- Japan

- /

- Hospitality

- /

- TSE:9279

Gift Holdings Inc.'s (TSE:9279) Share Price Is Still Matching Investor Opinion Despite 28% Slump

Gift Holdings Inc. (TSE:9279) shares have had a horrible month, losing 28% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

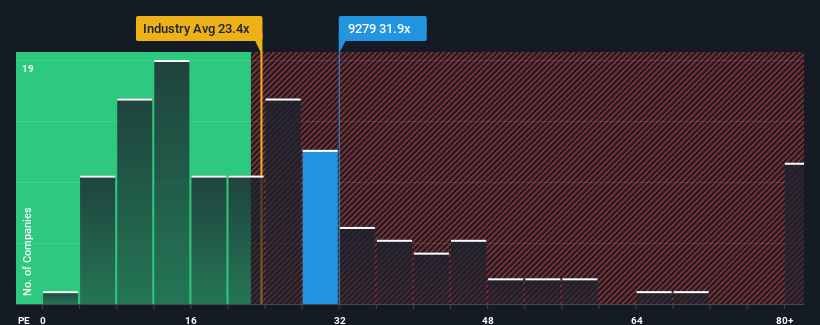

Even after such a large drop in price, Gift Holdings' price-to-earnings (or "P/E") ratio of 31.9x might still make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Gift Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Gift Holdings

What Are Growth Metrics Telling Us About The High P/E?

Gift Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 27% per year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 9.4% per annum growth forecast for the broader market.

In light of this, it's understandable that Gift Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Gift Holdings' P/E?

A significant share price dive has done very little to deflate Gift Holdings' very lofty P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Gift Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Gift Holdings is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Gift Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9279

Gift Holdings

Operates restaurants in Japan, the Republic of South Korea, and internationally.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives