- Japan

- /

- Consumer Finance

- /

- TSE:8572

Acom (TSE:8572): Evaluating Valuation After Profit Surge and Upbeat Financial Results

Reviewed by Simply Wall St

Acom (TSE:8572) just reported a sharp jump in its financial performance for the past half year, with profit attributable to shareholders up 71% compared to last year and strong revenue growth. Investors are taking notice because the company maintained its earnings forecast, supporting a sense of stability and focus.

See our latest analysis for Acom.

Acom’s steady execution is showing up in the numbers as well as the market. After a robust 70% profit surge, the share price has climbed over 21% year-to-date, capping a 26.7% total shareholder return in the past year alone. This underscores solid momentum that is drawing renewed investor attention.

If this kind of resilience has you inspired, broaden your search and discover fast growing stocks with high insider ownership

But with shares already up more than 20% in 2024 and profit growth front and center, investors have to ask if Acom’s stock still offers untapped value or if the market has already factored in these gains and future prospects.

Most Popular Narrative: Fairly Valued

With Acom's current share price hovering near ¥466.8 and the most widely followed narrative suggesting a fair value of ¥452.5, the numbers are closely aligned and indicate a consensus of balanced pricing. Investors should consider the drivers behind analyst conviction before weighing their next move.

The company's focus on embedded finance, highlighted through the GeNiE's Money Lamp service, can create new revenue streams by integrating lending services into existing digital platforms. This innovation is expected to drive future revenue growth.

Want to know what’s fueling this balanced outlook? It all hinges on ambitious revenue expansion, higher profits, and a projected earnings multiple that may surprise even seasoned investors. Tap into the details that shape this fair value and see how Acom stacks up against industry expectations.

Result: Fair Value of ¥452.5 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as the recent data breach and potential changes in overseas regulations could challenge Acom’s earnings momentum and reshape the current valuation outlook.

Find out about the key risks to this Acom narrative.

Another View: Is Acom Still Undervalued?

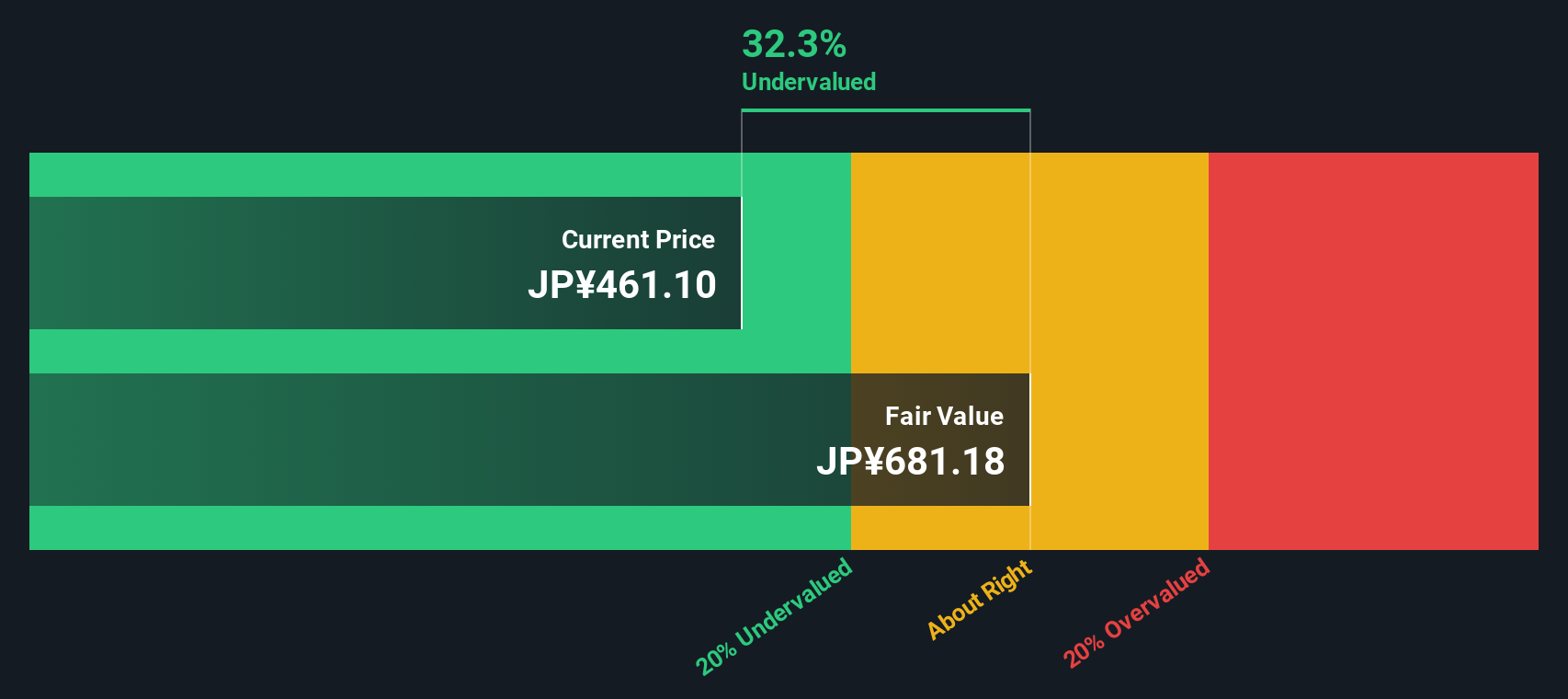

While consensus suggests Acom’s share price is about right, our DCF model paints a different picture. By projecting future cash flows, the SWS DCF model estimates fair value at ¥677.35, which is 32.6% above current levels. Does this signal untapped upside, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Acom Narrative

If you see the story differently or want to dig deeper into the numbers, you can shape your own view with a few quick steps: Do it your way

A great starting point for your Acom research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't limit your strategies to a single stock. Expand your potential by tapping into new trends and sectors that could transform your portfolio in 2024.

- Boost your yields and grow passive income when you track opportunities among these 14 dividend stocks with yields > 3% with strong and consistent payouts.

- Step ahead of the curve and invest in tomorrow's breakthroughs by targeting these 27 AI penny stocks with high exposure to artificial intelligence innovation.

- Capitalize on under-the-radar winners by reviewing these 882 undervalued stocks based on cash flows with impressive fundamentals that the market may be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8572

Acom

Engages in financial services business in Japan, Thailand, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives