- Japan

- /

- Hospitality

- /

- TSE:7611

Discovering None's Hidden Treasures Three Small Caps with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by declining consumer confidence and mixed economic indicators, small-cap stocks remain a focal point for investors seeking growth opportunities amid broader market volatility. In this environment, identifying small-cap companies with strong fundamentals and unique value propositions can offer intriguing possibilities for those looking to uncover hidden treasures in the stock market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Morinaga&Co (TSE:2201)

Simply Wall St Value Rating: ★★★★★☆

Overview: Morinaga&Co., Ltd. is engaged in the manufacturing, purchasing, and selling of confectionaries, foodstuffs, frozen desserts, and health products both in Japan and internationally with a market cap of ¥233.15 billion.

Operations: Morinaga&Co., Ltd. generates revenue through its diverse product lines, including confectionaries, foodstuffs, frozen desserts, and health products. The company's financial performance is influenced by its cost structure and pricing strategies across these segments.

Morinaga&Co., a notable player in the food industry, has seen its debt to equity ratio rise from 10.5% to 13.8% over five years, indicating a shift in financial strategy. Despite this, the company holds more cash than total debt and is trading at 45% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. Recent buyback activity saw Morinaga repurchase 3,858,700 shares for ¥9.99 billion to enhance shareholder returns and capital efficiency. With earnings growing at 5.9% annually over five years and high-quality past earnings noted, Morinaga's trajectory seems promising despite industry challenges.

- Get an in-depth perspective on Morinaga&Co's performance by reading our health report here.

Examine Morinaga&Co's past performance report to understand how it has performed in the past.

Mitani Sekisan (TSE:5273)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitani Sekisan Co., Ltd. is a Japanese company specializing in the production and sale of concrete products, with a market capitalization of ¥101.43 billion.

Operations: Mitani Sekisan generates revenue primarily from the production and sale of concrete products in Japan. The company's market capitalization stands at ¥101.43 billion.

Mitani Sekisan, a notable player in its field, has shown impressive financial health with earnings growing at an annual rate of 15% over the last five years. The company trades significantly below its estimated fair value by about 71%, suggesting potential undervaluation. Mitani's debt management is commendable, with a reduction in the debt-to-equity ratio from 0.5 to 0.3 over five years, and it holds more cash than total debt. Recently, Mitani completed a share repurchase of 411,800 shares for ¥2.53 billion as part of its capital policy strategy to enhance shareholder value.

- Unlock comprehensive insights into our analysis of Mitani Sekisan stock in this health report.

Understand Mitani Sekisan's track record by examining our Past report.

Hiday Hidaka (TSE:7611)

Simply Wall St Value Rating: ★★★★★★

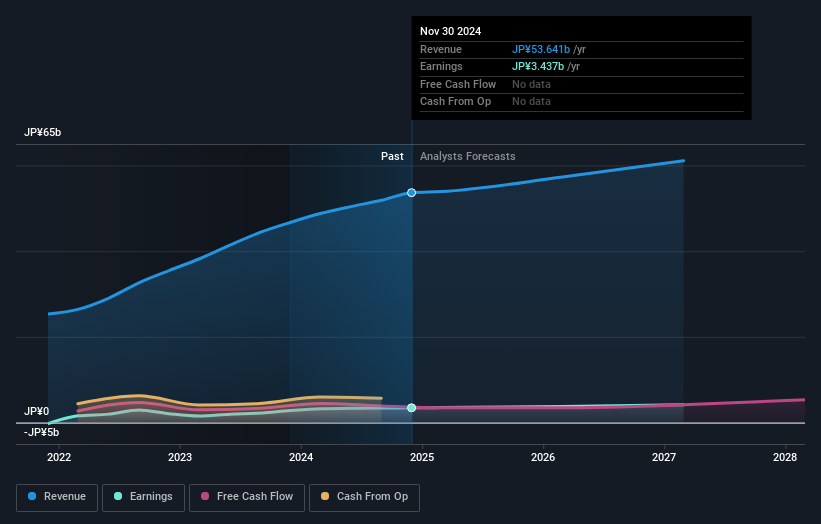

Overview: Hiday Hidaka Corp. operates in the restaurant industry in Japan with a market capitalization of ¥106.11 billion.

Operations: Hiday Hidaka generates revenue primarily from its restaurant operations in Japan. The company's financial performance is reflected in its market capitalization of ¥106.11 billion.

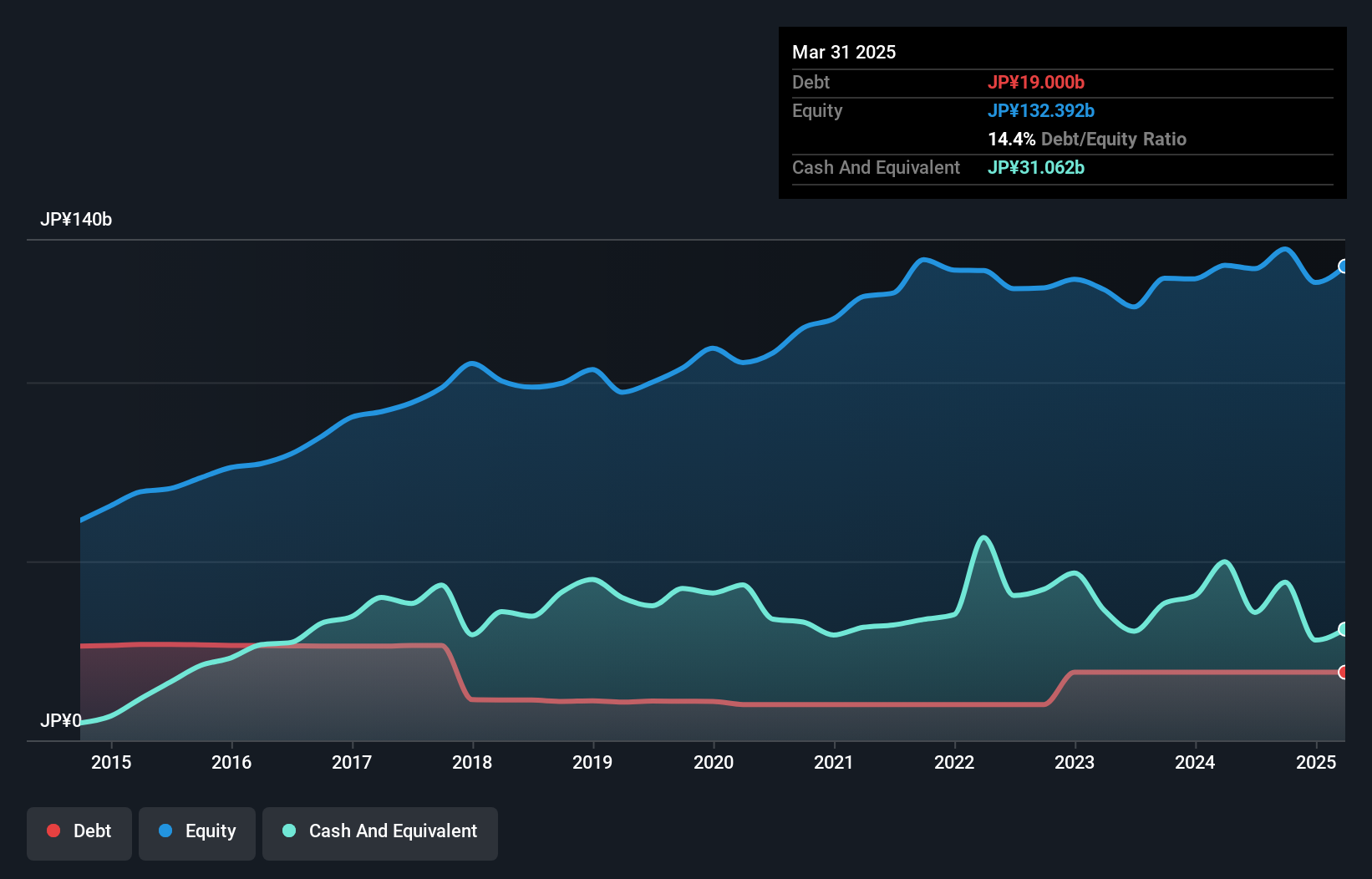

Hiday Hidaka stands out with a debt-free balance sheet, showcasing financial stability over the past five years. Its earnings have grown by 53% in the last year, surpassing the Hospitality industry's 25.4% growth rate, indicating robust performance. Trading at 26.9% below its estimated fair value suggests potential undervaluation in the market. The company has also increased its dividend to JPY 18 per share from JPY 17 previously, reflecting confidence in future cash flows and profitability. With high-quality earnings and a forecasted annual growth of 12.47%, Hiday Hidaka seems well-positioned for continued success in its sector.

- Navigate through the intricacies of Hiday Hidaka with our comprehensive health report here.

Gain insights into Hiday Hidaka's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 4638 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hiday Hidaka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7611

Flawless balance sheet with proven track record.

Market Insights

Community Narratives