Global Stocks Estimated To Be Up To 45.3% Below Intrinsic Value

Reviewed by Simply Wall St

In the face of trade uncertainties and mixed performances across global indices, investors are navigating a landscape marked by policy shifts and economic caution. With major indexes like the Dow Jones Industrial Average and S&P 500 closing lower amid escalating U.S.-China trade tensions, identifying stocks that are trading below their intrinsic value becomes crucial for those seeking potential opportunities in an uncertain market. As we explore three global stocks estimated to be up to 45.3% below intrinsic value, understanding what constitutes a good stock—such as strong fundamentals and resilience in volatile conditions—can help guide investment decisions in these challenging times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Chenbro Micom (TWSE:8210) | NT$220.00 | NT$437.32 | 49.7% |

| Pegasus (TSE:6262) | ¥463.00 | ¥923.53 | 49.9% |

| Insource (TSE:6200) | ¥853.00 | ¥1679.61 | 49.2% |

| LPP (WSE:LPP) | PLN15610.00 | PLN30721.86 | 49.2% |

| Lindab International (OM:LIAB) | SEK186.80 | SEK372.09 | 49.8% |

| TF Bank (OM:TFBANK) | SEK345.50 | SEK683.33 | 49.4% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €23.19 | 50.2% |

| Rise Consulting Group (TSE:9168) | ¥926.00 | ¥1832.63 | 49.5% |

| Komplett (OB:KOMPL) | NOK11.50 | NOK22.81 | 49.6% |

| Aozora Bank (TSE:8304) | ¥1864.00 | ¥3691.60 | 49.5% |

Let's review some notable picks from our screened stocks.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company engaged in the development, production, and sale of biopharmaceutical products, with a market cap of approximately CN¥27.93 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, totaling CN¥533.91 million.

Estimated Discount To Fair Value: 28.0%

Suzhou Zelgen Biopharmaceuticals is trading 28% below its estimated fair value of CN¥149.48, with a current price of CN¥107.6, indicating potential undervaluation based on discounted cash flow analysis. The company reported a significant increase in sales for Q1 2025 to CN¥167.64 million from CN¥108.24 million the previous year, while net losses narrowed to CN¥28.26 million from CN¥39.5 million, reflecting improved financial performance and robust revenue growth forecasts exceeding market averages.

- Our growth report here indicates Suzhou Zelgen BiopharmaceuticalsLtd may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Suzhou Zelgen BiopharmaceuticalsLtd stock in this financial health report.

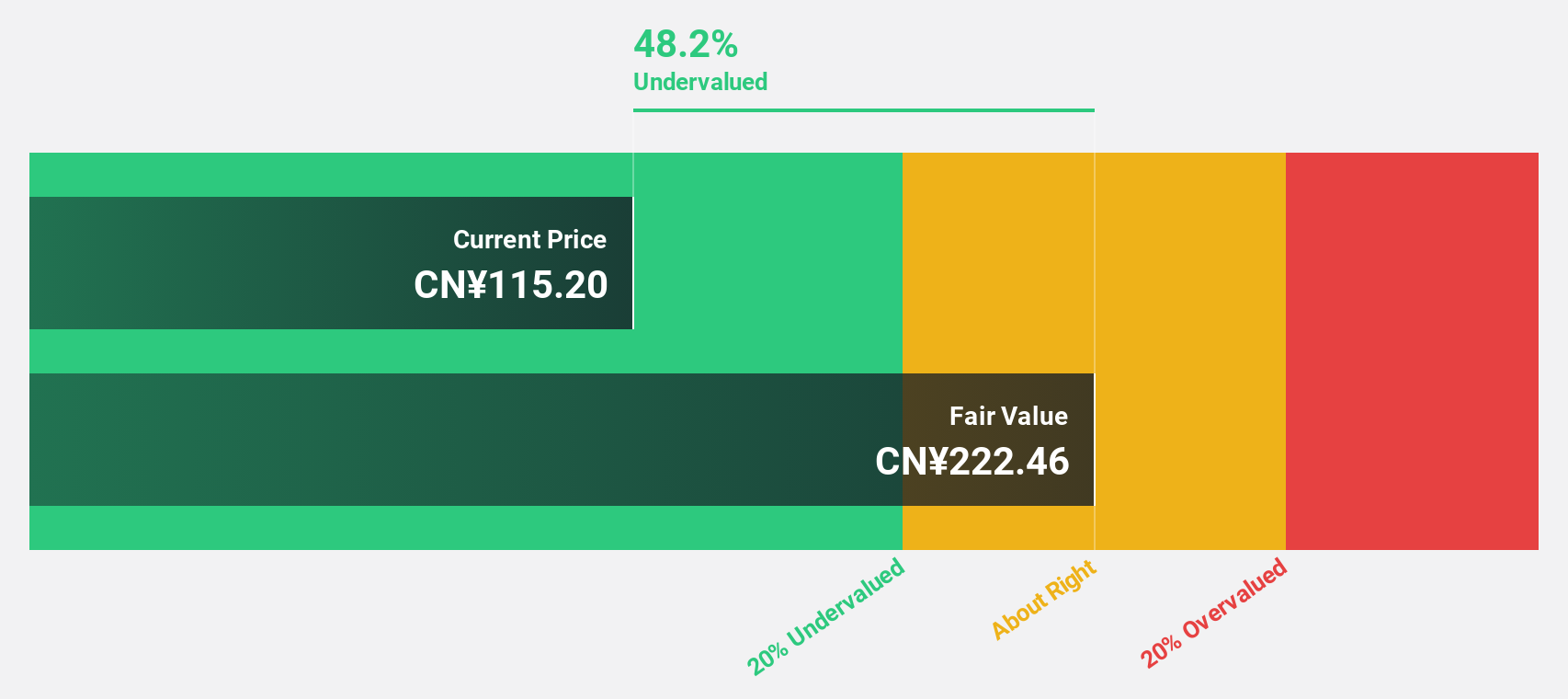

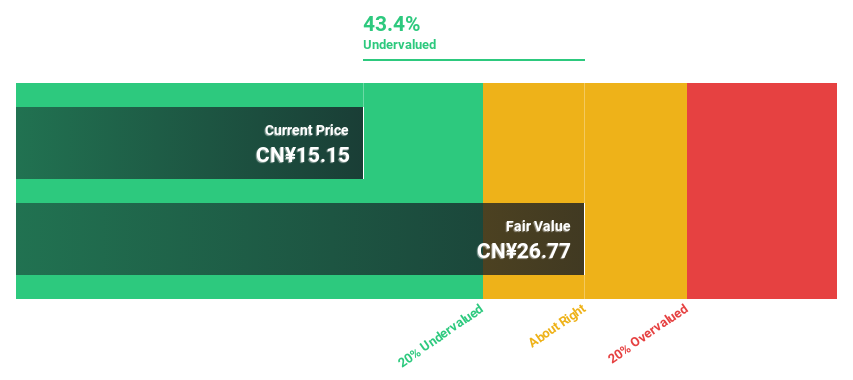

Zhejiang Garden BiopharmaceuticalLtd (SZSE:300401)

Overview: Zhejiang Garden Biopharmaceutical Co., Ltd. operates in the pharmaceutical industry with a market capitalization of CN¥7.65 billion.

Operations: The company generates its revenue from various segments within the pharmaceutical industry, though specific segment details are not provided in the available data.

Estimated Discount To Fair Value: 45.3%

Zhejiang Garden Biopharmaceutical is trading 46.5% below its fair value estimate of CN¥26.77, with a current price of CN¥14.31, highlighting potential undervaluation based on cash flows. Recent earnings for Q1 2025 showed net income growth to CN¥96.51 million from CN¥91.48 million year-over-year, despite slightly lower sales figures. The company's earnings and revenue are forecast to grow significantly above market averages, although its dividend yield remains modest and not well covered by free cash flows.

- Our earnings growth report unveils the potential for significant increases in Zhejiang Garden BiopharmaceuticalLtd's future results.

- Take a closer look at Zhejiang Garden BiopharmaceuticalLtd's balance sheet health here in our report.

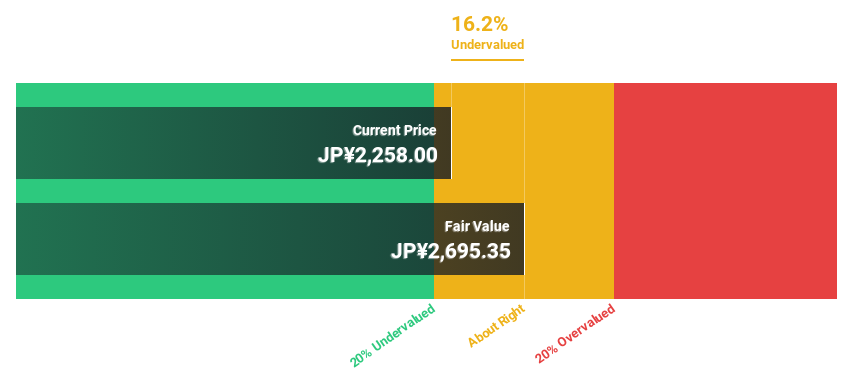

Financial Partners GroupLtd (TSE:7148)

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan, with a market capitalization of ¥188 billion.

Operations: The company's revenue is primarily derived from its Lease Fund Business, which generates ¥26.79 billion, Domestic Real Estate Fund Business with ¥79.79 billion, and Overseas Real Estate Fund Business contributing ¥4.23 billion.

Estimated Discount To Fair Value: 12.7%

Financial Partners Group Ltd. is trading at ¥2,253, which is 12.7% below its estimated fair value of ¥2,582.19, suggesting potential undervaluation based on cash flows despite a dividend not well covered by free cash flows. The company recently completed a share buyback and expanded operations with a new sales office in Morioka City to enhance regional presence and business performance. Earnings are forecast to grow faster than the Japanese market average but not significantly above 20% annually.

- The growth report we've compiled suggests that Financial Partners GroupLtd's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Financial Partners GroupLtd.

Taking Advantage

- Reveal the 466 hidden gems among our Undervalued Global Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Suzhou Zelgen BiopharmaceuticalsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688266

Suzhou Zelgen BiopharmaceuticalsLtd

Suzhou Zelgen Biopharmaceuticals Co.,Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives