- Japan

- /

- Hospitality

- /

- TSE:9704

AGORA Hospitality Group (TSE:9704) shareholder returns have been enviable, earning 337% in 5 years

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the AGORA Hospitality Group Co., Ltd (TSE:9704) share price. It's 337% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 73% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Since the stock has added JP¥3.8b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for AGORA Hospitality Group

While AGORA Hospitality Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, AGORA Hospitality Group can boast revenue growth at a rate of 13% per year. That's a fairly respectable growth rate. Arguably it's more than reflected in the very strong share price gain of 34% a year over a half a decade. We usually like strong growth stocks but it does seem the market already appreciates this one quite well!

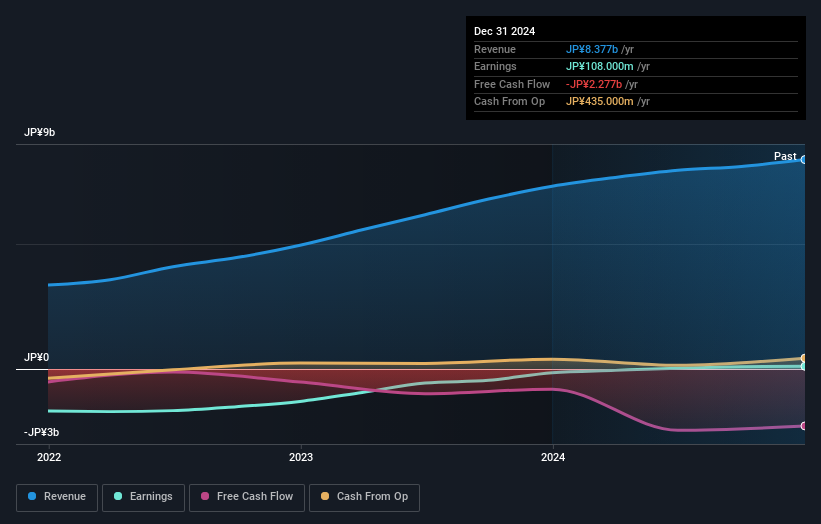

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on AGORA Hospitality Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that AGORA Hospitality Group shareholders have received a total shareholder return of 54% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 34% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand AGORA Hospitality Group better, we need to consider many other factors. Take risks, for example - AGORA Hospitality Group has 3 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9704

AGORA Hospitality Group

Engages in the hotel management and real estate development activities in Japan.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives