- Japan

- /

- Capital Markets

- /

- TSE:8473

SBI Holdings (TSE:8473): Assessing Valuation After Strong 2024 Share Price Climb

Reviewed by Simply Wall St

See our latest analysis for SBI Holdings.

After a powerful year-to-date run, SBI Holdings has caught the market’s attention with its share price climbing nearly 69% in 2024 and its total shareholder return hitting an impressive 112% over the past year. Momentum appears to be building, as investors are focusing on growth signals and renewed optimism following recent revenue gains.

If you’re curious what else the market’s momentum chasers are looking at, now is the perfect chance to broaden your view and explore fast growing stocks with high insider ownership

With SBI Holdings’ stock surging this year, investors are faced with a crucial question: is the current price a reflection of real value with untapped upside, or has the market already factored in all the expected growth?

Most Popular Narrative: 14% Overvalued

The most popular narrative suggests SBI Holdings is trading above its estimated fair value, with the narrative fair value sitting well below the latest closing price. With the last close at ¥6,771 and the fair value at ¥5,950, there is a clear divergence between what analysts expect and where the market currently stands.

The company's aggressive expansion into advanced technologies, such as digital assets, stablecoins, blockchain, and AI, appears to be fueling high growth expectations. However, increased regulatory scrutiny and uncertain legislative frameworks for cryptocurrencies and stablecoins in Japan and globally could result in sharply higher compliance costs and operational risk. This could potentially compress future net margins and heighten earnings volatility.

Curious how cutting-edge bets on AI, fintech, and digital assets are being weighed against shrinking future profit margins? Big expectations, bold forecasts, and a controversial growth runway are at the heart of this valuation. Get the numbers and the tensions that really matter in the full narrative breakdown.

Result: Fair Value of ¥5,950 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, record high profits and robust growth across multiple business units could still drive share prices higher if current positive trends persist.

Find out about the key risks to this SBI Holdings narrative.

Another View: SWS DCF Model Suggests a Different Story

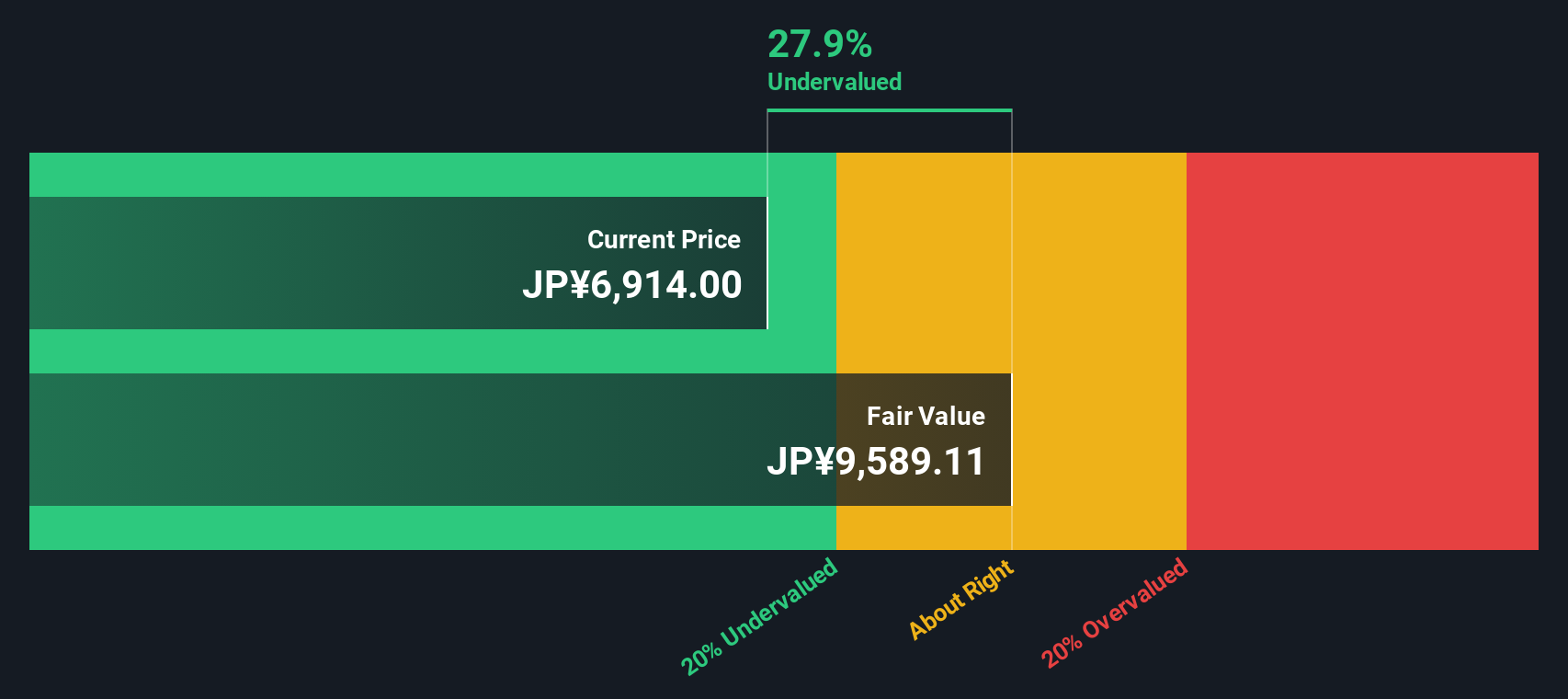

While the popular narrative values SBI Holdings as overvalued, our SWS DCF model paints a contrasting picture. It estimates the company’s fair value at ¥10,019, which is well above the current share price. This method challenges conventional market views and raises the question of which approach is closer to reality.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SBI Holdings Narrative

If you want to challenge these views or see what your own research might reveal, it takes just a few minutes to build your perspective. Do it your way.

A great starting point for your SBI Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Expand your watchlist now, as the market’s next big winners could be hiding in places you haven’t checked yet.

- Boost your search for companies with strong financials and growth potential by checking out these 3588 penny stocks with strong financials.

- Capitalize on high-yield opportunities by reviewing these 17 dividend stocks with yields > 3% with exceptional dividend returns above 3%.

- Unlock tomorrow’s technology trends when you scan these 24 AI penny stocks leading advancements in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japan and Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives