- China

- /

- Communications

- /

- SHSE:688418

Insider Confidence In High Growth Companies For November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are keenly observing how anticipated policy changes might influence growth trajectories. Amidst this backdrop, high insider ownership in growth companies can be a compelling indicator of confidence in a company's potential, suggesting that those closest to the business foresee continued success despite evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 32% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genew Technologies Co., Ltd. is involved in the research, development, production, and sale of communication and network products globally, with a market cap of CN¥6.32 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details or figures for Genew Technologies Co., Ltd. If you have access to additional data or a different section that outlines the revenue segments, please share it so I can assist you further.

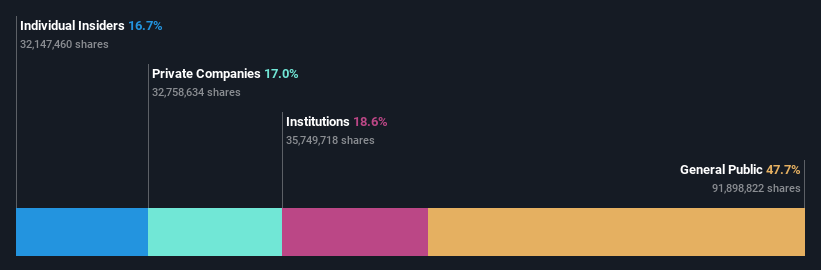

Insider Ownership: 16.7%

Revenue Growth Forecast: 32.4% p.a.

Genew Technologies Ltd. demonstrates strong growth potential, with revenue projected to increase by 32.4% annually, outpacing the Chinese market's average. The company is expected to achieve profitability within three years, despite a low future return on equity of 10.9%. Recent earnings show significant improvement, with net income of CNY 16.61 million for the first nine months of 2024 compared to a net loss last year, reflecting its growth trajectory and operational progress.

- Click to explore a detailed breakdown of our findings in Genew TechnologiesLtd's earnings growth report.

- Our valuation report unveils the possibility Genew TechnologiesLtd's shares may be trading at a premium.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Flaircomm Microelectronics, Inc. specializes in developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of approximately CN¥5.68 billion.

Operations: The company's revenue is primarily derived from its Wireless Communications Equipment segment, which generated CN¥995.17 million.

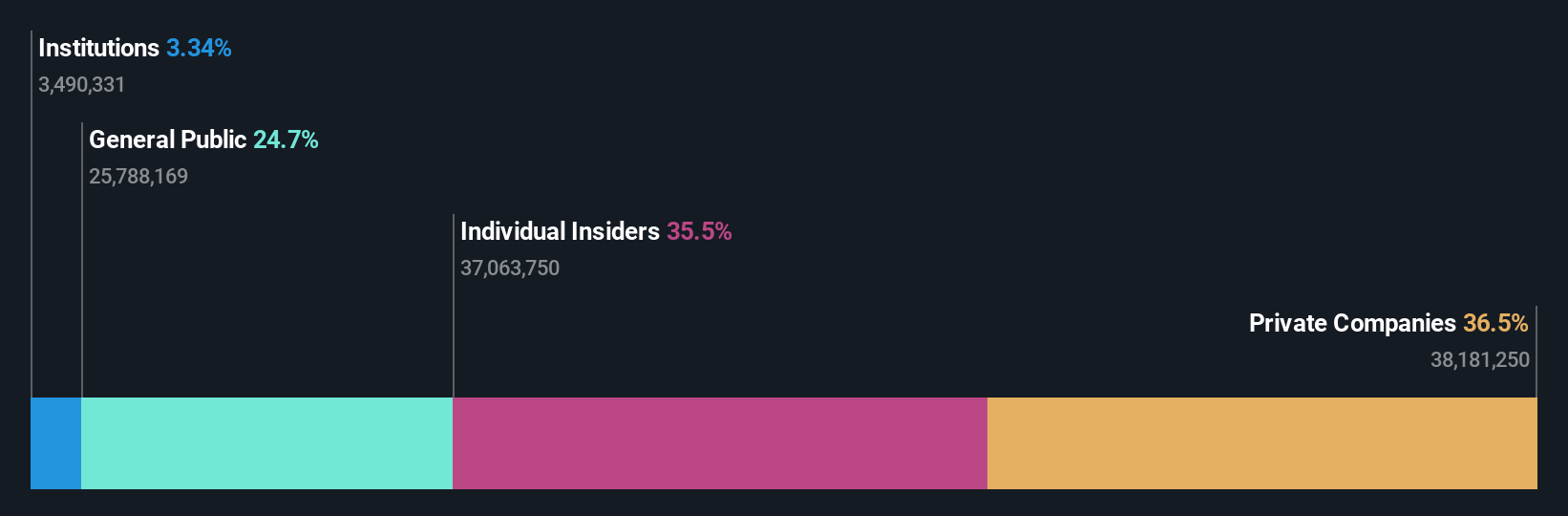

Insider Ownership: 35.5%

Revenue Growth Forecast: 22.5% p.a.

Flaircomm Microelectronics shows promising growth potential, with earnings projected to rise by 28% annually, outpacing the Chinese market average. Recent earnings for the nine months ended September 2024 reveal a net income increase to CNY 134.87 million from CNY 93.19 million last year, reflecting strong operational performance. Despite a volatile share price and low future return on equity of 16.8%, its revenue growth forecast of 22.5% annually supports its growth trajectory post-IPO completion in September 2024.

- Click here to discover the nuances of Flaircomm Microelectronics with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Flaircomm Microelectronics' share price might be too optimistic.

Inforich (TSE:9338)

Simply Wall St Growth Rating: ★★★★★★

Overview: Inforich Inc. provides portable power bank sharing services in Japan and has a market cap of ¥42.43 billion.

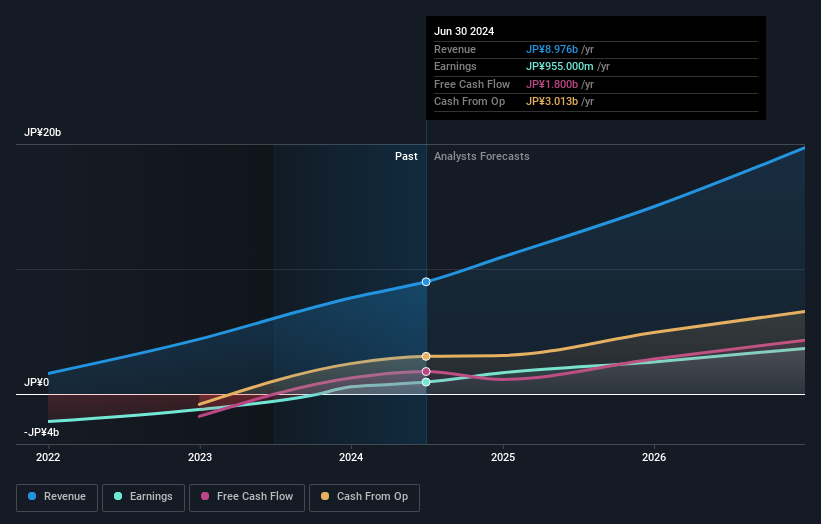

Operations: The company's revenue primarily comes from its Charge Spot Business, generating ¥8.98 billion.

Insider Ownership: 19.1%

Revenue Growth Forecast: 24.2% p.a.

Inforich demonstrates strong growth potential with earnings expected to grow 29.8% annually, surpassing the JP market average. The company's revenue is also forecasted to increase by 24.2% per year, indicating robust expansion prospects. Despite recent share price volatility and large one-off items affecting results, Inforich trades at a significant discount to its estimated fair value. Recent board meetings highlight strategic moves including acquiring Trim Inc., which could enhance its growth trajectory further.

- Delve into the full analysis future growth report here for a deeper understanding of Inforich.

- Our valuation report here indicates Inforich may be overvalued.

Make It Happen

- Click through to start exploring the rest of the 1519 Fast Growing Companies With High Insider Ownership now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688418

Genew TechnologiesLtd

Engages in the research and development, production, and sale of communication and network products worldwide.

High growth potential with excellent balance sheet.