- Japan

- /

- Consumer Services

- /

- TSE:9769

Top Asian Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As global markets react to new U.S. tariffs, Asian indices have shown resilience, with China's hopes for stimulus and Japan's economic challenges in focus. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.10% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.33% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.81% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.05% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

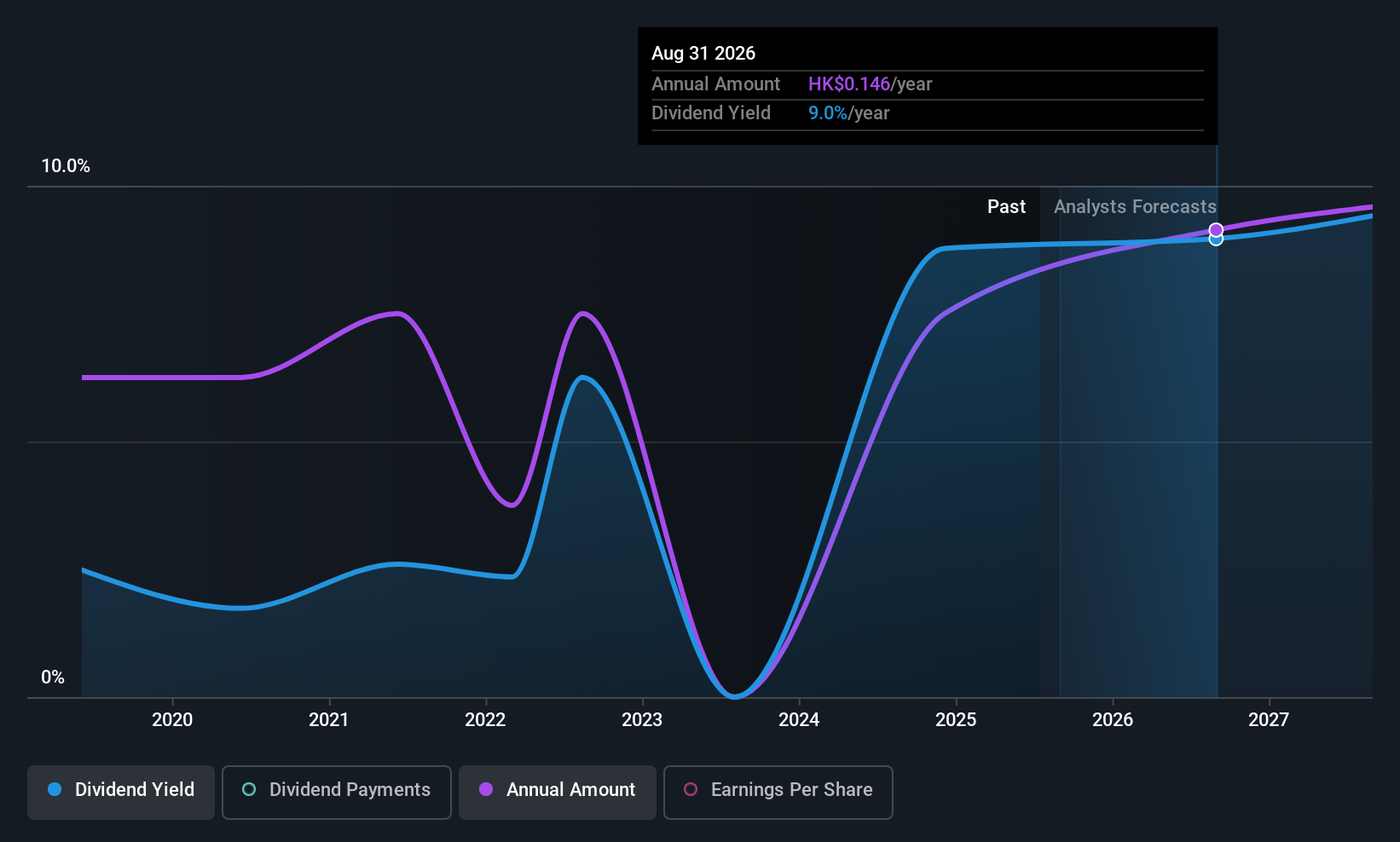

China Kepei Education Group (SEHK:1890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Kepei Education Group Limited is an investment holding company offering private vocational and profession-oriented education services in the People's Republic of China, with a market cap of HK$3.20 billion.

Operations: China Kepei Education Group Limited generates revenue of CN¥1.74 billion from its private vocational education services in the People’s Republic of China.

Dividend Yield: 8.2%

China Kepei Education Group's dividends are well-covered by earnings and cash flows, with a payout ratio of 30% and a cash payout ratio of 39.4%. Despite being in the top 25% for dividend yield in Hong Kong, its six-year dividend history is marked by volatility and unreliability. Recent earnings showed sales growth but a slight decline in net income. The board changes align with new governance codes, potentially impacting future strategic decisions.

- Delve into the full analysis dividend report here for a deeper understanding of China Kepei Education Group.

- Our valuation report here indicates China Kepei Education Group may be undervalued.

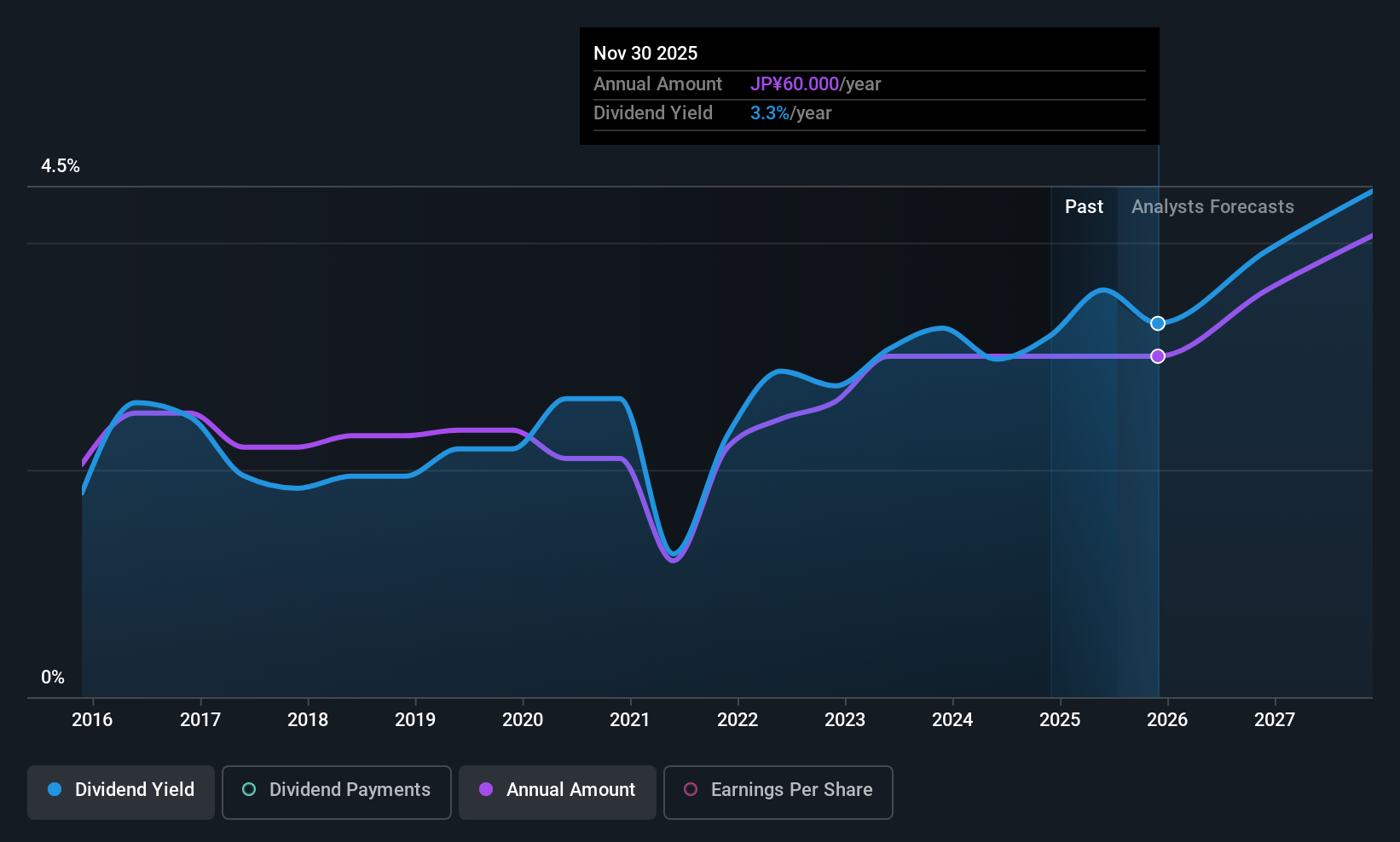

OSG (TSE:6136)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OSG Corporation, along with its subsidiaries, manufactures and sells cutting tools across Japan, the Americas, Europe, Africa, and Asia with a market cap of ¥156.89 billion.

Operations: OSG Corporation generates revenue through its manufacturing and sales of cutting tools across various regions, including Japan, the Americas, Europe, Africa, and Asia.

Dividend Yield: 3.1%

OSG Corporation's dividends are covered by earnings and cash flows, with a payout ratio of 40.5% and a cash payout ratio of 52.4%. Despite a decade-long volatile dividend history, recent affirmations maintain the quarterly dividend at ¥28 per share, alongside guidance for an additional commemorative dividend. Trading below estimated fair value enhances its appeal; however, its yield remains below Japan's top quartile. Recent buybacks may affect future distributions positively by reducing outstanding shares.

- Get an in-depth perspective on OSG's performance by reading our dividend report here.

- According our valuation report, there's an indication that OSG's share price might be on the expensive side.

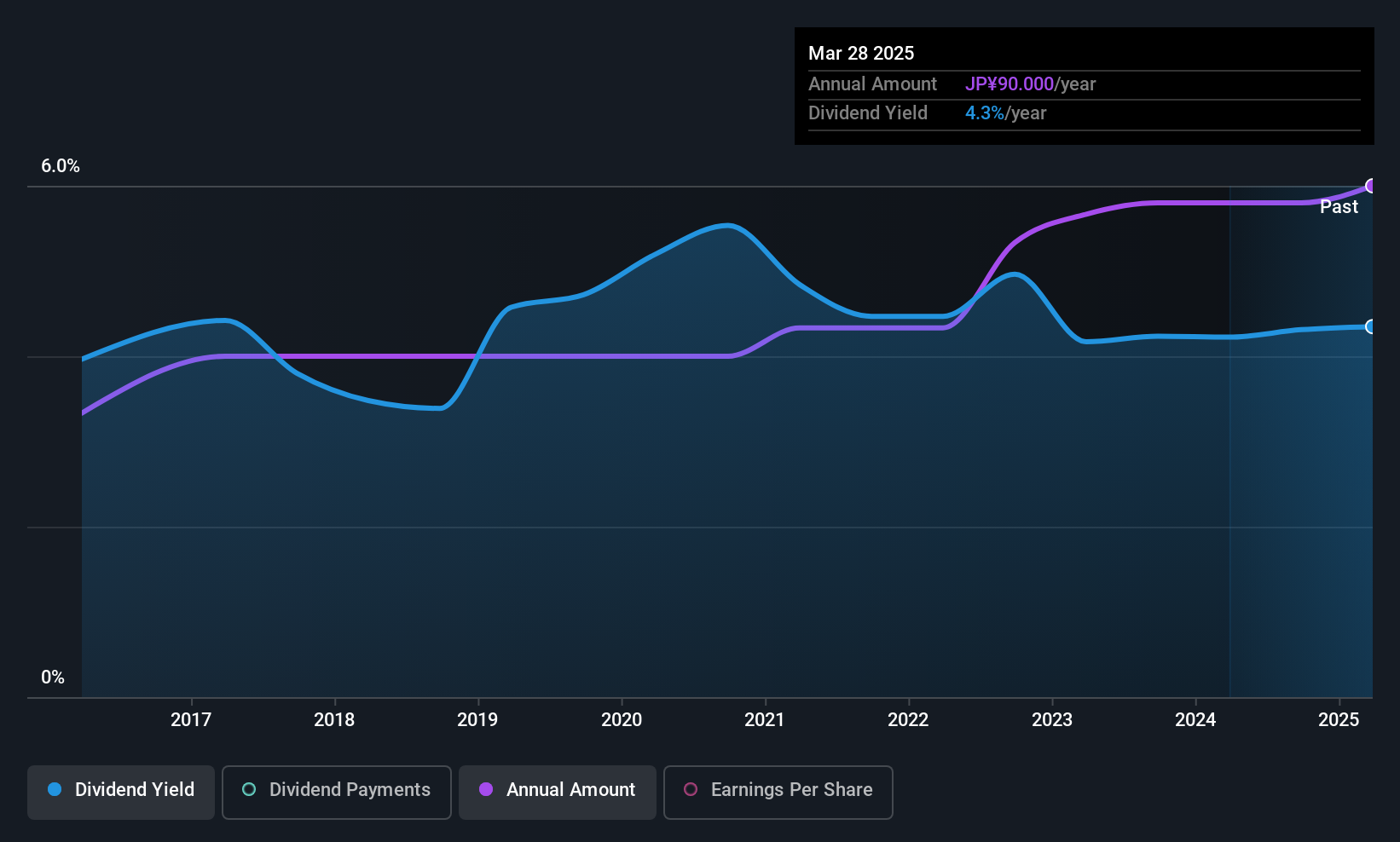

GakkyushaLtd (TSE:9769)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Gakkyusha Co., Ltd. operates cram schools providing entrance exam guidance for junior high, high school, and university students in Japan and internationally, with a market cap of ¥26.43 billion.

Operations: Gakkyusha Co., Ltd. generates its revenue primarily from managing educational institutions that offer exam preparation services for students aiming to enter junior high schools, high schools, and universities both in Japan and abroad.

Dividend Yield: 4.2%

Gakkyusha Ltd. offers a compelling dividend profile, with dividends covered by earnings and cash flows (payout ratio: 51.2%, cash payout ratio: 66.7%). The dividend yield of 4.24% ranks in the top quartile of the Japanese market, supported by stable and growing payouts over a decade. Recent announcements include an increase to ¥45 per share for FY2025, with further hikes expected for FY2026, reflecting confidence in sustained profitability and shareholder returns.

- Click here to discover the nuances of GakkyushaLtd with our detailed analytical dividend report.

- According our valuation report, there's an indication that GakkyushaLtd's share price might be on the cheaper side.

Where To Now?

- Dive into all 1202 of the Top Asian Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9769

GakkyushaLtd

Manages cram schools that offers entrance exams guidance to junior high schools, high schools, and universities in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives