- Japan

- /

- Consumer Services

- /

- TSE:7366

June 2024 Spotlight On High Insider Ownership Growth Stocks In Japan

Reviewed by Simply Wall St

Amid a backdrop of mixed weekly returns and a strengthening yen posing challenges for Japanese exporters, the Japanese market continues to exhibit resilience, particularly in the services sector. This environment underscores the potential value of focusing on growth companies with high insider ownership, which may offer unique advantages in navigating current market dynamics.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 26.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 91.1% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 54.1% |

| freee K.K (TSE:4478) | 24% | 80.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

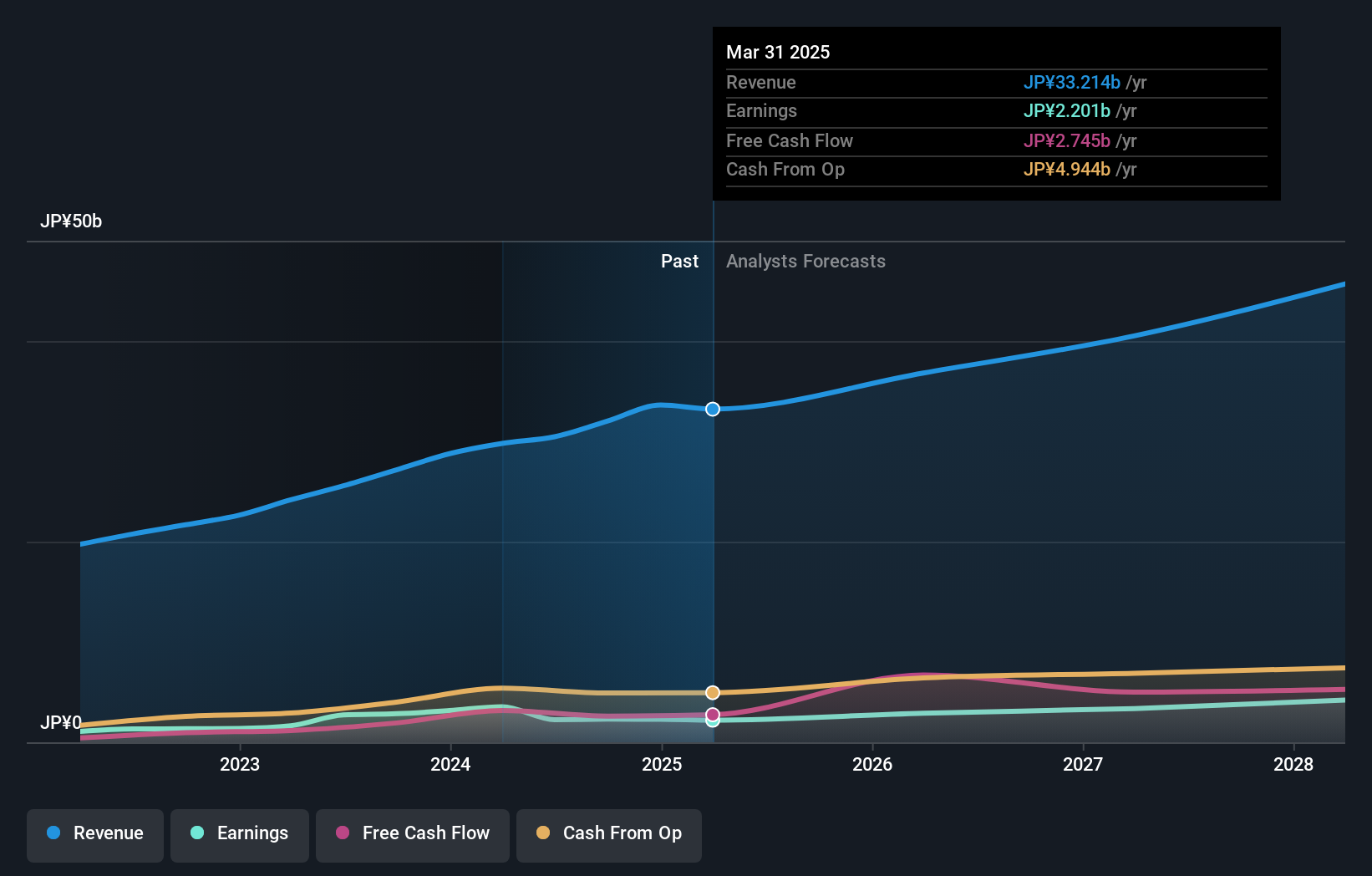

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan, with a market capitalization of approximately ¥117.45 billion.

Operations: The firm's platforms focus on recruitment and healthcare services in Japan.

Insider Ownership: 34%

Earnings Growth Forecast: 28.7% p.a.

Medley, a Japanese company with high insider ownership, is poised for substantial growth. Its earnings are expected to increase by 28.7% annually over the next three years, outpacing the broader Japanese market significantly. Recent corporate actions include raising its fiscal year guidance substantially above previous expectations and expanding internationally with a new office in the Philippines to support global growth. However, potential investors should note its highly volatile share price in recent months.

- Click here to discover the nuances of Medley with our detailed analytical future growth report.

- According our valuation report, there's an indication that Medley's share price might be on the expensive side.

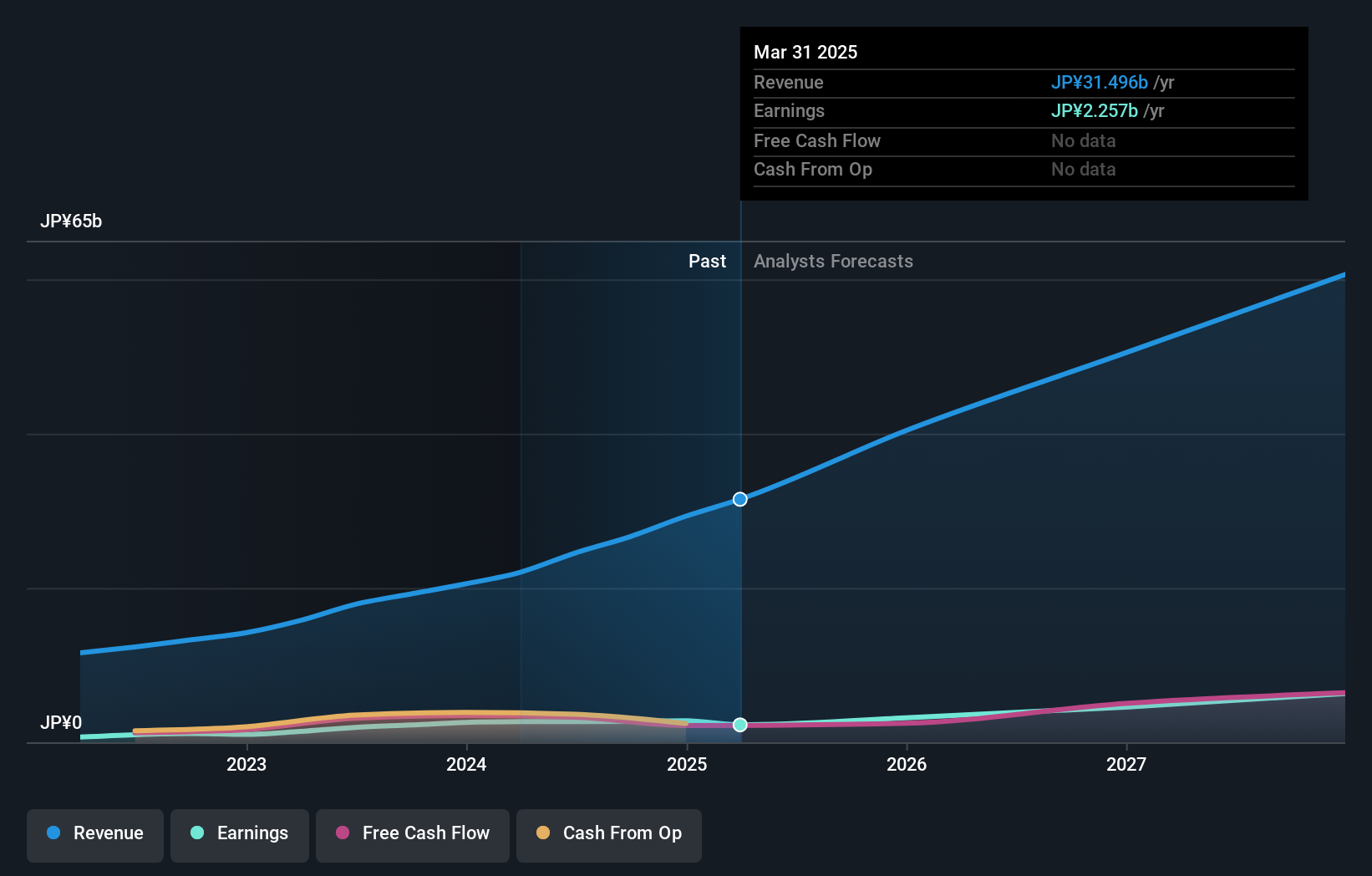

LITALICO (TSE:7366)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LITALICO Inc. operates schools for learning and preschools in Japan, with a market capitalization of approximately ¥60.13 billion.

Operations: The company generates its revenue primarily through educational services in Japan.

Insider Ownership: 37.7%

Earnings Growth Forecast: 12.6% p.a.

LITALICO, a Japanese growth company with high insider ownership, trades at 36.2% below its estimated fair value, suggesting potential undervaluation. The company's earnings and revenue are both on an upward trajectory, with earnings having increased by 115.6% last year and expected to grow by 12.56% annually. Revenue forecasts also outpace the broader Japanese market significantly at 13.8% annually. Recently, LITALICO raised its fiscal year guidance and increased dividends, reflecting confidence in sustained growth despite not reaching top-tier growth rates.

- Take a closer look at LITALICO's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of LITALICO shares in the market.

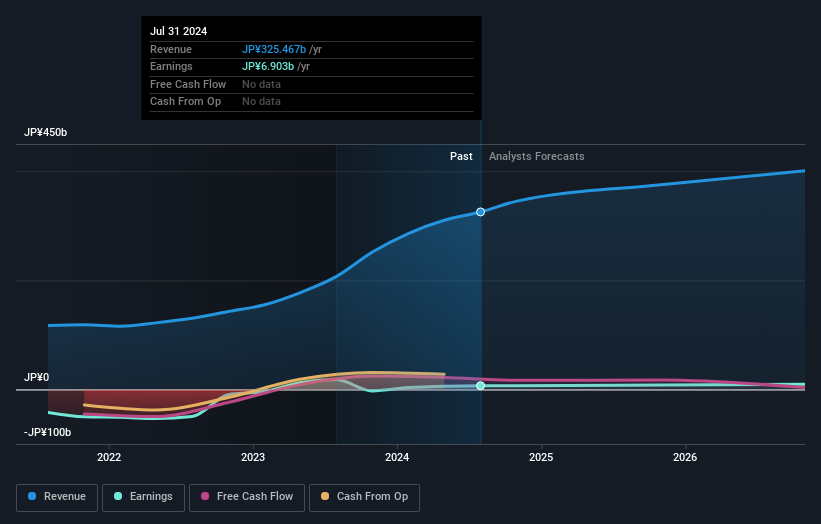

H.I.S (TSE:9603)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: H.I.S. Co., Ltd. operates globally as a travel agency with a market capitalization of approximately ¥135.83 billion.

Operations: The company earns its revenue primarily from providing travel agency services globally.

Insider Ownership: 32.9%

Earnings Growth Forecast: 20.2% p.a.

H.I.S. Co., Ltd., a Japanese growth company with substantial insider ownership, is trading at 11.5% below its estimated fair value, indicating potential undervaluation. While the company's return on equity is projected to be modest at 11.8%, its earnings are expected to grow by 20.2% annually, outpacing the Japanese market forecast of 8.7%. However, its debt is poorly covered by operating cash flow, and one-off items have impacted financial results negatively. Revenue growth projections stand at 7.2% per year, also above the market average of 4.1%.

- Unlock comprehensive insights into our analysis of H.I.S stock in this growth report.

- The valuation report we've compiled suggests that H.I.S' current price could be inflated.

Next Steps

- Dive into all 103 of the Fast Growing Japanese Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7366

Reasonable growth potential slight.