- Japan

- /

- Consumer Finance

- /

- TSE:7383

Positive Sentiment Still Eludes Net Protections Holdings, Inc. (TSE:7383) Following 28% Share Price Slump

Net Protections Holdings, Inc. (TSE:7383) shares have had a horrible month, losing 28% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

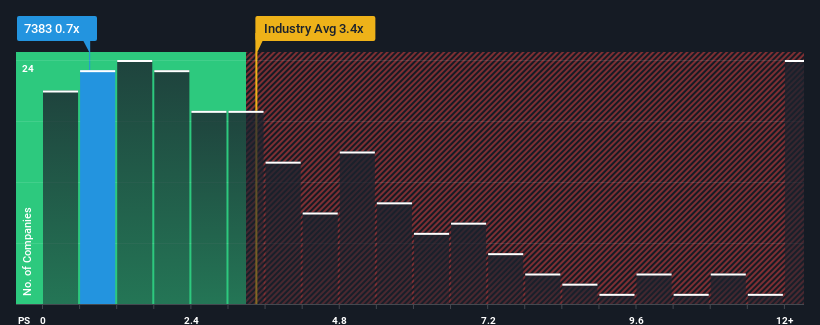

In spite of the heavy fall in price, there still wouldn't be many who think Net Protections Holdings' price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Japan's Consumer Finance industry is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Net Protections Holdings

How Net Protections Holdings Has Been Performing

Net Protections Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Net Protections Holdings will help you uncover what's on the horizon.How Is Net Protections Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Net Protections Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Revenue has also lifted 19% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 9.4% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 4.9% per year, which is noticeably less attractive.

In light of this, it's curious that Net Protections Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Net Protections Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Net Protections Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Net Protections Holdings you should know about.

If these risks are making you reconsider your opinion on Net Protections Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Net Protections Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7383

Net Protections Holdings

Provides buy now pay later (BNPL) services in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives