- Japan

- /

- Consumer Finance

- /

- TSE:7383

Revenues Tell The Story For Net Protections Holdings, Inc. (TSE:7383) As Its Stock Soars 30%

Despite an already strong run, Net Protections Holdings, Inc. (TSE:7383) shares have been powering on, with a gain of 30% in the last thirty days. The last month tops off a massive increase of 272% in the last year.

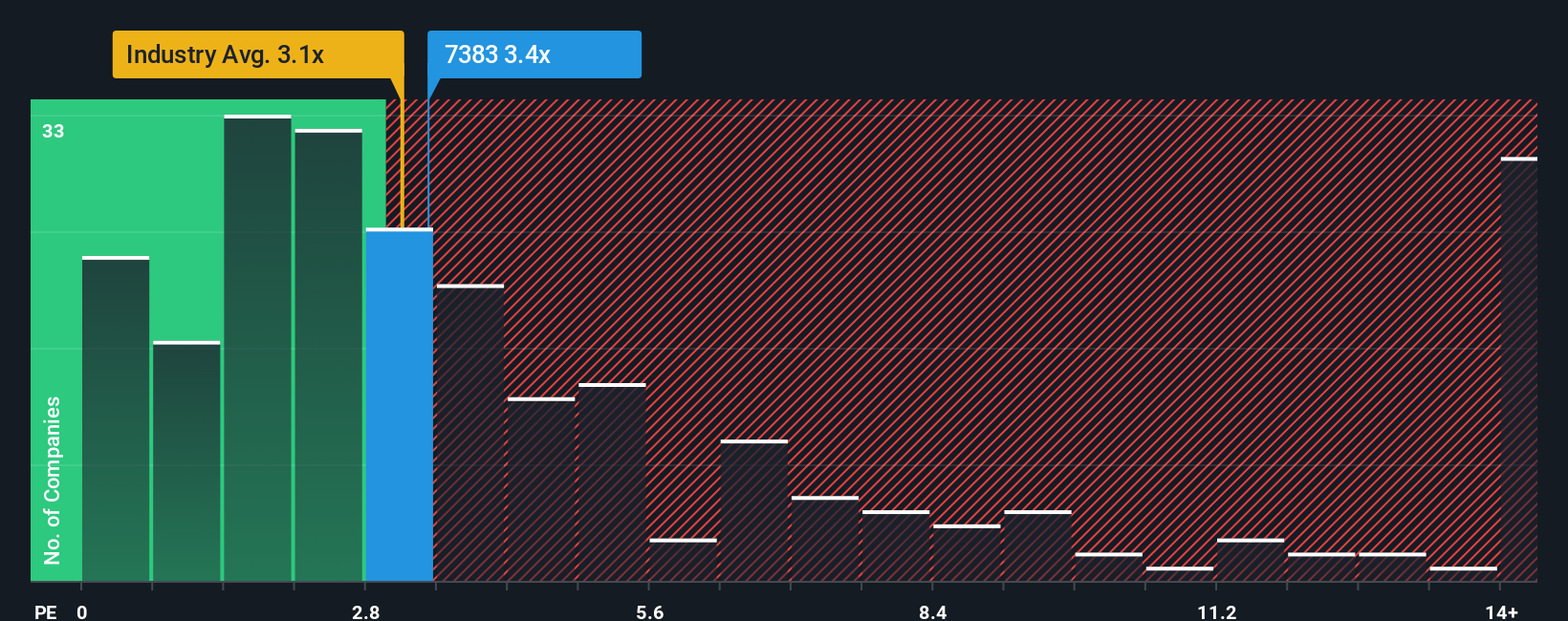

Following the firm bounce in price, given around half the companies in Japan's Consumer Finance industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Net Protections Holdings as a stock to avoid entirely with its 3.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Net Protections Holdings

How Has Net Protections Holdings Performed Recently?

There hasn't been much to differentiate Net Protections Holdings' and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Net Protections Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Net Protections Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Net Protections Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 23% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the four analysts following the company. With the industry only predicted to deliver 5.9% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Net Protections Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The strong share price surge has lead to Net Protections Holdings' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Net Protections Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Net Protections Holdings that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Net Protections Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7383

Net Protections Holdings

Provides buy now pay later (BNPL) services in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives