- Japan

- /

- Diversified Financial

- /

- TSE:8566

A Look at Ricoh Leasing (TSE:8566) Valuation Following Latest Dividend Hike

Reviewed by Simply Wall St

Ricoh Leasing Company (TSE:8566) just announced a dividend increase for the second quarter, raising its payout to ¥90 per share from ¥80 last year. This bump may catch investor attention, especially for those eyeing total shareholder returns.

See our latest analysis for Ricoh Leasing Company.

Ricoh Leasing Company’s recent dividend hike follows a planned merger with its wholly-owned subsidiary, signaling both confidence and a drive for operational efficiency. While the 1-year share price return has been steady, the 1-year total shareholder return stands at an impressive 16.06%, highlighting the value of reinvested dividends. Over the long term, its 5-year total shareholder return of 127.43% shows consistent rewards for patient investors, suggesting momentum is still in play for those focused on the bigger picture.

If you’re curious where else market momentum and smart ownership are combining for strong results, now is the perfect moment to discover fast growing stocks with high insider ownership

Given this upbeat track record and a newly increased dividend, the question now is whether Ricoh Leasing Company’s shares are trading below their true value or if the market is already factoring in its future growth prospects. Could this be a buying opportunity?

Price-to-Earnings of 12.8x: Is it justified?

Ricoh Leasing Company’s current share price reflects a price-to-earnings (P/E) ratio of 12.8x, which positions it slightly above both the peer average of 12.7x and the Japanese diversified financial industry average of 12.3x. This means investors are paying a premium for each unit of reported earnings compared to the broader industry.

The P/E ratio is widely used because it links a company’s share price with its earnings power, allowing comparisons across companies and sectors. For Ricoh Leasing Company, this multiple suggests that the market might be expecting steadier earnings or lower growth volatility relative to some competitors, particularly within a mature financial sector.

Despite resilient performance and reliable past earnings, the premium relative to both industry and peers may indicate that investors expect solid returns, but not rapid expansion. The market’s pricing could adjust if future profit growth surprises or sector headwinds emerge.

Compared to the industry’s P/E of 12.3x, Ricoh Leasing Company’s valuation is slightly higher, but not out of line. The difference versus peers is also minimal, pointing to neither a clear bargain nor an aggressive overvaluation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.8x (OVERVALUED)

However, persistent sector headwinds or unexpected earnings stagnation could challenge Ricoh Leasing Company’s positive momentum and valuation premium in the coming quarters.

Find out about the key risks to this Ricoh Leasing Company narrative.

Another View: Discounted Cash Flow Paints a Different Picture

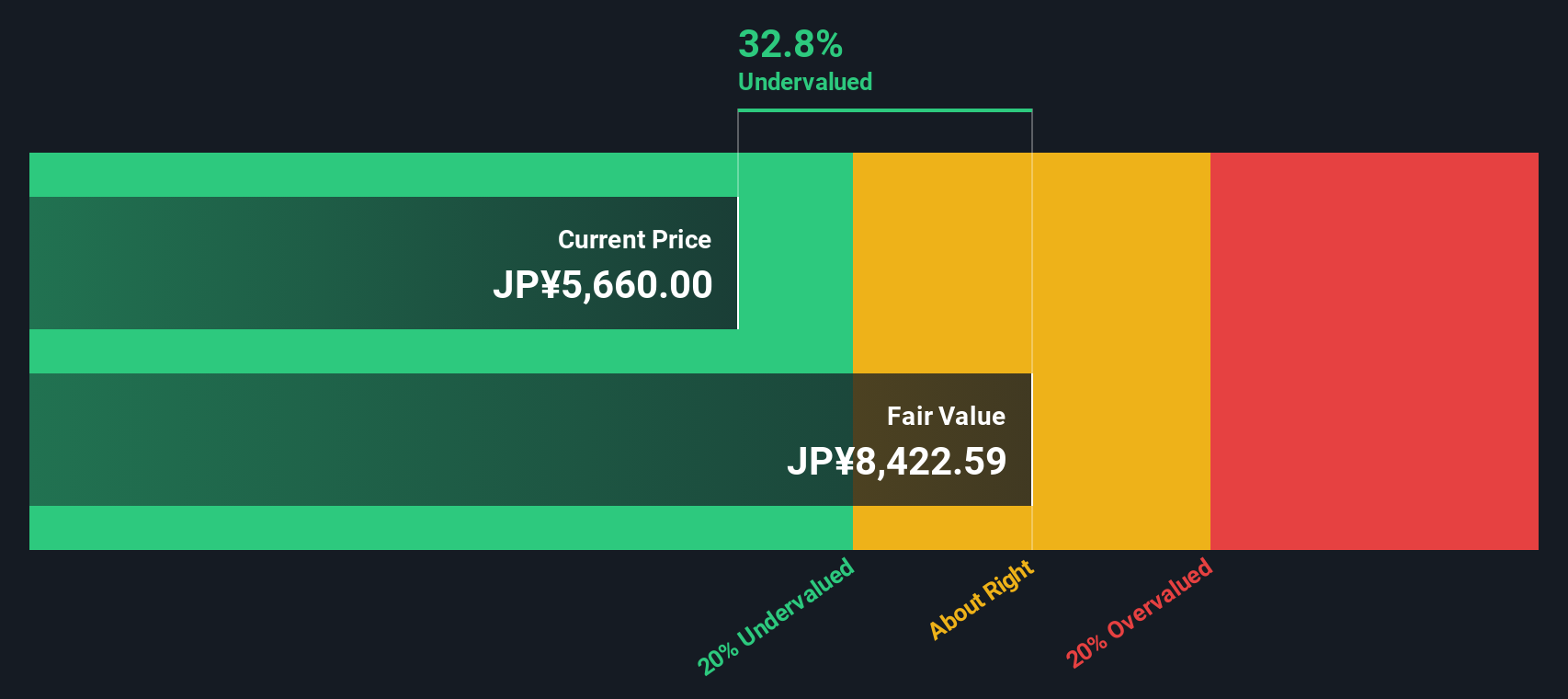

While Ricoh Leasing Company’s share price looks expensive compared to earnings multiples, our DCF model tells a different story. Based on projected cash flows, the SWS DCF model suggests the shares are trading about 33% below their estimated fair value. Could the market be underestimating future cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ricoh Leasing Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ricoh Leasing Company Narrative

If you have a different perspective or want a hands-on look at the data, you can build your own narrative for Ricoh Leasing Company in just a few minutes: Do it your way

A great starting point for your Ricoh Leasing Company research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on smarter opportunities. Let Simply Wall Street’s Screener open the door to unique strategies and under-the-radar stocks most investors overlook.

- Snap up income potential by reviewing these 16 dividend stocks with yields > 3% that offer reliable yields and strengthen your portfolio’s cash flow.

- Position yourself at the forefront of artificial intelligence by evaluating these 25 AI penny stocks, where pioneering companies are driving the next tech wave.

- Boost your growth strategy by hunting for value in these 879 undervalued stocks based on cash flows currently trading below their intrinsic worth based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8566

Ricoh Leasing Company

Engages in leasing and finance, investment, and service businesses in Japan.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives