- Japan

- /

- Hospitality

- /

- TSE:9936

Does Ohsho Food Service's (TSE:9936) Steady Dividend Amid Rising Sales Signal Focus on Stability?

Reviewed by Sasha Jovanovic

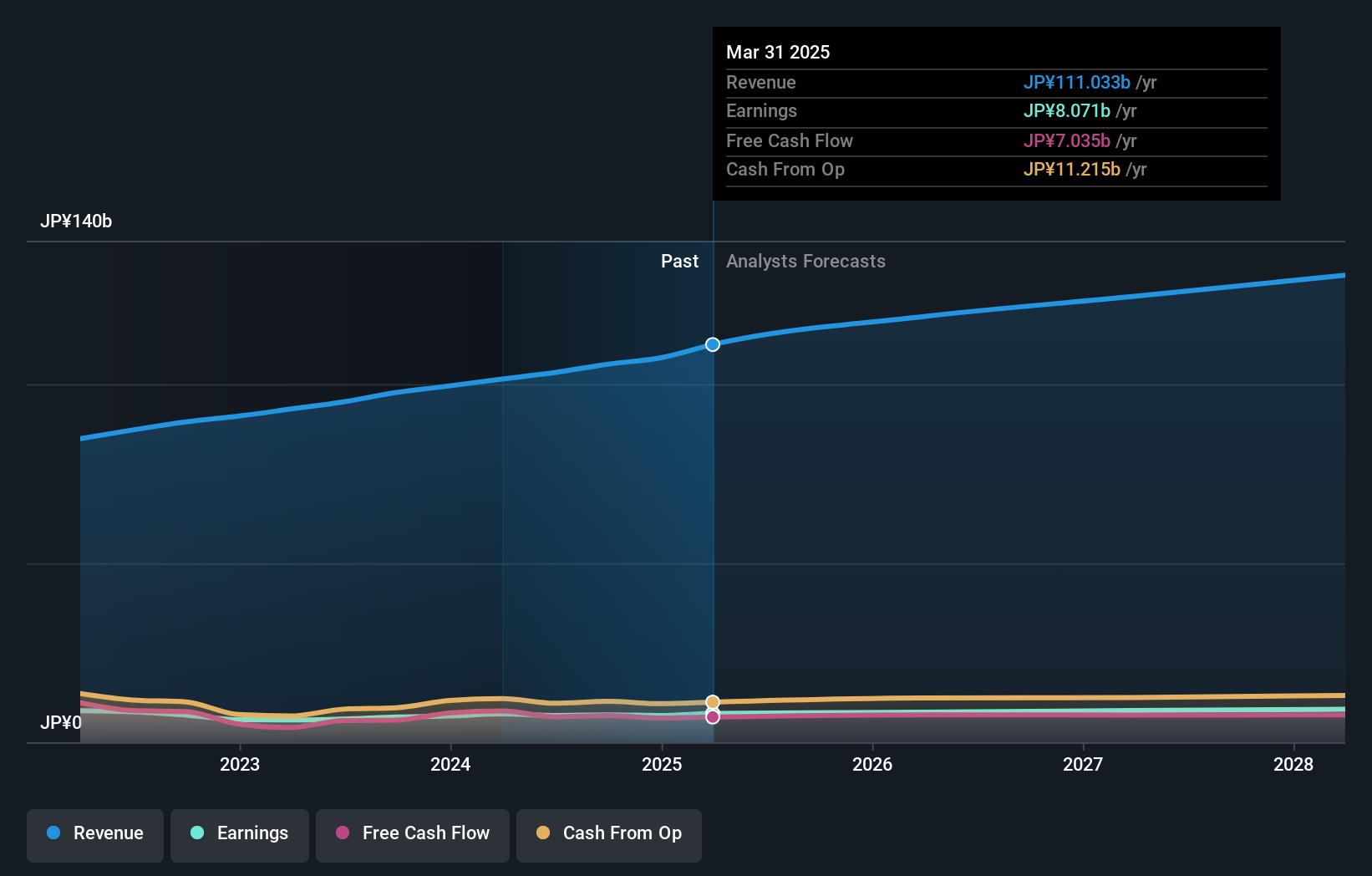

- Ohsho Food Service Corp. recently reported an 8.6% increase in net sales for the second quarter of fiscal 2026, while profit attributable to owners remained stable and the dividend forecast was maintained.

- This combination of solid sales growth and a steady dividend outlook highlights the company's focus on business stability and long-term stakeholder confidence.

- We'll explore how the confirmed stable dividend forecast shapes Ohsho Food Service's broader investment narrative amid ongoing sales momentum.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Ohsho Food Service's Investment Narrative?

For those considering Ohsho Food Service as a potential holding, the overarching story hinges on confidence in stable, moderate growth and the company’s ability to deliver reliable returns in a sector known for its steady pace. The recent 8.6% rise in net sales and reaffirmed stable dividend forecast provide a sense of continuity following a period of management changes and dividend reductions. While the latest results may ease some immediate concerns over sales momentum, the market’s muted response and continued trimming of dividends suggest that the strongest short term catalysts, like a meaningful recovery in ordinary profit or dividend growth, remain unchanged in importance. Likewise, lingering risks such as the relatively inexperienced management team and a still-volatile dividend track record have not fundamentally shifted in light of this update, so the big picture outlook remains anchored by cautious optimism. However, the less experienced management team is one factor investors shouldn’t overlook.

Ohsho Food Service's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Ohsho Food Service - why the stock might be worth as much as ¥3087!

Build Your Own Ohsho Food Service Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ohsho Food Service research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ohsho Food Service research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ohsho Food Service's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9936

Ohsho Food Service

Operates and franchises a chain of Chinese restaurants under the Gyoza no OHSHO brand name in Japan.

Flawless balance sheet and fair value.

Market Insights

Community Narratives