- Japan

- /

- Retail Distributors

- /

- TSE:2733

Undiscovered Gems with Promising Potential In January 2025

Reviewed by Simply Wall St

As global markets experience a surge in optimism due to potential trade deals and enthusiasm for AI investments, major indices like the S&P 500 have reached new highs, while smaller-cap stocks have shown more modest performance. In this dynamic environment, identifying promising small-cap stocks requires a keen eye for companies that can leverage current trends and economic shifts to unlock hidden value.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Idun Industrier AB (publ) is an investment holding company that manufactures and sells glass fiber reinforced fat- and oil separators in Sweden, with a market capitalization of SEK3.58 billion.

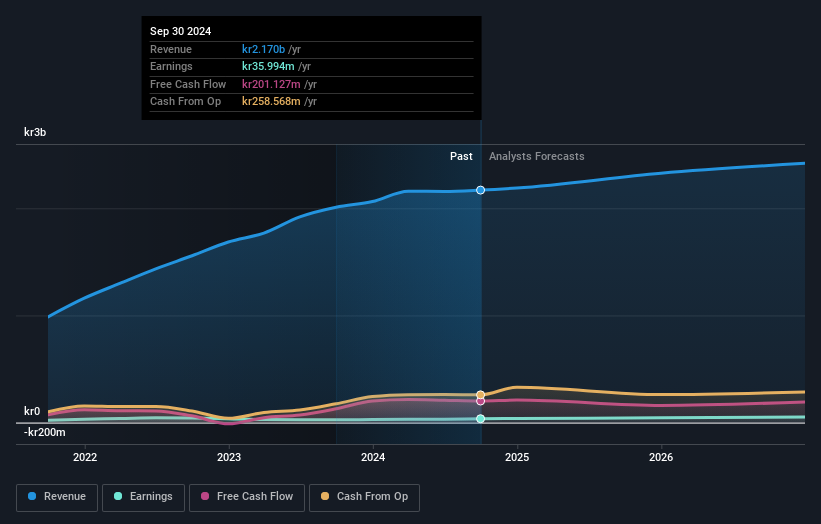

Operations: Idun Industrier generates revenue primarily from its Manufacturing segment, contributing SEK1.34 billion, followed by Service & Maintenance at SEK834.40 million.

Idun Industrier, a smaller player in its field, has demonstrated notable financial resilience. Over the past five years, the company reduced its debt to equity ratio from 185.4% to 99.5%, indicating improved leverage management. Despite high net debt to equity at 56.9%, earnings grew by an impressive 37.3% last year, surpassing industry averages of around 3%. The company's earnings are expected to grow by 16.72% annually; however, interest payments remain inadequately covered with EBIT covering only 2.6 times these obligations. Trading at an attractive valuation of about 8.5% below fair value adds potential appeal for investors seeking growth opportunities within this sector.

- Delve into the full analysis health report here for a deeper understanding of Idun Industrier.

Understand Idun Industrier's track record by examining our Past report.

Arata (TSE:2733)

Simply Wall St Value Rating: ★★★★★☆

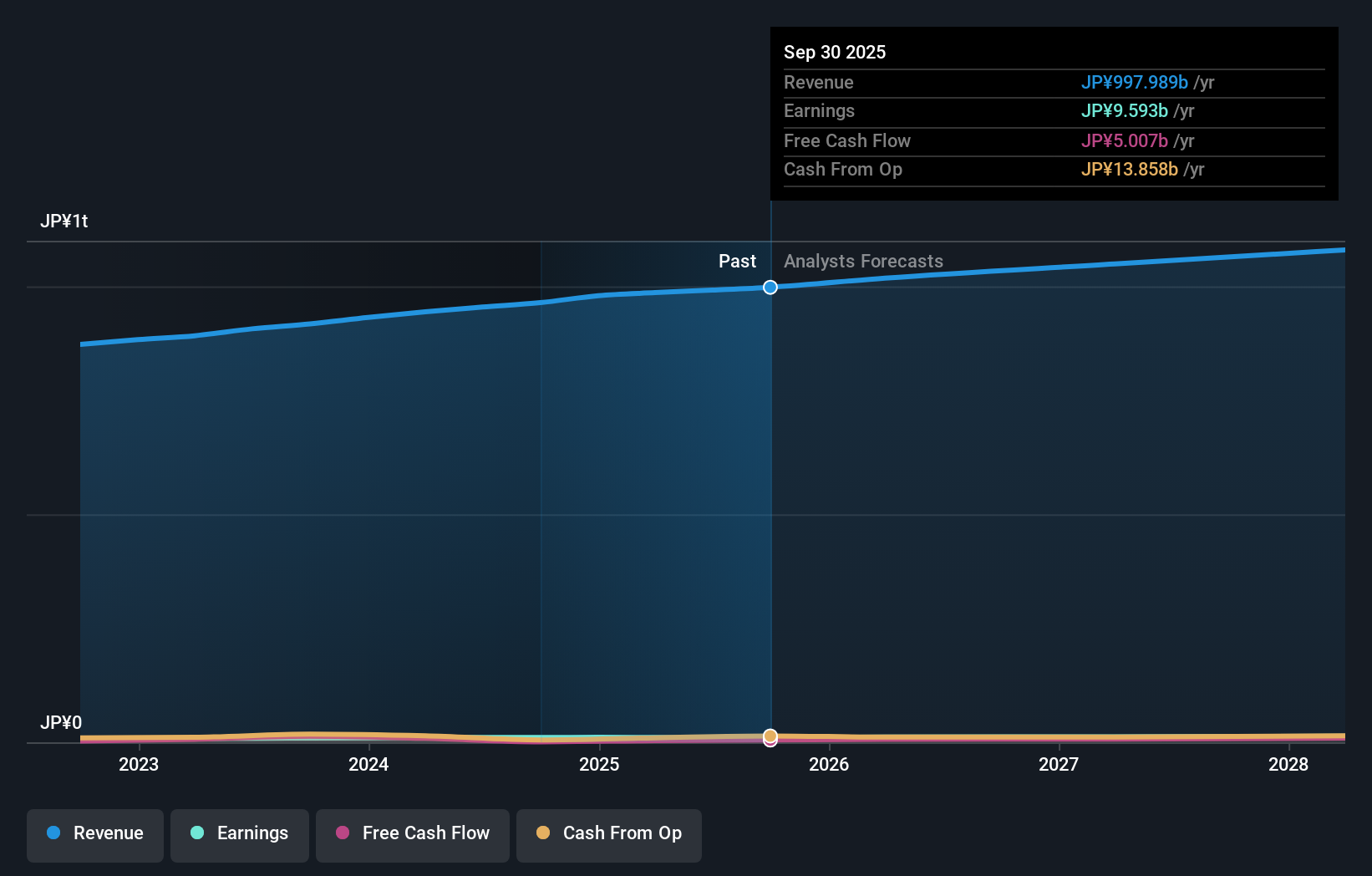

Overview: Arata Corporation operates as a wholesaler of daily goods, cosmetics, household goods, and pet supplies in Japan with a market capitalization of ¥105.98 billion.

Operations: Arata's primary revenue stream is from its wholesale business of daily necessities and cosmetics, generating ¥964.28 billion. The company's financial performance can be analyzed through its net profit margin, which provides insight into profitability after accounting for all expenses.

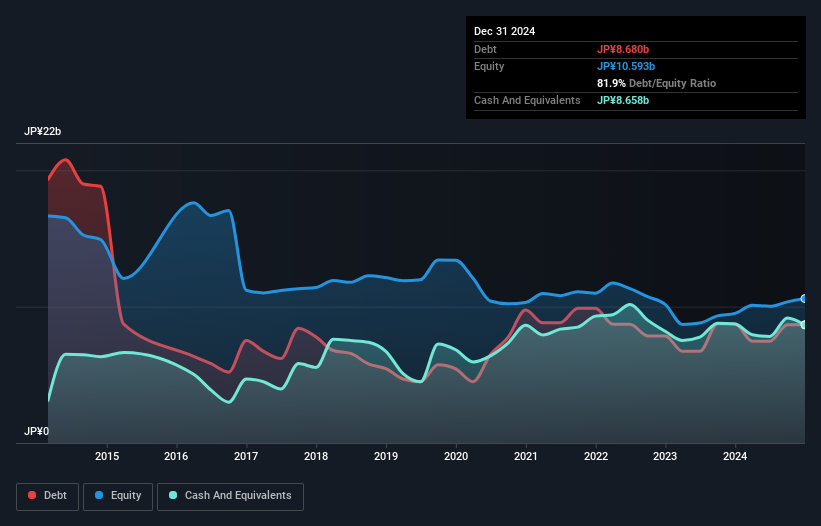

Arata, a promising player in the market, has shown impressive financial resilience. With earnings growth of 12.8% over the past year, it outpaced the Retail Distributors industry by a significant margin. The company's debt to equity ratio improved from 54% to 31.7% over five years, indicating prudent financial management. Trading at 59.3% below its estimated fair value suggests potential for appreciation. Recent buybacks saw Arata repurchasing shares worth ¥2,999 million, reflecting confidence in its valuation strategy. Despite reducing dividends from JPY 83 to JPY 51 per share recently, Arata's profitability and strategic moves hint at robust future prospects.

- Navigate through the intricacies of Arata with our comprehensive health report here.

Gain insights into Arata's historical performance by reviewing our past performance report.

Kappa Create (TSE:7421)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kappa Create Co., Ltd. operates in the restaurant management industry, with a market capitalization of approximately ¥72.05 billion.

Operations: Kappa Create generates revenue primarily from its Conveyor Belt Sushi Business, which accounts for ¥59.42 billion, and Delica segment contributing ¥13.86 billion.

Kappa Create, a small but intriguing player in the hospitality sector, has recently turned profitable, marking a significant milestone. Its debt-to-equity ratio has risen from 42.8% to 83.9% over five years, indicating increased leverage but not without merit as its interest payments are well-covered by EBIT at 14 times coverage. The company showcases high-quality earnings and maintains a positive free cash flow position with US$2.31 million reported recently. While these elements suggest robust financial health, the increased leverage might pose some risk if not managed carefully in future market conditions.

Next Steps

- Investigate our full lineup of 4687 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2733

Arata

Engages in the wholesale of daily goods, cosmetics, household goods, pet supplies, and others in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion