- Japan

- /

- Diversified Financial

- /

- TSE:3769

Is GMO Payment Gateway (TSE:3769) Overvalued? A Fresh Look at Its Current Valuation

Reviewed by Simply Wall St

What’s Behind the Latest Moves in GMO Payment Gateway (TSE:3769) Stock?

If you own shares in GMO Payment Gateway (TSE:3769) or have it on your watchlist, you might be wondering what’s next after its recent performance. Although there has not been a headline-grabbing event to sway the stock in either direction, its latest moves are catching investors’ attention. Sometimes, it is these quieter periods that prompt the toughest questions, especially for long-term holders who are watching valuations closely.

When you take a step back and look at the bigger picture, it becomes clear that momentum has not been on the stock’s side lately. Over the past year, GMO Payment Gateway has delivered a negative total return, and the last three years have not been much kinder either. However, the year-to-date gain suggests that sentiment may be shifting, even as the recent quarter saw some pullback. In the absence of major news, this choppy performance often signals that investors are debating where future growth will come from.

With the stock drifting and long-term returns still lagging, the key questions are whether GMO Payment Gateway is now undervalued, or if the current price simply reflects what the market anticipates ahead.

Price-to-Earnings of 32.1x: Is it justified?

Based on the price-to-earnings (P/E) ratio, GMO Payment Gateway appears expensive compared to its industry peers. Its P/E of 32.1x is well above the JP Diversified Financial industry average of 13.1x. This suggests that the market is placing a premium on its earnings.

The price-to-earnings multiple reflects how much investors are willing to pay for each yen of earnings. In financial services, a higher P/E can indicate expectations of strong future growth or high earnings quality. However, it may also mean the stock is overvalued relative to peers if not supported by superior fundamentals.

This elevated valuation suggests that the market could be overpricing the company’s future earnings potential. The premium may reflect expectations of substantial growth or operational advantages that justify paying more per unit of current earnings. Investors should weigh whether these optimistic assumptions are realistic, given the company’s recent return trends.

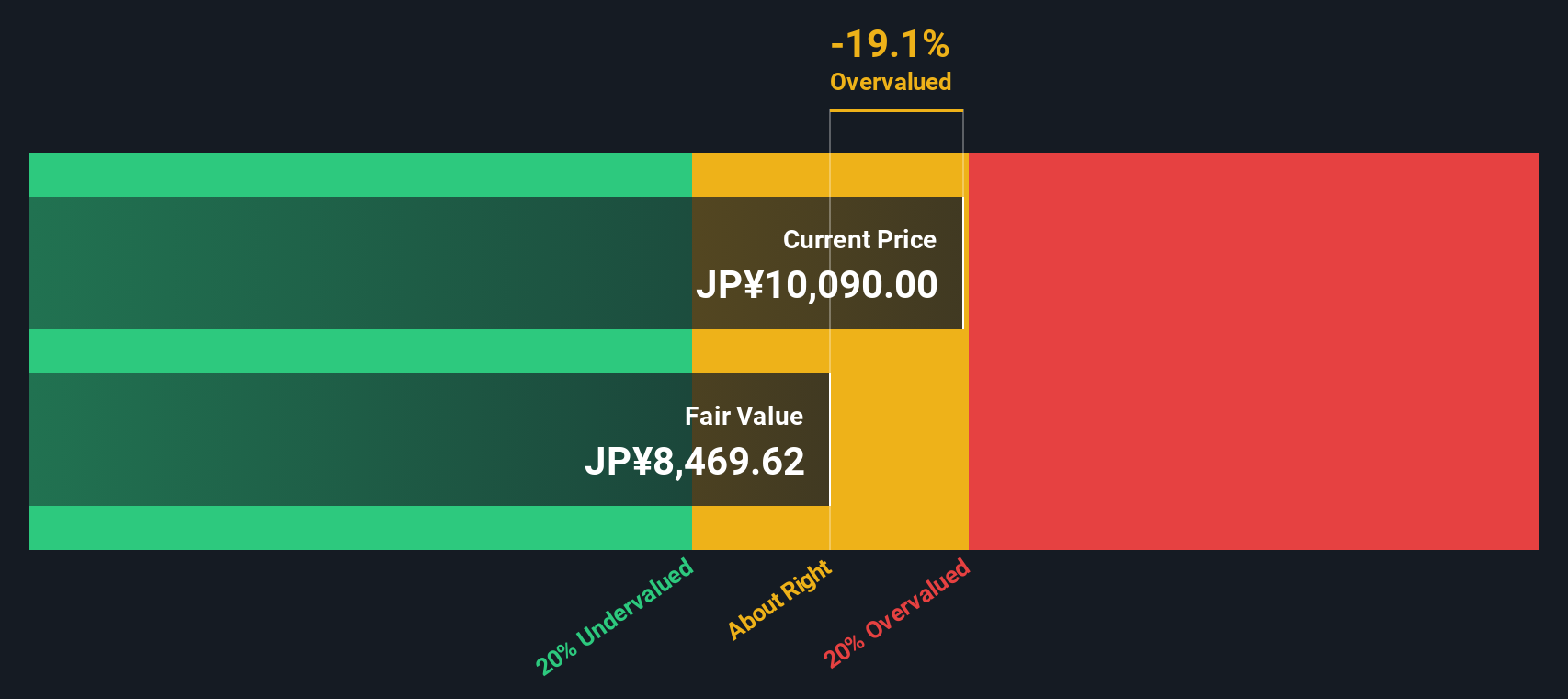

Result: Fair Value of ¥8,484 (OVERVALUED)

See our latest analysis for GMO Payment Gateway.However, slower earnings momentum or a wider market downturn could quickly challenge the stock’s lofty valuation and shift investor sentiment.

Find out about the key risks to this GMO Payment Gateway narrative.Another View: What Does Our DCF Model Say?

While the market’s earnings multiple suggests GMO Payment Gateway is priced high, our DCF model points in the same direction. This indicates the stock is overvalued. But does this reinforce the market's caution or hint at overlooked potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GMO Payment Gateway Narrative

If you would rather dig into the numbers firsthand or want to form your own perspective, you can quickly analyze and shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GMO Payment Gateway.

Looking for more investment ideas?

Smart investors always keep an eye out for compelling opportunities beyond the obvious choices. Don’t let market momentum pass you by; stay ahead and uncover your next potential winner using these hand-picked lists:

- Amplify your income stream by reviewing companies offering dividend stocks with yields > 3% and see which businesses deliver steady yields above 3%.

- Spot hidden opportunities in the market by searching for stocks that are undervalued stocks based on cash flows and currently trading below their cash flow value.

- Stay at the forefront of emerging technology by checking out breakthrough leaders in the future of medicine with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:3769

GMO Payment Gateway

Engages in the provision of payment related and financial services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)