CURVES HOLDINGS Co., Ltd. (TSE:7085) will pay a dividend of ¥6.00 on the 24th of November. This makes the dividend yield 1.6%, which is above the industry average.

View our latest analysis for CURVES HOLDINGS

CURVES HOLDINGS' Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, prior to this announcement, CURVES HOLDINGS' dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 29.2%. If the dividend continues along recent trends, we estimate the payout ratio will be , which is in the range that makes us comfortable with the sustainability of the dividend.

CURVES HOLDINGS Doesn't Have A Long Payment History

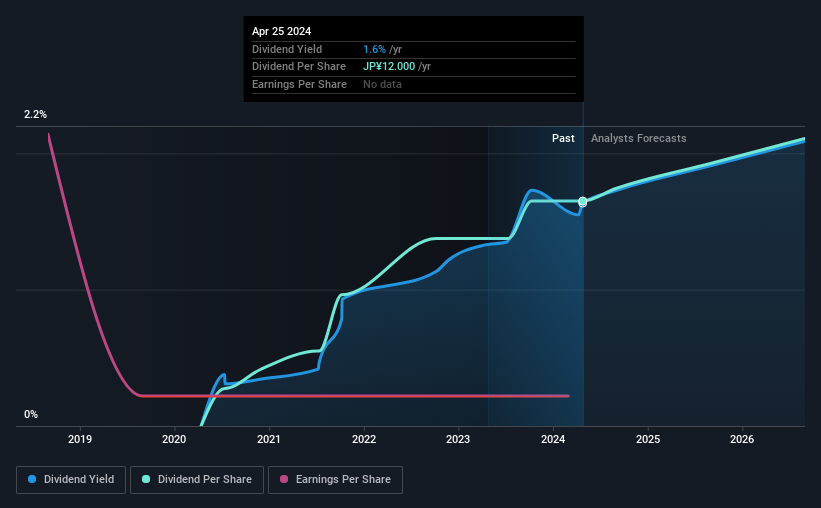

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2020, the dividend has gone from ¥2.00 total annually to ¥12.00. This means that it has been growing its distributions at 57% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. Earnings per share has been sinking by 11% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Our Thoughts On CURVES HOLDINGS' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for CURVES HOLDINGS that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7085

CURVES HOLDINGS

Engages in the operation and management of fitness club for women under the Curves brand name in Japan and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026