- Japan

- /

- Hospitality

- /

- TSE:8783

Investors Appear Satisfied With GFA Co., Ltd.'s (TSE:8783) Prospects As Shares Rocket 69%

GFA Co., Ltd. (TSE:8783) shareholders have had their patience rewarded with a 69% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 4.8% isn't as impressive.

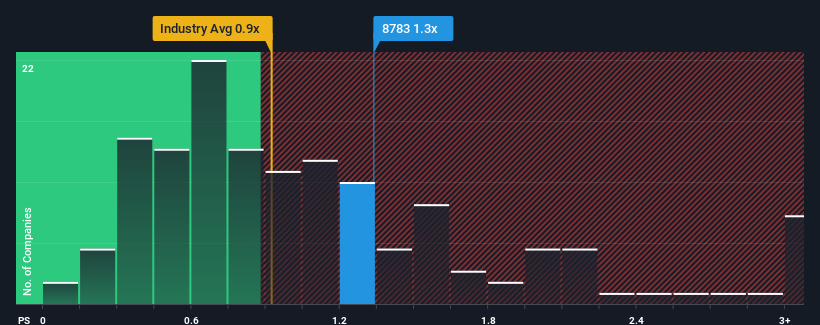

Although its price has surged higher, there still wouldn't be many who think GFA's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in Japan's Hospitality industry is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for GFA

What Does GFA's P/S Mean For Shareholders?

The revenue growth achieved at GFA over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on GFA will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for GFA, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is GFA's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like GFA's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. The latest three year period has also seen an excellent 45% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 11% shows it's about the same on an annualised basis.

With this in consideration, it's clear to see why GFA's P/S matches up closely to its industry peers. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

GFA appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that GFA maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Having said that, be aware GFA is showing 5 warning signs in our investment analysis, and 4 of those are significant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8783

Adequate balance sheet slight.

Market Insights

Community Narratives