- Taiwan

- /

- Hospitality

- /

- TPEX:2732

February 2025's Best Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate through the turbulence of tariff uncertainties and mixed economic indicators, investors are keenly observing shifts in sectors such as manufacturing and services. Despite these challenges, dividend stocks remain a focal point for those seeking steady income streams, particularly when market volatility underscores the appeal of reliable payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.78% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.13% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.87% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

illimity Bank (BIT:ILTY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: illimity Bank S.p.A. operates in Italy offering private banking, investment, and trading services with a market cap of €309.81 million.

Operations: illimity Bank S.p.A. generates its revenue through segments including B-Ilty (€15.60 million), Corporate Banking (€82.60 million), Investment Banking (€15.70 million), and Specialised Credit (€62.20 million).

Dividend Yield: 6.7%

illimity Bank's dividend payments are well covered by earnings, with a current payout ratio of 34.5% and forecasts indicating continued coverage in three years at 21.5%. Despite its high dividend yield being among the top 25% in Italy, illimity has only paid dividends for two years, raising concerns about long-term reliability. Recent earnings showed a decline, and the bank faces challenges with high levels of bad loans (13.9%). Additionally, an acquisition proposal by Banca IFIS could impact future dividend prospects if completed as planned in September 2025.

- Take a closer look at illimity Bank's potential here in our dividend report.

- Our valuation report here indicates illimity Bank may be undervalued.

La Kaffa International (TPEX:2732)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: La Kaffa International Co., Ltd. operates a franchise of chain restaurants in Taiwan and internationally, with a market cap of NT$4.45 billion.

Operations: La Kaffa International Co., Ltd. generates revenue from several segments, including NT$164.38 million from China, NT$814 million from America and Australia, and NT$1.37 billion from its Kingza Subsidiary in Taiwan.

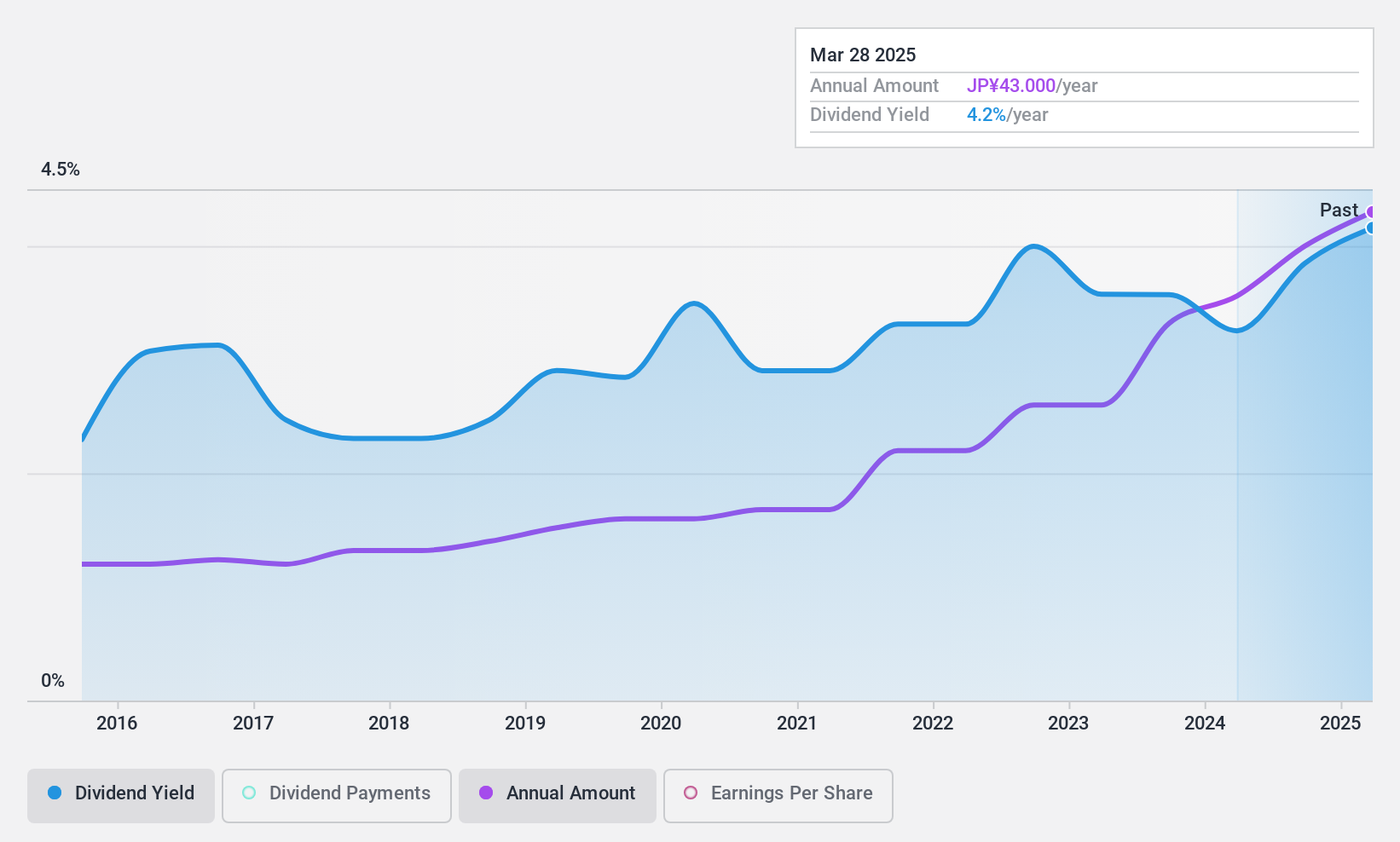

Dividend Yield: 5.1%

La Kaffa International's dividend yield of 5.12% ranks in the top 25% in Taiwan, yet its sustainability is questionable due to a high payout ratio of 99.9%, indicating dividends aren't well covered by earnings. Although dividends have grown over ten years, they've been volatile with significant annual drops. Recent earnings show declining net income and EPS compared to last year, raising concerns about future dividend reliability despite being covered by cash flows with a payout ratio of 71.6%.

- Dive into the specifics of La Kaffa International here with our thorough dividend report.

- Our valuation report here indicates La Kaffa International may be overvalued.

Mizuho Leasing Company (TSE:8425)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mizuho Leasing Company, Limited offers general leasing services both in Japan and internationally, with a market cap of ¥292.50 billion.

Operations: Mizuho Leasing Company, Limited generates revenue through its general leasing services provided domestically and internationally.

Dividend Yield: 4%

Mizuho Leasing Company has increased its dividend guidance to ¥23 per share, reflecting improved profitability and a commitment to shareholder returns. Despite a low payout ratio of 13.2%, dividends have been volatile over the past decade, with significant annual drops. The company's financial position is challenged by debt not well covered by operating cash flow, and it lacks free cash flows to sustain dividends. Recent earnings growth supports the revised dividend outlook amidst these concerns.

- Click to explore a detailed breakdown of our findings in Mizuho Leasing Company's dividend report.

- The valuation report we've compiled suggests that Mizuho Leasing Company's current price could be quite moderate.

Key Takeaways

- Click here to access our complete index of 1954 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:2732

La Kaffa International

Operates franchise of chain restaurants in Taiwan and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives