- Japan

- /

- Diversified Financial

- /

- TSE:8425

Mizuho Leasing Company, Limited's (TSE:8425) Shares Not Telling The Full Story

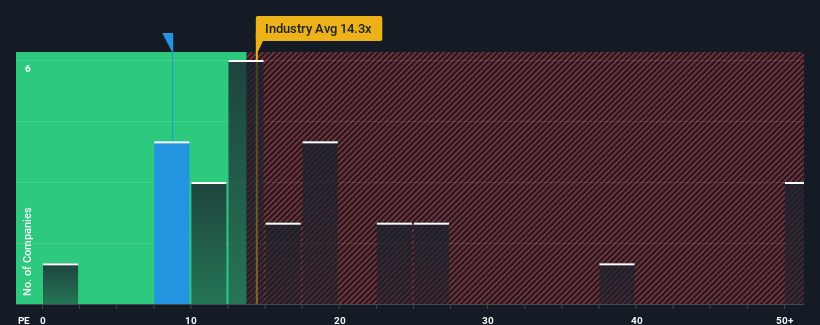

Mizuho Leasing Company, Limited's (TSE:8425) price-to-earnings (or "P/E") ratio of 8.7x might make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 23x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Mizuho Leasing Company as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Mizuho Leasing Company

Is There Any Growth For Mizuho Leasing Company?

The only time you'd be truly comfortable seeing a P/E as low as Mizuho Leasing Company's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 39%. The latest three year period has also seen an excellent 35% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Mizuho Leasing Company's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Mizuho Leasing Company's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Mizuho Leasing Company currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Mizuho Leasing Company you should be aware of, and 1 of them is a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Mizuho Leasing Company, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8425

Mizuho Leasing Company

Provides general leasing services in Japan and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives