- Japan

- /

- Consumer Services

- /

- TSE:9769

Top Asian Dividend Stocks To Watch In March 2025

Reviewed by Simply Wall St

As global markets navigate uncertainties around trade policies and economic growth, Asian markets are capturing attention with their potential for stability and income generation through dividend stocks. In this environment, selecting dividend stocks that offer consistent payouts and resilience amidst market fluctuations can be a strategic approach for investors seeking reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.02% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.12% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.85% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.32% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.87% | ★★★★★★ |

Click here to see the full list of 1131 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

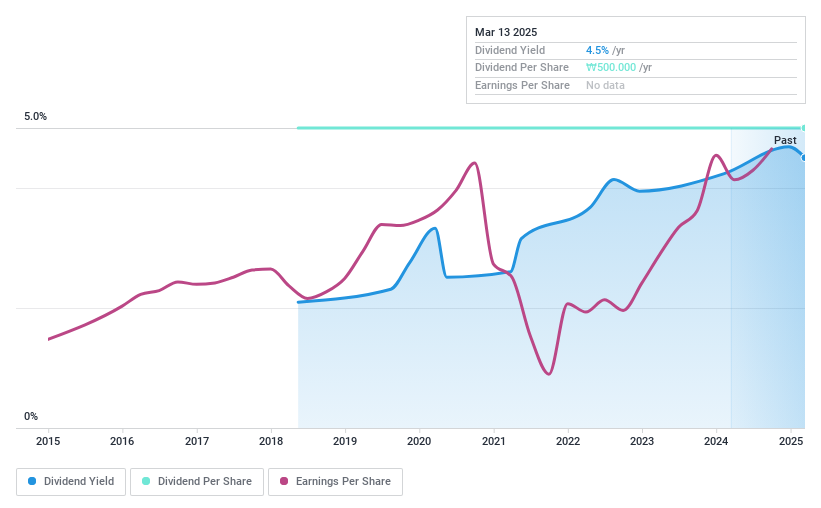

JW Lifescience (KOSE:A234080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JW Lifescience Corporation specializes in providing national infusion solutions both in South Korea and internationally, with a market capitalization of ₩175.44 billion.

Operations: JW Lifescience Corporation generates revenue primarily from its Pharmaceuticals segment, amounting to ₩221.32 million.

Dividend Yield: 4.4%

JW Lifescience's dividend yield of 4.41% places it in the top 25% of Korean market payers, though its seven-year history shows unreliable payments without growth. Despite this, dividends are well covered by earnings and cash flows, with payout ratios at 26.9% and 16.3%, respectively. Trading significantly below estimated fair value suggests potential for capital appreciation alongside income generation, but investors should be cautious about the stock's short dividend history and volatility in payments.

- Delve into the full analysis dividend report here for a deeper understanding of JW Lifescience.

- Upon reviewing our latest valuation report, JW Lifescience's share price might be too pessimistic.

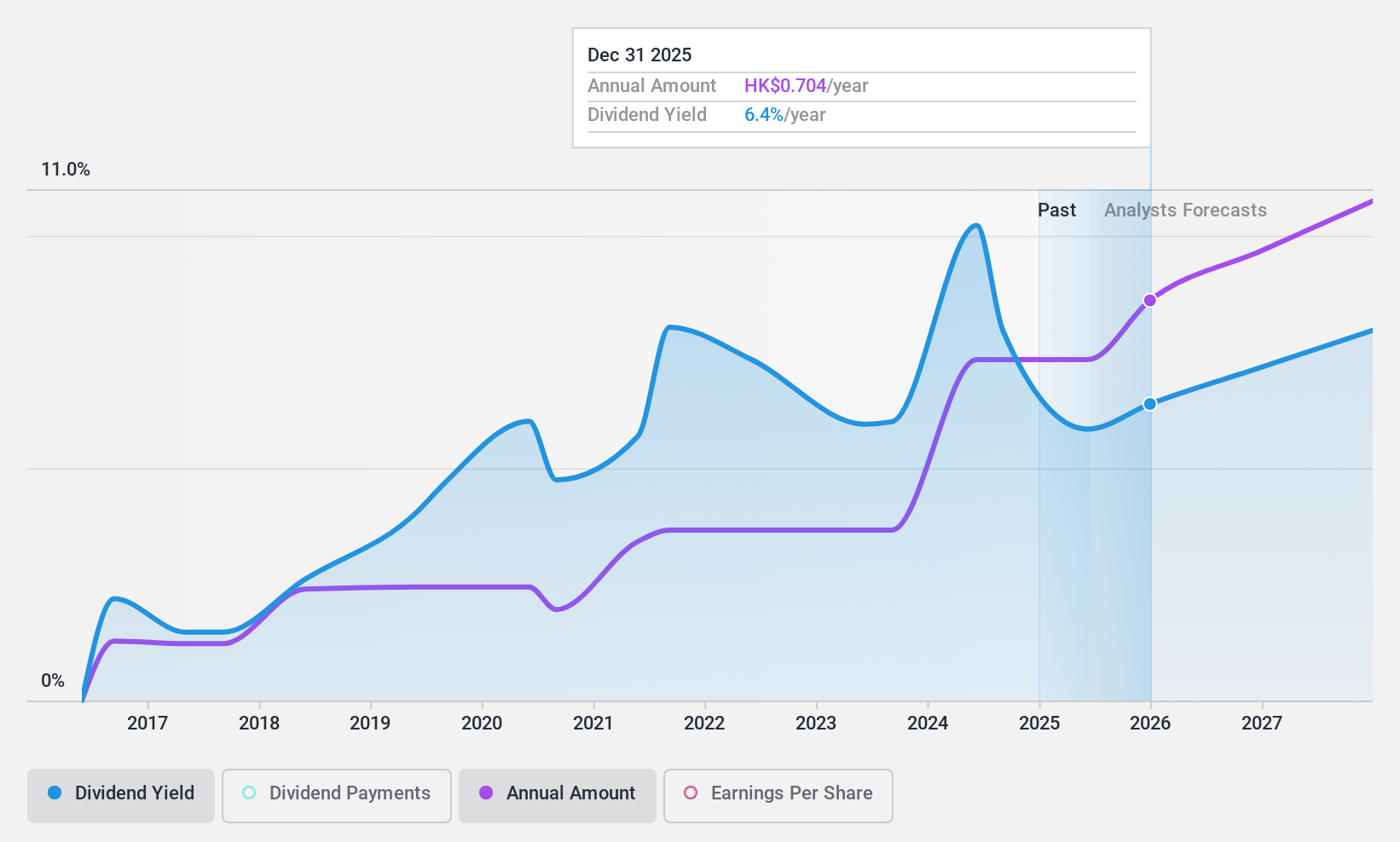

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consun Pharmaceutical Group Limited researches, develops, manufactures, and sells Chinese medicines and medical contrast medium products in China with a market cap of HK$7.08 billion.

Operations: Consun Pharmaceutical Group's revenue is primarily derived from the Consun Pharmaceutical Segment, contributing CN¥2.33 billion, and the Yulin Pharmaceutical Segment, which adds CN¥409.99 million.

Dividend Yield: 6.8%

Consun Pharmaceutical Group's dividend yield of 6.82% is below the top 25% in Hong Kong, with a history of volatility and unreliability over the past decade despite some growth. Dividends are well-covered by earnings and cash flows, with payout ratios at 52.3% and 54%. Trading at a significant discount to fair value indicates potential for capital gains; however, recent executive changes may impact stability. The ongoing CKD drug trial could influence future performance.

- Take a closer look at Consun Pharmaceutical Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Consun Pharmaceutical Group is trading behind its estimated value.

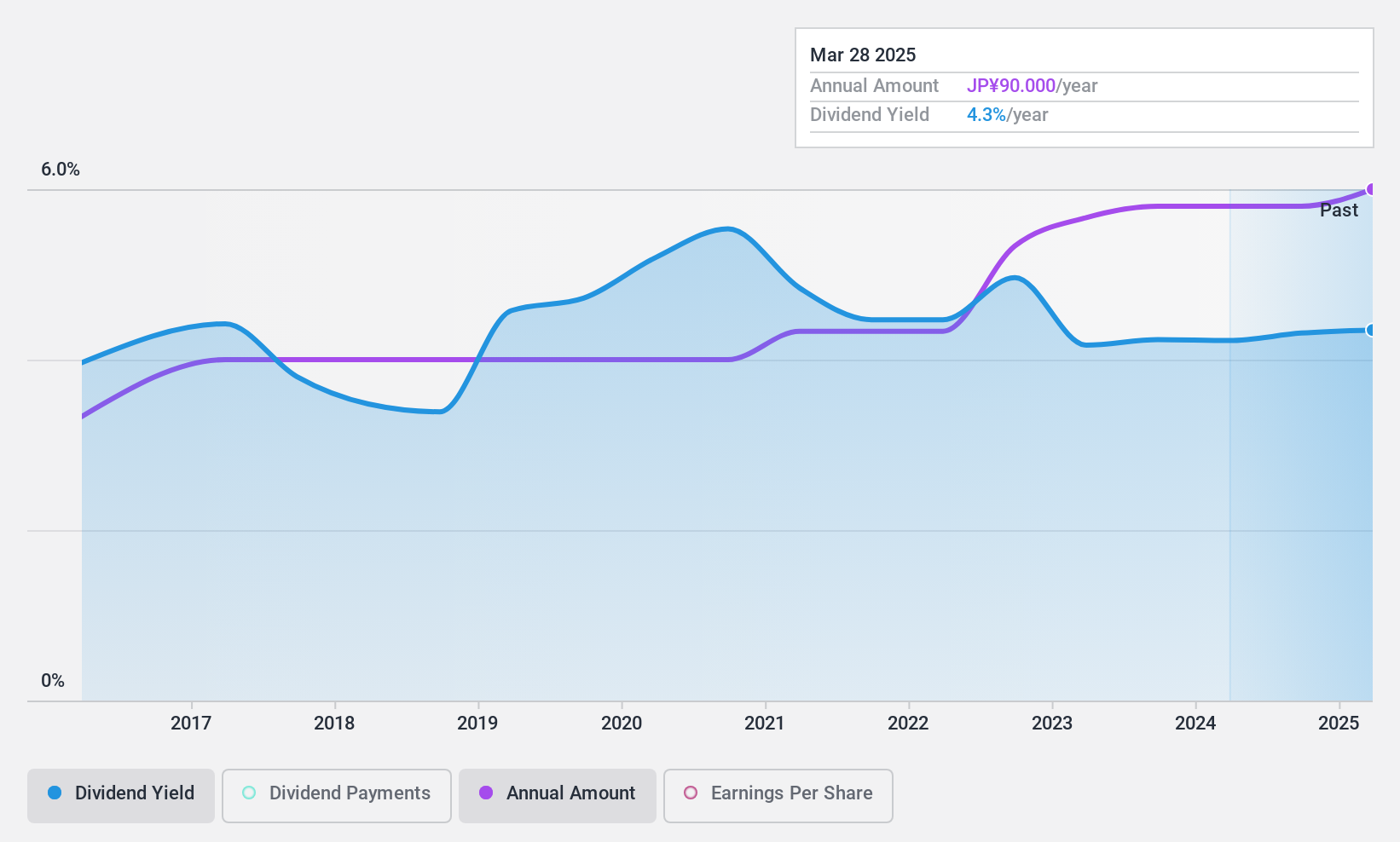

GakkyushaLtd (TSE:9769)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Gakkyusha Ltd (TSE:9769) operates cram schools providing entrance exam guidance for junior high, high school, and university students in Japan and internationally, with a market cap of ¥24.64 billion.

Operations: Gakkyusha Ltd (TSE:9769) generates revenue primarily from its management of educational institutions that prepare students for entrance exams at various academic levels both domestically and abroad.

Dividend Yield: 4%

Gakkyusha Ltd. offers a compelling dividend profile with a yield of 3.97%, placing it in the top quartile of Japanese dividend payers. The company's dividends have been stable and growing over the past decade, supported by earnings and cash flows, with payout ratios at 51.2% and 50.8%. Additionally, Gakkyusha trades at a notable discount to its estimated fair value, suggesting potential for capital appreciation alongside reliable income generation from dividends.

- Unlock comprehensive insights into our analysis of GakkyushaLtd stock in this dividend report.

- Our expertly prepared valuation report GakkyushaLtd implies its share price may be lower than expected.

Next Steps

- Click through to start exploring the rest of the 1128 Top Asian Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GakkyushaLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9769

GakkyushaLtd

Manages cram schools that offers entrance exams guidance to junior high schools, high schools, and universities in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives