- Japan

- /

- Diversified Financial

- /

- TSE:8593

How Upgraded Earnings Guidance and Dividend Hike Will Impact Mitsubishi HC Capital (TSE:8593) Investors

Reviewed by Sasha Jovanovic

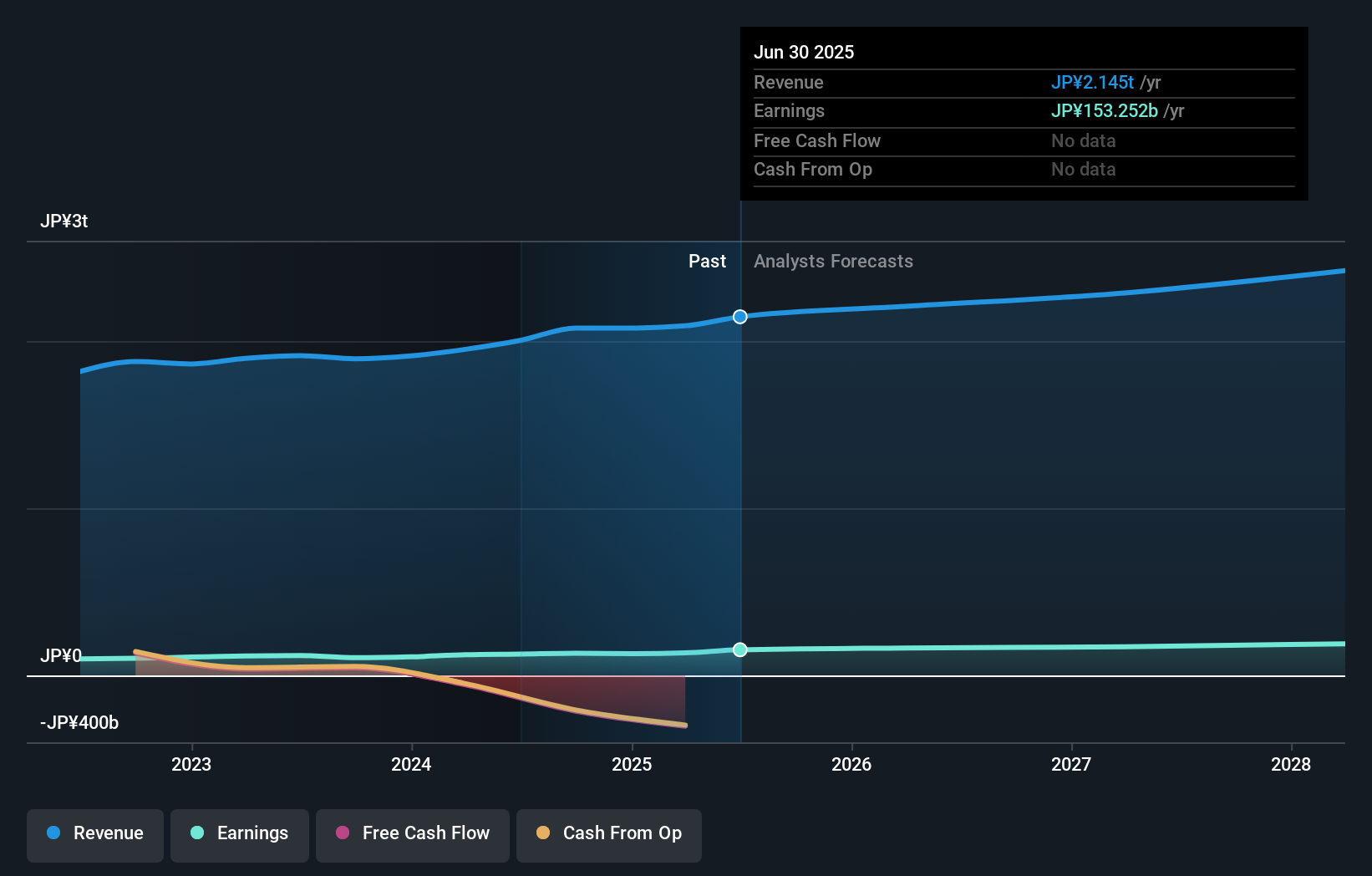

- Mitsubishi HC Capital Inc. recently announced its half-year earnings for the period ended September 30, 2025, reporting sales of JPY 1.13 trillion and net income of JPY 88.79 billion, along with an increased interim dividend of JPY 22.00 per share payable December 5, 2025.

- The company also provided guidance for the fiscal year ending March 31, 2026, projecting net income of JPY 160 billion and earnings per share of JPY 111.44, reflecting management’s forward-looking expectations.

- We’ll now explore what the upgraded earnings guidance means for Mitsubishi HC Capital’s investment outlook and investor confidence.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Mitsubishi HC Capital's Investment Narrative?

For anyone serious about Mitsubishi HC Capital, the big picture is built on steady, predictable financial services and a pattern of cautious growth rather than bold expansion. The recent boost in half-year profits and the higher interim dividend certainly bolster short-term confidence: these announcements provide a shot in the arm for near-term sentiment and could nudge the stock price closer to analyst targets. However, the company’s forward guidance remains mostly unchanged, reflecting management’s measured view of the operating environment. The strongest ongoing catalysts continue to be attractive valuation metrics and a history of earnings growth that’s outstripped industry averages. Yet the core risks have not shifted in a material way, debt coverage by operating cash flow is still a concern and cash flows are only just enough to cover an increasing dividend. Market reaction since the announcement has been measured, suggesting that while the good news supports the investment case, it doesn’t fundamentally alter the main risks or catalysts for shareholders.

Unlike the earnings bump, debt coverage is an issue investors should not overlook. Despite retreating, Mitsubishi HC Capital's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Mitsubishi HC Capital - why the stock might be worth over 2x more than the current price!

Build Your Own Mitsubishi HC Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi HC Capital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mitsubishi HC Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi HC Capital's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8593

Mitsubishi HC Capital

Engages in the lease, installment sale, and other financing activities in Japan, North America, the United Kingdom, rest of Europe, the Middle and Near East, Asia, Oceania, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives