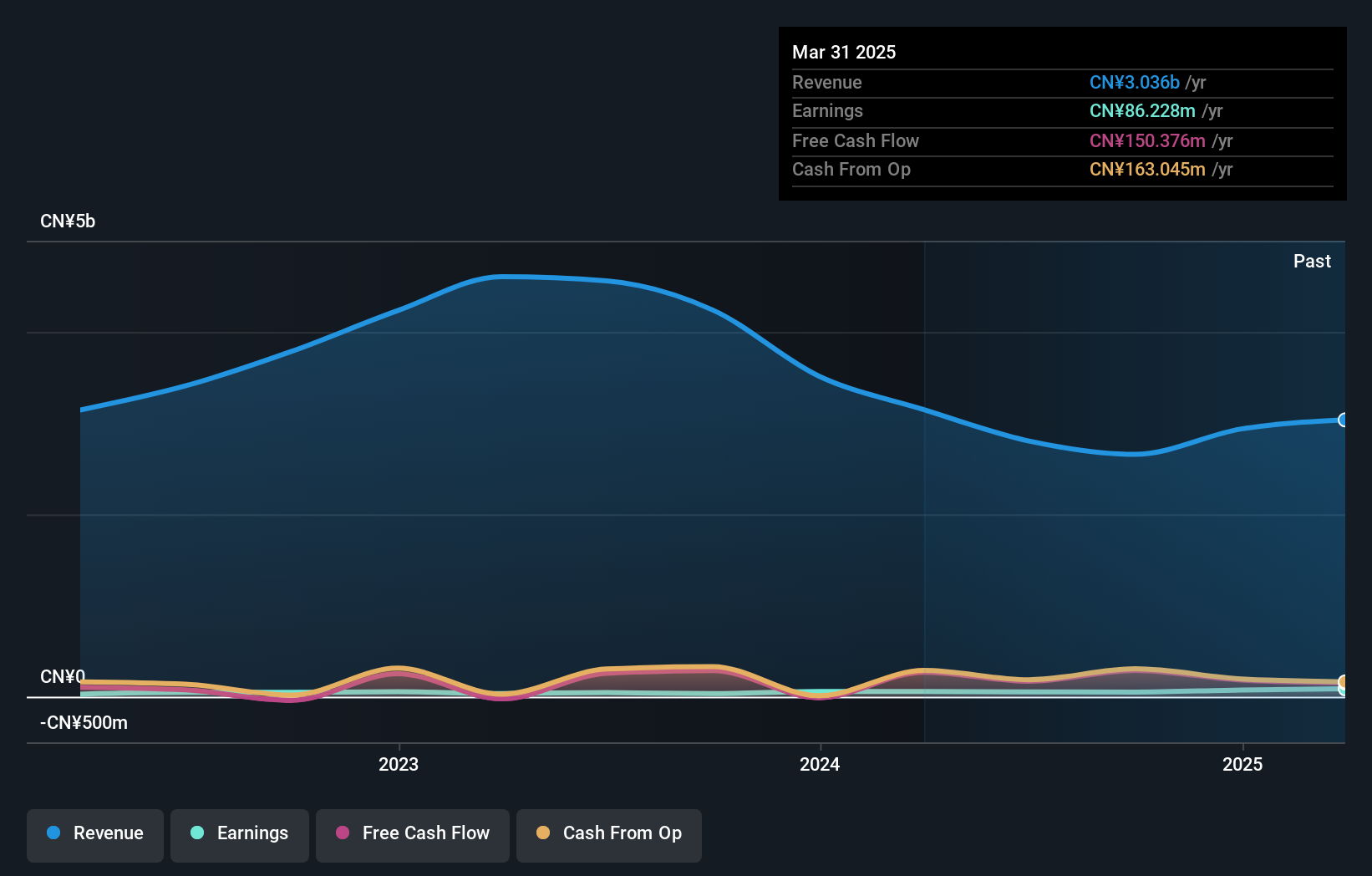

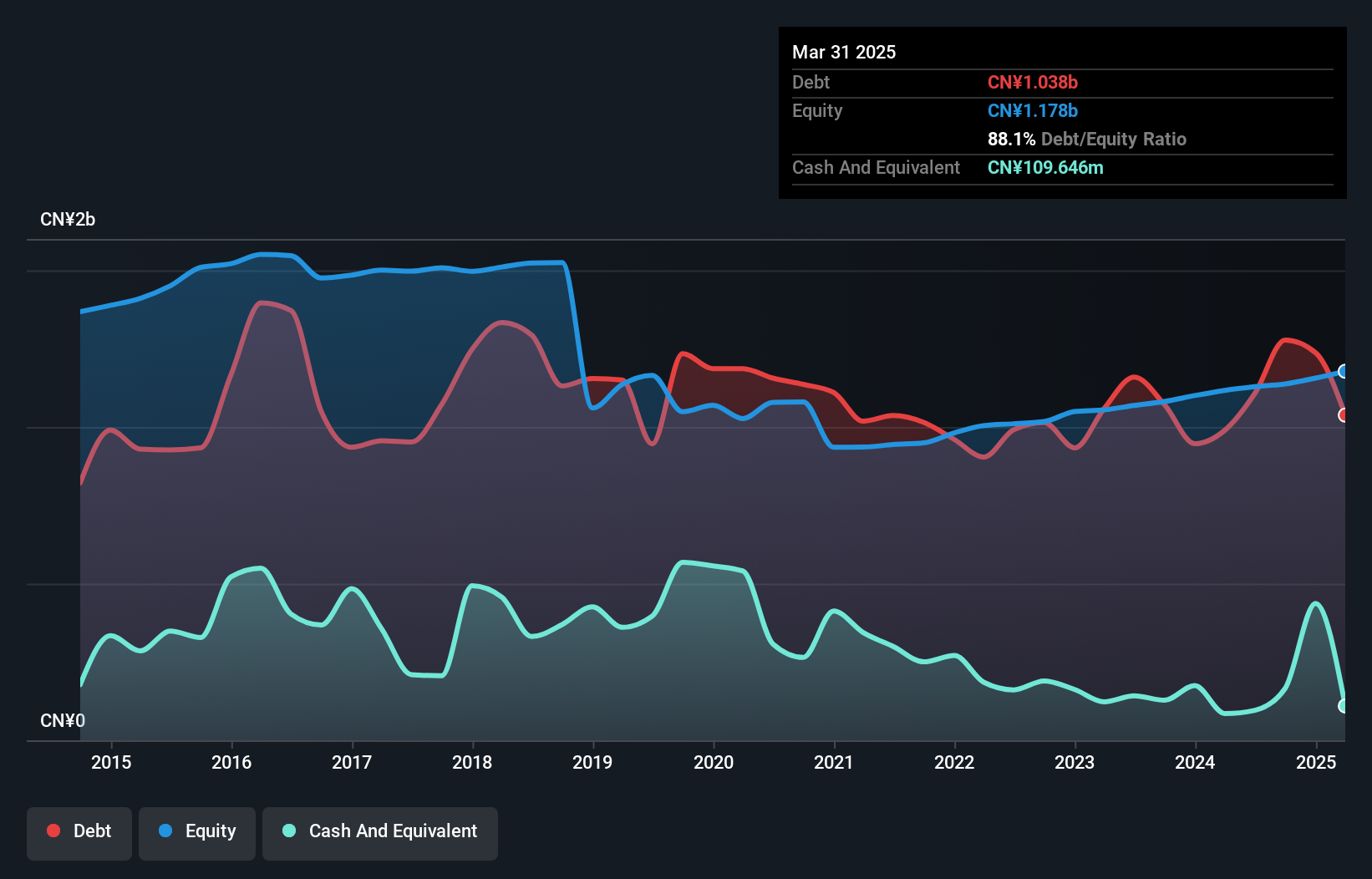

Center International Group Ltd. exhibits a mixed financial landscape with notable elements. Over the past year, earnings surged by 47.3%, outpacing the construction industry's -5.4% trend, although a CN¥58.9M one-off gain influenced these results significantly. Despite this boost, earnings have shrunk by an average of 39.8% annually over five years, reflecting challenges in sustaining growth momentum without exceptional items. The debt-to-equity ratio improved from 29.4% to 27.1%, indicating prudent financial management over five years and more cash than total debt suggests robust liquidity despite declining sales from CN¥2,742M to CN¥1,885M year-on-year for nine months ending September 2024.

- Click here to discover the nuances of Center International GroupLtd with our detailed analytical health report.

Understand Center International GroupLtd's track record by examining our Past report.

Yuan Cheng CableLtd (SZSE:002692)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yuan Cheng Cable Co., Ltd. is involved in the design, research and development, production, and sales of wire and cable products in China with a market capitalization of CN¥3.35 billion.

Operations: Yuan Cheng Cable Co., Ltd. generates revenue primarily from the production and sales of wire and cable products in China. The company has a market capitalization of CN¥3.35 billion, reflecting its position in the industry.

Yuan Cheng Cable, a nimble player in the electrical industry, has shown impressive growth with earnings climbing 10.1% over the past year, outpacing the industry's 1.5%. Although its net debt to equity ratio remains high at 97.9%, it has improved from 117.7% five years ago, indicating some progress in managing leverage. Recent financial results highlight robust sales of CNY 3.18 billion for the first nine months of 2024, compared to CNY 2.27 billion last year, and net income rose to CNY 51.38 million from CNY 32 million previously, reflecting strong operational performance amidst challenging conditions.

Ugreen Group (SZSE:301606)

Simply Wall St Value Rating: ★★★★★★

Overview: Ugreen Group Limited focuses on the research, development, design, production, and sale of consumer electronic products both in China and internationally with a market capitalization of CN¥13.99 billion.

Operations: Ugreen Group generates revenue primarily from the sale of computer peripherals, amounting to CN¥5.76 billion.

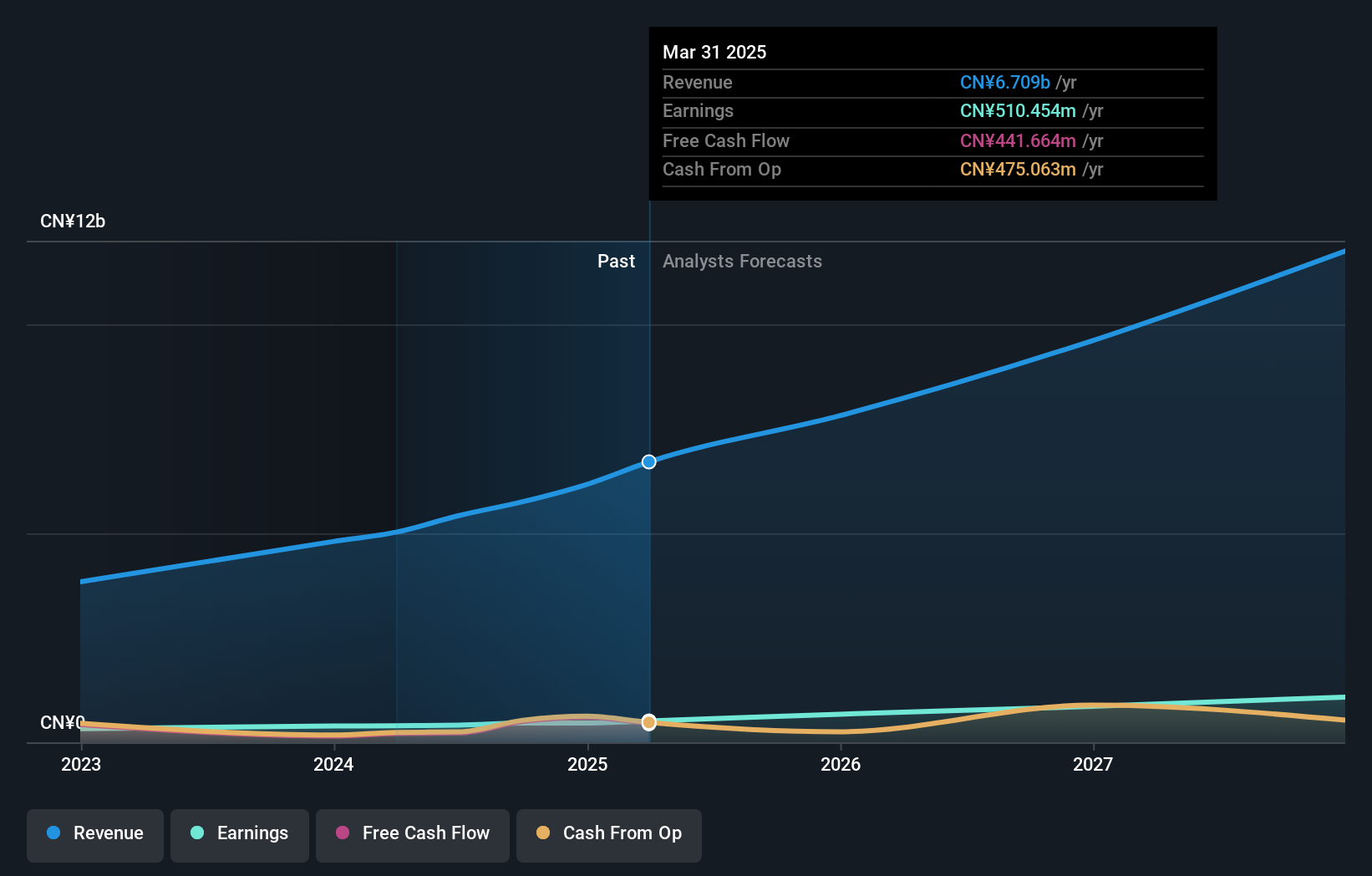

Ugreen Group shines as a tech player with its recent financial performance and innovative product offerings. The company reported sales of CNY 4.31 billion for the first nine months of 2024, up from CNY 3.35 billion last year, while net income rose to CNY 321.77 million from CNY 249.55 million. With a price-to-earnings ratio of 33x, Ugreen is attractively valued compared to the CN market average of 34x and boasts high-quality earnings without any debt over the past five years. Its new Nexode power banks showcase cutting-edge technology with features like fast charging and smart displays, enhancing consumer appeal in an increasingly device-dependent world.

- Click to explore a detailed breakdown of our findings in Ugreen Group's health report.

Gain insights into Ugreen Group's historical performance by reviewing our past performance report.

Make It Happen

- Discover the full array of 4735 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603098

Center International GroupLtd

Provides building metal enclosure systems solutions in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives