- Japan

- /

- Food and Staples Retail

- /

- TSE:2659

Kotobuki Spirits And 2 Other Undiscovered Gems In Japan

Reviewed by Simply Wall St

As Japan's stock markets have been on the rise, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, investors are increasingly interested in exploring opportunities within this dynamic environment. Amidst yen weakness and a cautious stance from the Bank of Japan, small-cap stocks like Kotobuki Spirits are drawing attention as potential undiscovered gems that may offer unique value propositions in a fluctuating market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Kotobuki Spirits (TSE:2222)

Simply Wall St Value Rating: ★★★★★★

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that specializes in the production and sale of sweets, with a market capitalization of ¥292.46 billion.

Operations: Kotobuki Spirits generates revenue primarily through its segments Shukrei, Casey Shii, and Kotobuki Confectionery/Tajima Kotobuki, contributing ¥27.03 billion, ¥18.88 billion, and ¥13.19 billion respectively.

Kotobuki Spirits, a smaller player in Japan's market, is catching attention with its robust financial health. The company has seen earnings growth of 33.7% over the past year, surpassing the Food industry's 26.8%. Trading at 45.3% below its estimated fair value suggests potential undervaluation. Additionally, Kotobuki's debt to equity ratio improved from 2.1 to 0.9 over five years, highlighting prudent financial management and positioning it for future opportunities in the industry landscape.

- Click to explore a detailed breakdown of our findings in Kotobuki Spirits' health report.

Gain insights into Kotobuki Spirits' past trends and performance with our Past report.

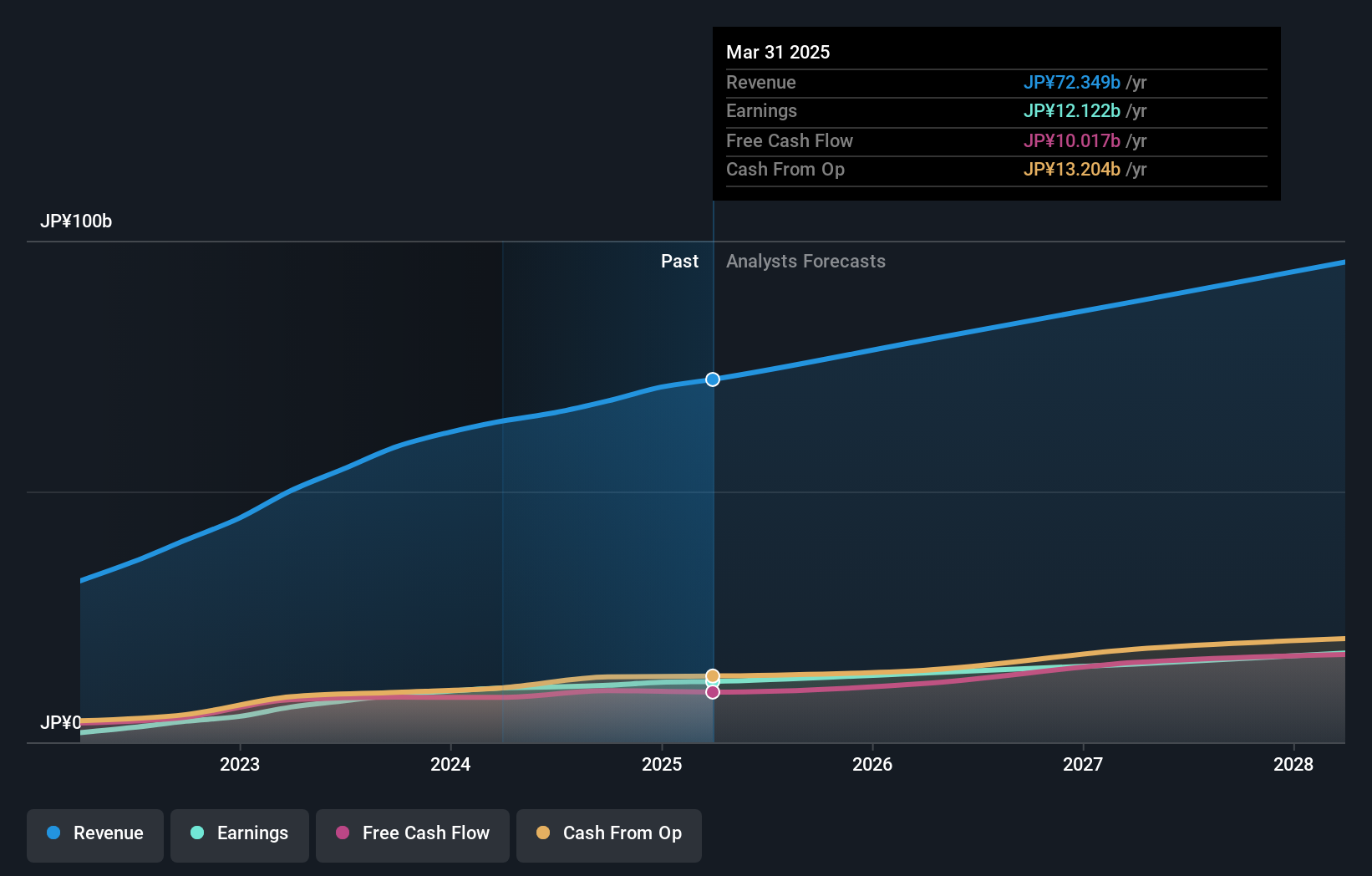

SAN-ALTD (TSE:2659)

Simply Wall St Value Rating: ★★★★★★

Overview: SAN-A CO., LTD. operates a chain of supermarkets in Okinawa with a market capitalization of ¥180.53 billion.

Operations: The company generates revenue primarily from its supermarket operations in Okinawa. It has a market capitalization of ¥180.53 billion, reflecting its significant presence in the region's retail sector.

San-A Ltd. stands out with its debt-free status, having maintained this position for the past five years, which provides a solid foundation for financial stability. Trading at 40.5% below its estimated fair value suggests potential undervaluation in the market. Although earnings growth of 17.6% over the past year lagged behind the Consumer Retailing industry's 21.4%, it remains profitable with high-quality earnings and a forecasted annual growth of 4.5%.

- Get an in-depth perspective on SAN-ALTD's performance by reading our health report here.

Gain insights into SAN-ALTD's historical performance by reviewing our past performance report.

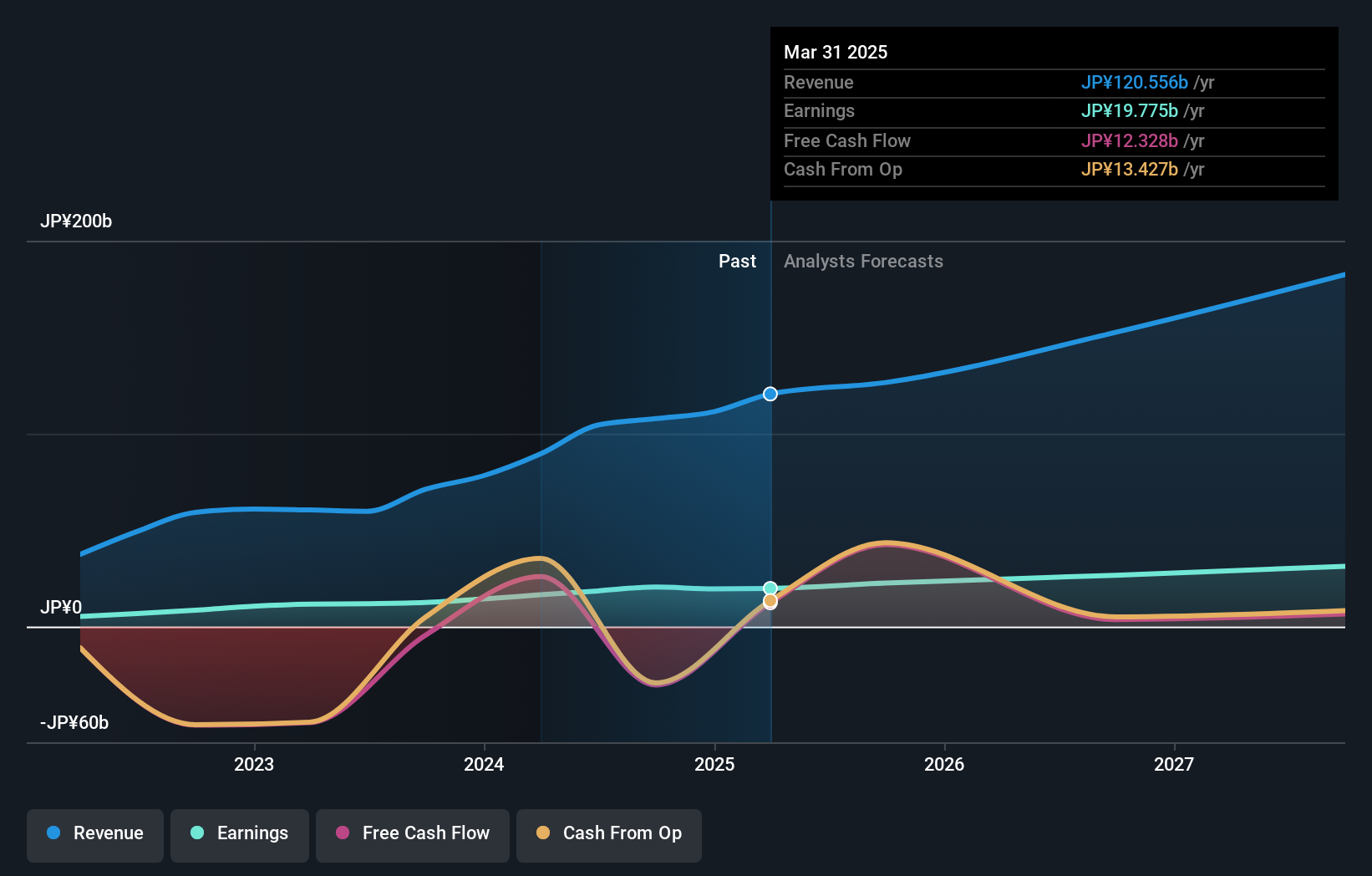

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Value Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market capitalization of ¥206.11 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse financial product and service offerings in Japan, contributing to a market capitalization of ¥206.11 billion.

Financial Partners Group, a nimble player in Japan's financial landscape, has shown impressive earnings growth of 55.9% over the past year, outpacing the industry average of 24.9%. Despite a high net debt to equity ratio of 228.7%, its ability to cover interest payments is not a concern due to robust earnings quality. Recently, the company repurchased shares worth ¥1.14 billion and expanded operations with a new sales office in Imabari City, reflecting strategic growth initiatives.

Seize The Opportunity

- Delve into our full catalog of 731 Japanese Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2659

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives