In the wake of recent global market developments, U.S. stocks have surged to record highs following a "red sweep" in the elections, buoyed by investor optimism around potential growth and tax reforms. Amidst these dynamic shifts, dividend stocks present a compelling opportunity for investors seeking stable income streams and potential capital appreciation in an evolving economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.79% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.04% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

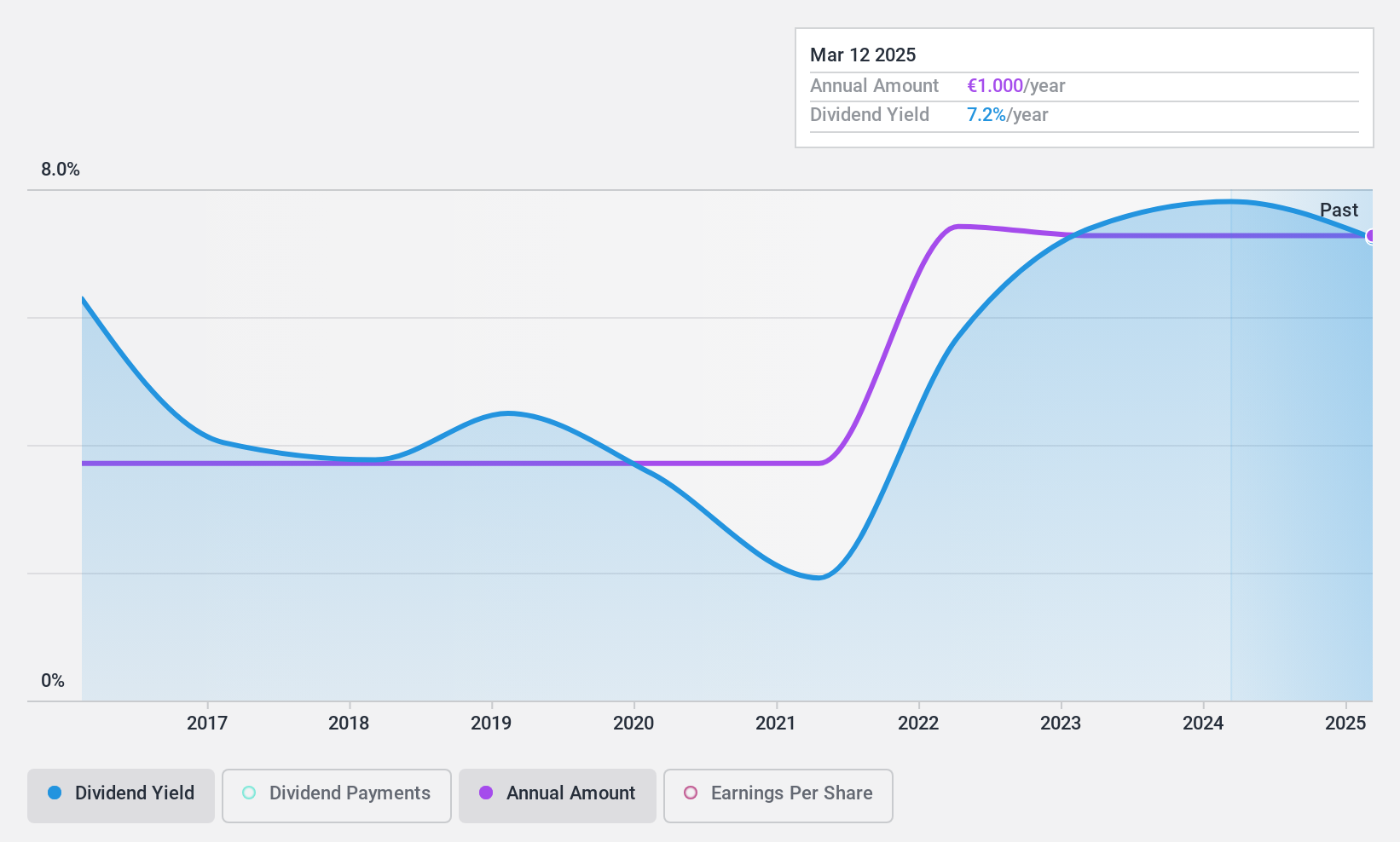

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products in France and internationally with a market cap of €107.70 million.

Operations: Piscines Desjoyaux SA generates revenue through the design, manufacture, and sale of swimming pools and related products both domestically in France and internationally.

Dividend Yield: 8.3%

Piscines Desjoyaux's dividend payments have been stable and reliable over the past decade, with consistent growth. However, the current dividend yield of 8.33% is not well covered by free cash flows, indicated by a high cash payout ratio of 486.2%. While the payout ratio of 72.5% suggests coverage by earnings, sustainability concerns arise due to insufficient cash flow support. The stock trades at a discount of 20.4% below its estimated fair value in the market.

- Navigate through the intricacies of Piscines Desjoyaux with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Piscines Desjoyaux's current price could be quite moderate.

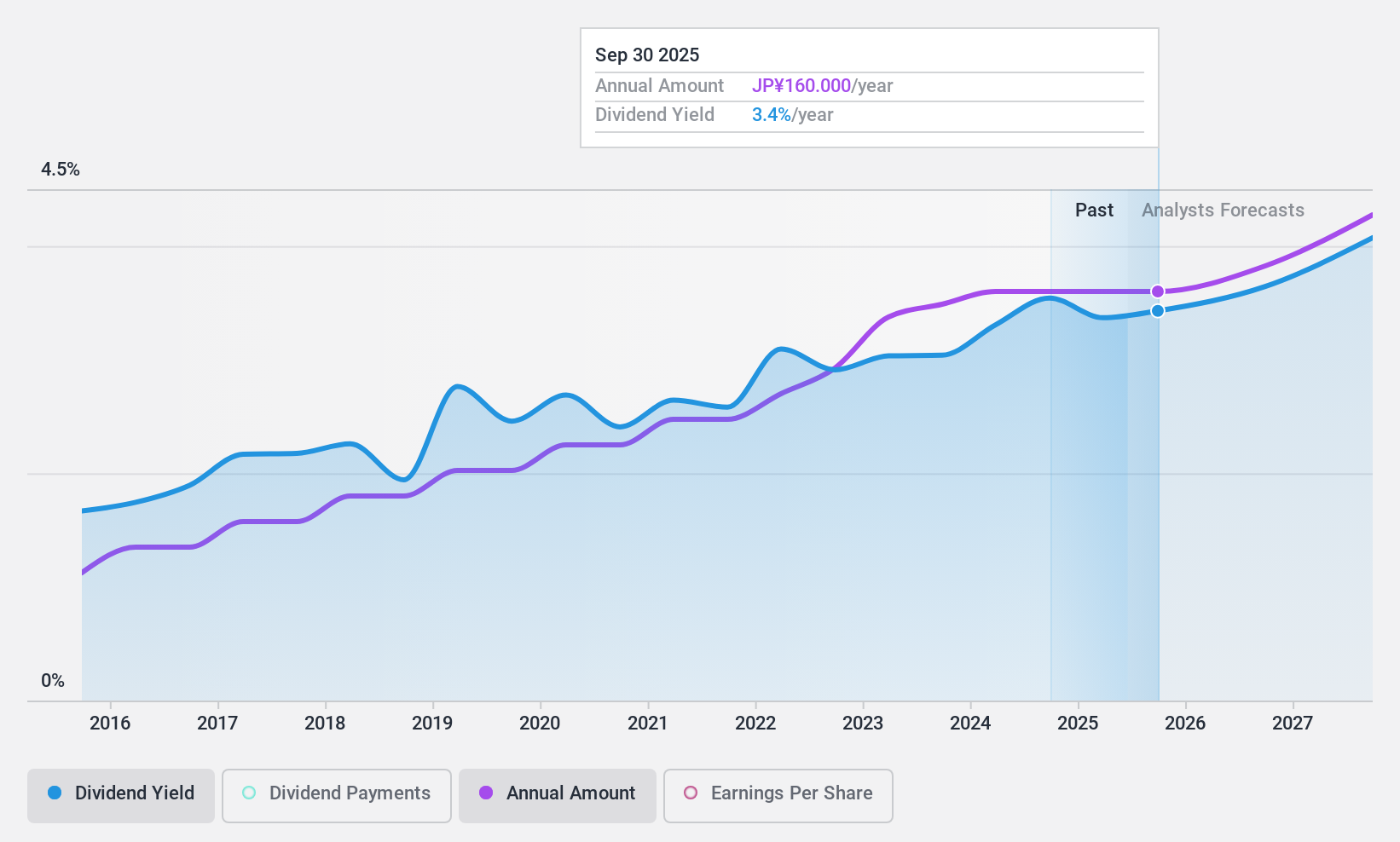

Mitsubishi Research Institute (TSE:3636)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Research Institute, Inc. offers research, consulting, and ICT solutions to both public and private sectors in Japan with a market cap of ¥686.30 billion.

Operations: Mitsubishi Research Institute, Inc.'s revenue is primarily derived from IT services amounting to ¥71.37 billion and think tank consulting services totaling ¥45.49 billion.

Dividend Yield: 3.6%

Mitsubishi Research Institute offers a stable and reliable dividend yield of 3.65%, supported by a sustainable payout ratio of 50.6% from earnings and 26.8% from cash flows. The company's dividends have consistently grown over the past decade without volatility, though the yield is slightly below top-tier Japanese dividend payers. Recent strategic alliances in AI could enhance future business prospects, potentially impacting financial performance positively as it trades at a significant discount to fair value estimates.

- Click to explore a detailed breakdown of our findings in Mitsubishi Research Institute's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Mitsubishi Research Institute shares in the market.

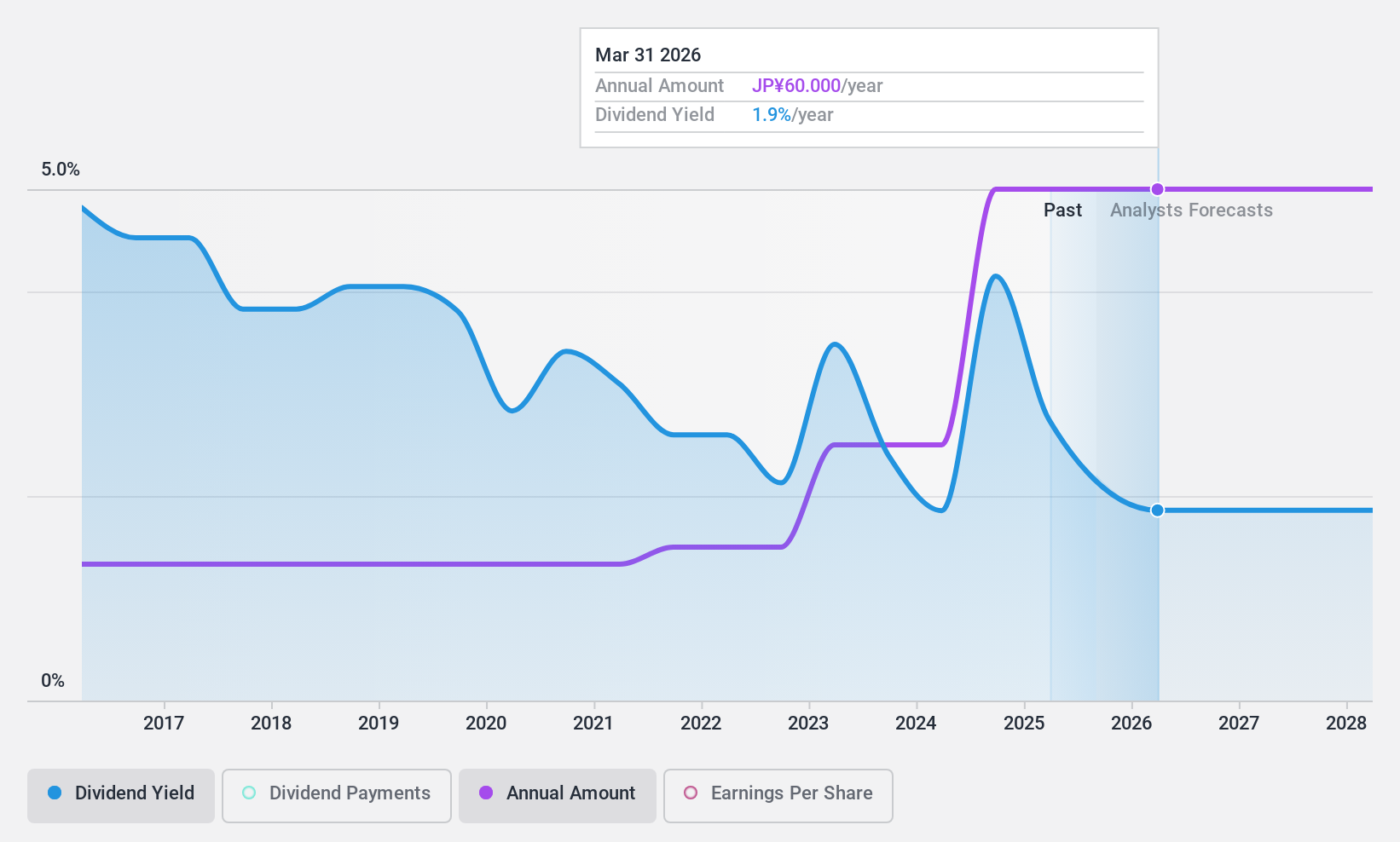

With us (TSE:9696)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: With us Corporation, along with its subsidiaries, operates as an education service company in Japan and has a market cap of ¥15.81 billion.

Operations: With us Corporation generates revenue through its education services in Japan.

Dividend Yield: 3.4%

With us Corporation has consistently increased dividends over the last decade, maintaining stability with minimal volatility. However, its dividend yield of 3.44% is below the top quartile in Japan, and payouts are not supported by free cash flows or earnings due to large one-off items affecting results. Despite a reasonable payout ratio of 63.8%, sustainability concerns remain as earnings growth was strong at 56.9% last year but lacks cash flow backing for dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of With us.

- Upon reviewing our latest valuation report, With us' share price might be too optimistic.

Make It Happen

- Click here to access our complete index of 1939 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALPDX

Piscines Desjoyaux

Designs, manufactures, and markets swimming pools and related products in France and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives