- Japan

- /

- Consumer Finance

- /

- TSE:7383

Net Protections Holdings, Inc.'s (TSE:7383) 35% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Net Protections Holdings, Inc. (TSE:7383) shares have been powering on, with a gain of 35% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 66% in the last year.

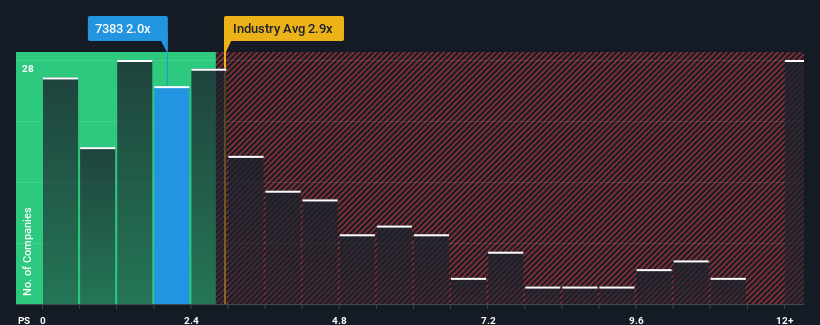

Following the firm bounce in price, given close to half the companies operating in Japan's Consumer Finance industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Net Protections Holdings as a stock to potentially avoid with its 2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Net Protections Holdings

How Net Protections Holdings Has Been Performing

Recent times haven't been great for Net Protections Holdings as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Net Protections Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Net Protections Holdings?

The only time you'd be truly comfortable seeing a P/S as high as Net Protections Holdings' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.1% last year. The latest three year period has also seen a 18% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% each year during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 22% per annum growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Net Protections Holdings' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Net Protections Holdings' P/S

Net Protections Holdings' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Net Protections Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 1 warning sign for Net Protections Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Net Protections Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Net Protections Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Net Protections Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7383

Net Protections Holdings

Provides buy now pay later (BNPL) services in Japan and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives