- China

- /

- Electrical

- /

- SHSE:600261

Uncovering Undiscovered Gems on None Exchange January 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of new political developments and shifting economic indicators, major indices like the S&P 500 have seen a surge toward record highs, fueled by optimism over potential trade deals and AI investments. Despite this buoyant sentiment, smaller-cap stocks have lagged behind their larger counterparts, presenting a unique opportunity to explore lesser-known companies that may offer untapped potential. In this context, identifying promising stocks often involves looking beyond current market trends to find companies with strong fundamentals and innovative prospects that align with emerging economic themes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Korea Ratings | NA | 0.84% | 0.92% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| An Phat Bioplastics | 62.46% | 9.85% | 4.38% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Zhejiang Yankon Group (SHSE:600261)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Yankon Group Co., Ltd. is involved in the research, development, production, and sales of lighting appliances in China with a market cap of CN¥4.74 billion.

Operations: Yankon Group generates revenue primarily from its lighting and electrical industry segment, amounting to CN¥3.22 billion.

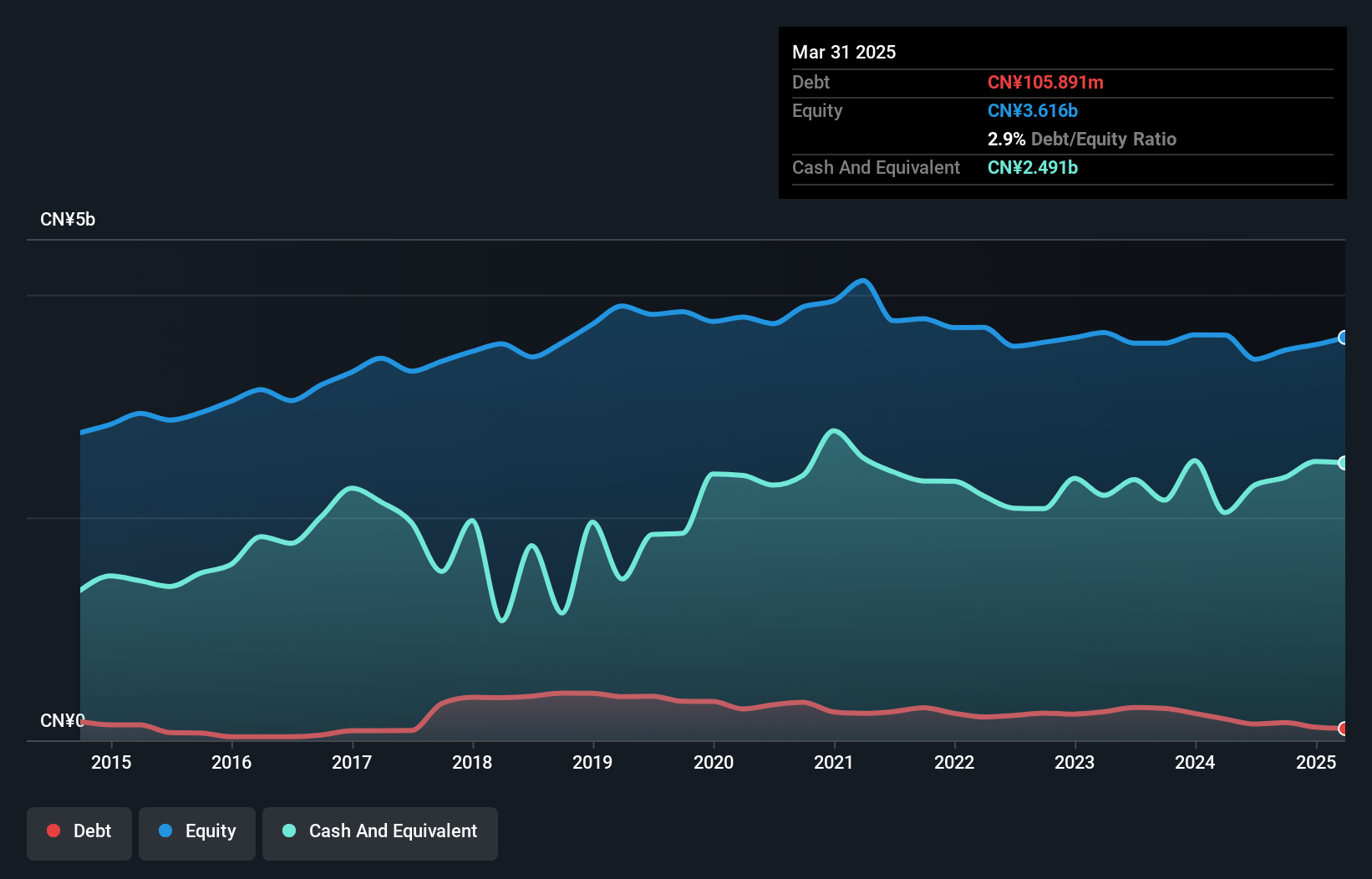

Zhejiang Yankon Group, a small player in the electrical industry, has shown promising signs with its earnings growth of 13.3% over the past year, outpacing the industry's 0.8%. Despite a significant one-off gain of CN¥61.9M affecting recent results, it trades at 11.1% below estimated fair value, suggesting potential undervaluation. The company's debt to equity ratio has improved from 9.1% to 4.5% over five years, indicating prudent financial management and more cash than total debt enhances its stability further. While earnings have seen an annual decrease of 25.6%, strong interest coverage remains reassuring for investors.

- Unlock comprehensive insights into our analysis of Zhejiang Yankon Group stock in this health report.

Explore historical data to track Zhejiang Yankon Group's performance over time in our Past section.

Bic Camera (TSE:3048)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bic Camera Inc., along with its subsidiaries, is involved in the manufacture and sale of audiovisual products in Japan, with a market capitalization of ¥289.13 billion.

Operations: Bic Camera generates revenue primarily from the sale of audiovisual products in Japan. The company's market capitalization stands at ¥289.13 billion.

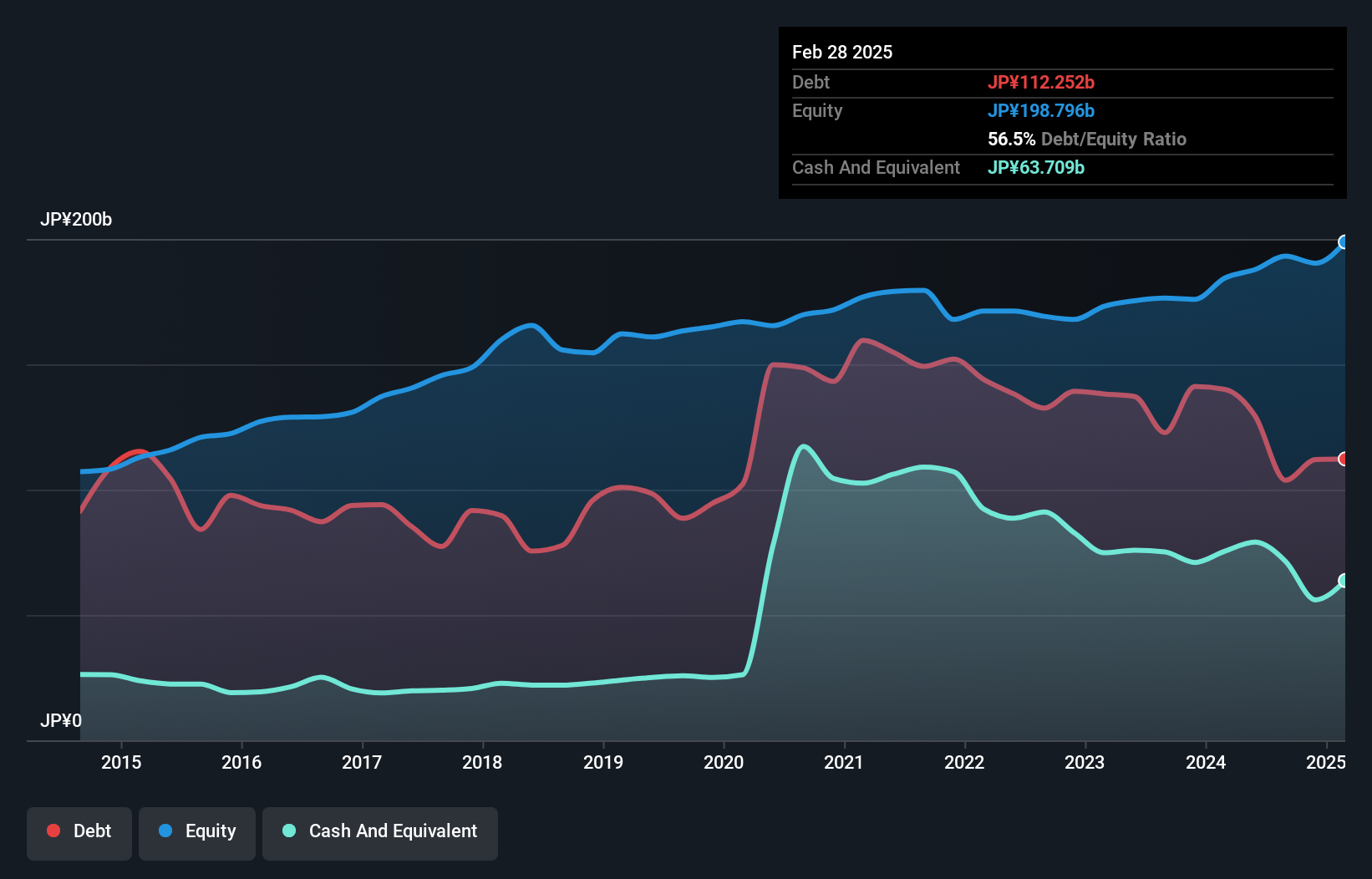

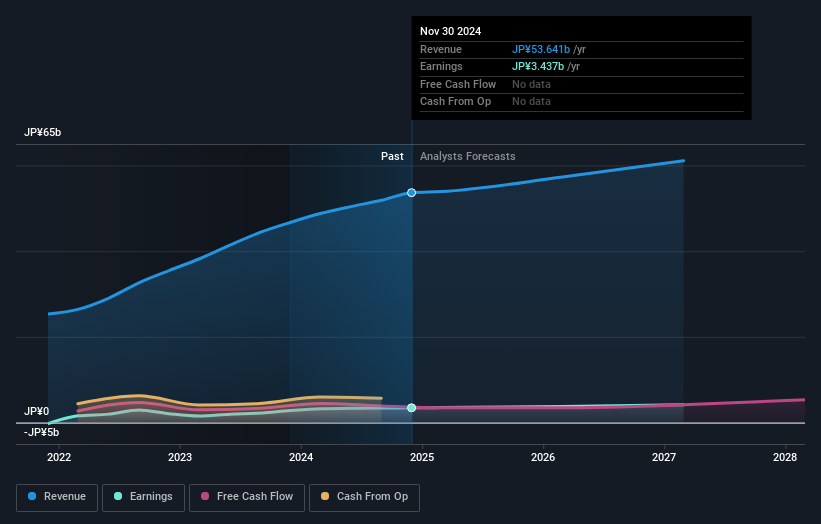

Bic Camera, a notable player in the retail sector, showcases promising growth with earnings surging by 327% last year, outpacing industry averages. Trading at 37% below its estimated fair value, it presents an intriguing opportunity for investors. The company's net debt to equity ratio stands at a satisfactory 29%, with interest payments well covered by EBIT at an impressive 1548x. Recent guidance indicates expected net sales of ¥952 billion and operating profit of ¥26.5 billion for the fiscal year ending August 2025. Despite reducing its annual dividend to ¥20 per share, Bic Camera plans a second-quarter payout increase to ¥16 per share from last year's ¥9.

- Click to explore a detailed breakdown of our findings in Bic Camera's health report.

Evaluate Bic Camera's historical performance by accessing our past performance report.

Hiday Hidaka (TSE:7611)

Simply Wall St Value Rating: ★★★★★★

Overview: Hiday Hidaka Corp. operates in the restaurant industry in Japan with a market cap of ¥115.45 billion.

Operations: Hiday Hidaka generates revenue primarily from its restaurant operations in Japan. The company's net profit margin has shown notable fluctuations over recent periods, reflecting changes in operational efficiency and cost management strategies.

Hiday Hidaka, a promising player in its sector, showcases impressive financial health with no debt over the past five years and earnings growth of 35.8% annually. The company is trading at 12.4% below its estimated fair value, suggesting potential for appreciation. Despite slightly lagging behind industry growth rates recently, it remains profitable with high-quality earnings and positive free cash flow. A recent share repurchase program worth ¥2 billion for up to 760,000 shares reflects a strategic move to adapt to market dynamics while enhancing shareholder value by July 2025. This initiative underscores confidence in its operational strategy and future prospects.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4679 more companies for you to explore.Click here to unveil our expertly curated list of 4682 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Yankon Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600261

Zhejiang Yankon Group

Engages in the research and development, production, and sales of lighting appliances in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives