- China

- /

- Electronic Equipment and Components

- /

- SHSE:688522

Top Insider-Owned Growth Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate the early days of 2025, optimism surrounding potential trade deals and AI advancements has propelled U.S. stocks to record highs, with growth stocks outperforming value shares for the first time this year. In this environment, companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business, making them noteworthy for investors seeking growth opportunities amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

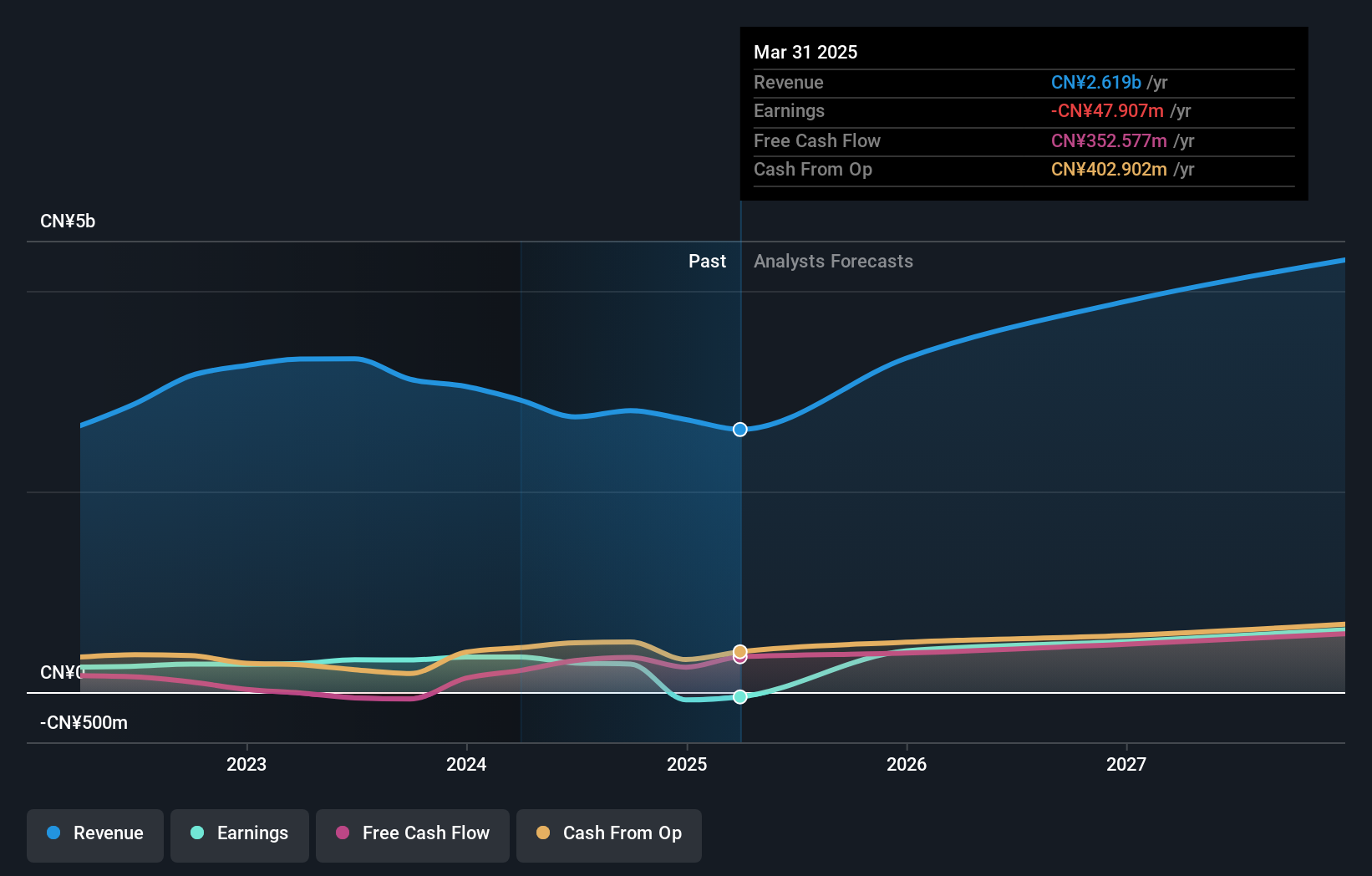

Overview: Naruida Technology Co., Ltd. manufactures and sells polarized multifunctional active phased array radars in China, with a market cap of CN¥10.82 billion.

Operations: The company generates revenue of CN¥235.19 million from its Scientific & Technical Instruments segment.

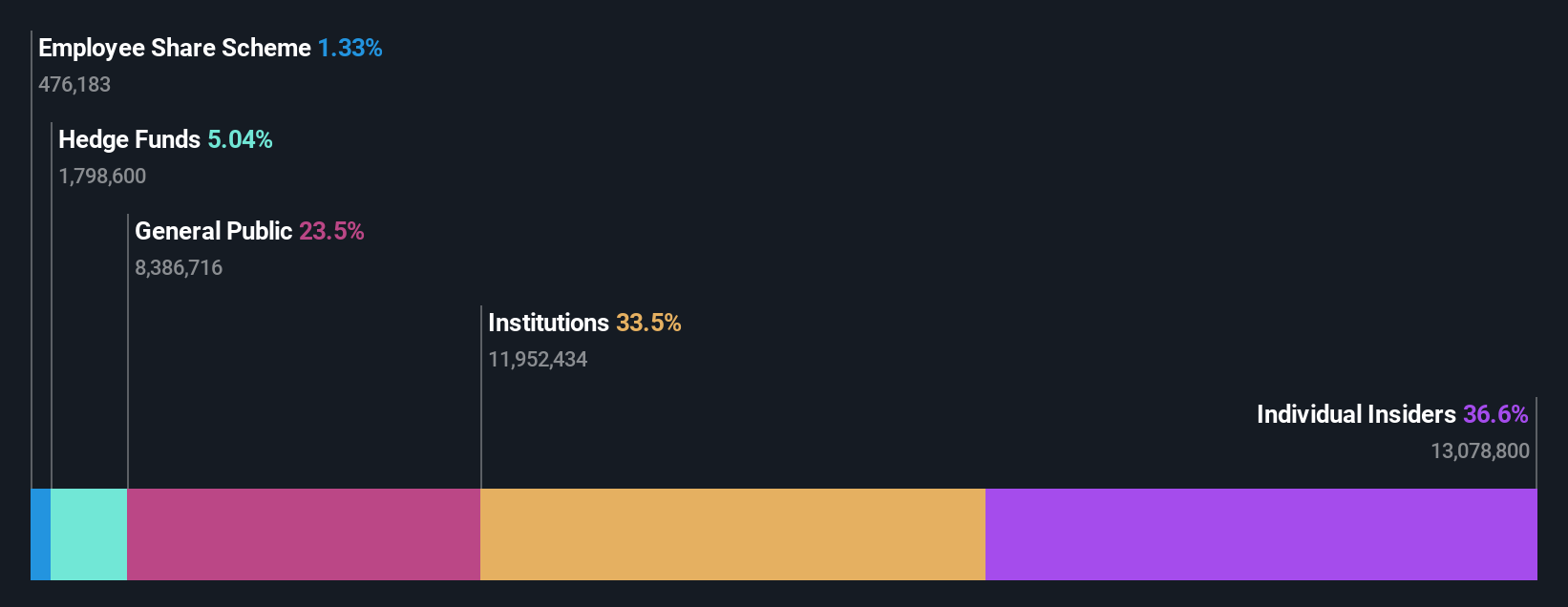

Insider Ownership: 17.8%

Revenue Growth Forecast: 55.6% p.a.

Naruida Technology exhibits strong growth potential with forecasted revenue and earnings growth rates of 55.6% and 67.53% per year, respectively, outpacing the broader Chinese market. Despite a decline in profit margins from 39.5% to 23.8%, the company maintains high-quality earnings with significant non-cash contributions. Recent private placements indicate strategic insider confidence, though no substantial insider trading has been reported over the past three months, suggesting stable internal sentiment toward future prospects.

- Dive into the specifics of Naruida Technology here with our thorough growth forecast report.

- Our valuation report here indicates Naruida Technology may be overvalued.

Hangzhou Zhongtai Cryogenic Technology (SZSE:300435)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Zhongtai Cryogenic Technology Corporation develops, designs, manufactures, and sells cryogenic equipment in China with a market cap of CN¥4.53 billion.

Operations: The company's revenue primarily comes from its activities in the development, design, manufacturing, and sale of cryogenic equipment within China.

Insider Ownership: 12.3%

Revenue Growth Forecast: 15.1% p.a.

Hangzhou Zhongtai Cryogenic Technology is trading at a good value, 23.8% below its estimated fair value. Its earnings are expected to grow significantly at 47.54% annually, surpassing the Chinese market average. The company completed a share buyback of CNY 69.33 million recently, indicating strategic financial management despite an unstable dividend record and low forecasted return on equity of 17.6%. Revenue growth is projected at 15.1%, slightly above the market rate.

- Click to explore a detailed breakdown of our findings in Hangzhou Zhongtai Cryogenic Technology's earnings growth report.

- The analysis detailed in our Hangzhou Zhongtai Cryogenic Technology valuation report hints at an deflated share price compared to its estimated value.

LITALICO (TSE:7366)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LITALICO Inc. operates schools for learning and preschools in Japan, with a market cap of ¥39.28 billion.

Operations: The company generates revenue from its operations of schools for learning and preschools in Japan.

Insider Ownership: 36.8%

Revenue Growth Forecast: 14.0% p.a.

LITALICO is trading at a substantial discount, 52.1% below its estimated fair value. The company's earnings are projected to grow at 21.15% annually, outpacing the Japanese market average of 8.2%. Despite recent volatility in share price and lower profit margins compared to last year, LITALICO's revenue growth forecast of 14% remains above the market rate. Recent leadership changes and an increased dividend forecast reflect ongoing strategic adjustments aimed at enhancing shareholder value.

- Take a closer look at LITALICO's potential here in our earnings growth report.

- Our valuation report unveils the possibility LITALICO's shares may be trading at a discount.

Next Steps

- Dive into all 1475 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Naruida Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688522

Naruida Technology

Manufactures and sells polarized multifunctional active phased array radars in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives