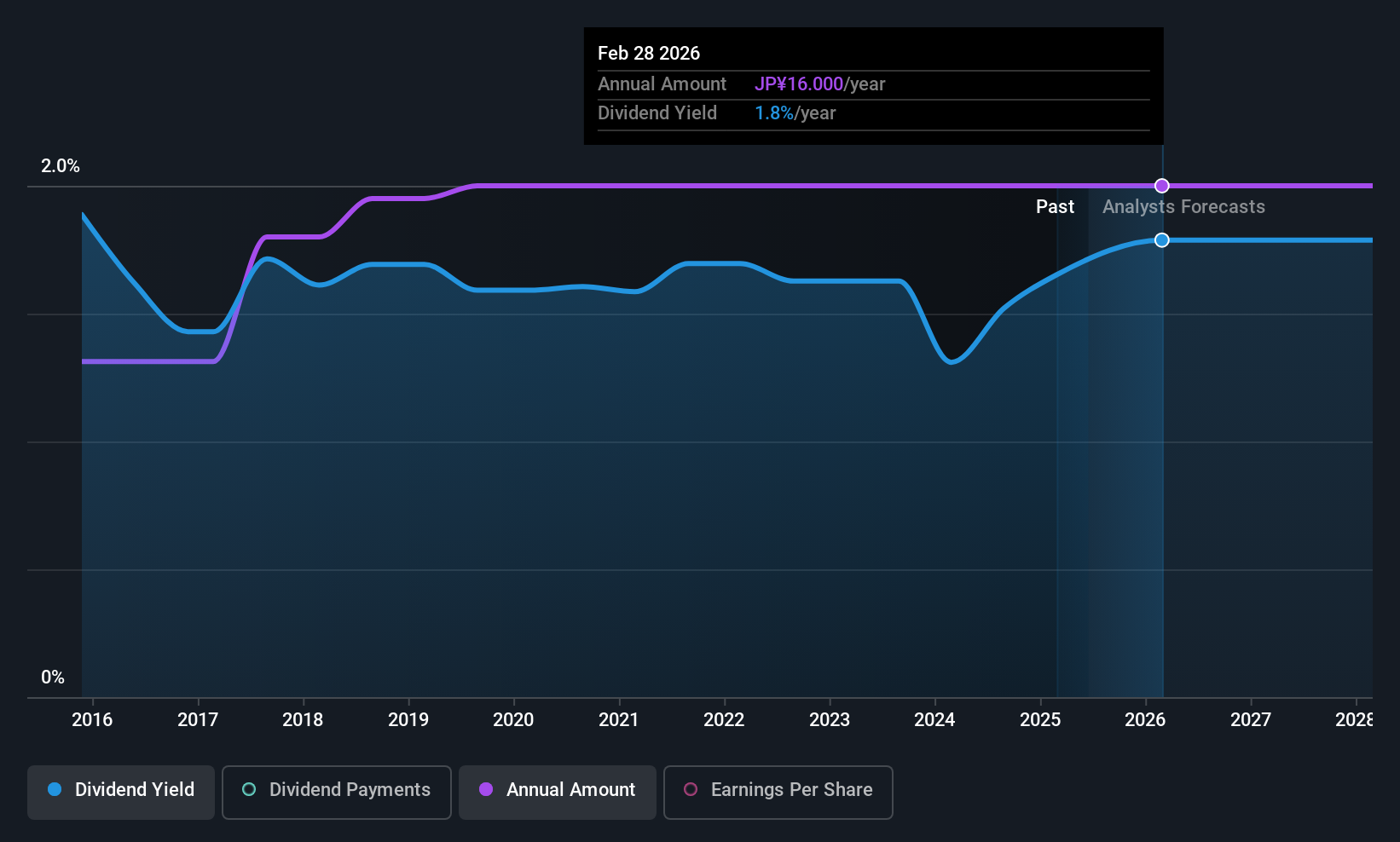

Ichibanya Co., Ltd. (TSE:7630) will pay a dividend of ¥8.00 on the 17th of November. This means the annual payment is 1.8% of the current stock price, which is above the average for the industry.

Ichibanya's Payment Could Potentially Have Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Ichibanya was paying out quite a large proportion of both earnings and cash flow, with the dividend being 116% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Earnings per share is forecast to rise by 9.7% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 77% which is a bit high but can definitely be sustainable.

Check out our latest analysis for Ichibanya

Ichibanya Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of ¥7.50 in 2015 to the most recent total annual payment of ¥16.00. This works out to be a compound annual growth rate (CAGR) of approximately 7.9% a year over that time. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Ichibanya hasn't seen much change in its earnings per share over the last five years.

Ichibanya's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. Although they have been consistent in the past, we think the payments are a little high to be sustained. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Are management backing themselves to deliver performance? Check their shareholdings in Ichibanya in our latest insider ownership analysis. Is Ichibanya not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7630

Ichibanya

Operates and franchises curry specialty stores in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives