- Japan

- /

- Hospitality

- /

- TSE:4681

Resorttrust (TSE:4681): Evaluating Valuation Ahead of Key Board Meeting on Buybacks, Forecasts, and Dividends

Reviewed by Simply Wall St

Resorttrust (TSE:4681) has drawn investor attention following the announcement of a board meeting set for November 13. During this meeting, the company will address treasury share disposal, possible forecast revisions, and a dividend payment from retained earnings.

See our latest analysis for Resorttrust.

Resorttrust’s upcoming board meeting is fueling speculation, and that is showing up in the price action: the share price climbed 3.47% in the latest trading day and is now up 23.51% year-to-date. Investors with a long-term focus are also in solid territory, with a stellar 1-year total shareholder return of 33.09% and 150.13% over five years. This suggests momentum is building on both short and long horizons.

If news like Resorttrust’s has you thinking about what else could be on the move, this could be a prime moment to broaden your horizons and discover fast growing stocks with high insider ownership

Yet with shares surging this year and trading close to analyst price targets, investors are left wondering whether Resorttrust is still undervalued and primed for further gains, or if the market has already accounted for its growth story.

Price-to-Earnings of 19.4x: Is it justified?

Resorttrust’s shares last traded at ¥1,907, which equates to a price-to-earnings (P/E) ratio of 19.4x. This is notably below both the peer group and industry averages, pointing to a relative undervaluation.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of current earnings. In sectors like hospitality, where growth rates and profit margins can fluctuate, this metric offers a quick read on market optimism or skepticism toward future earnings potential.

Right now, Resorttrust trades at a significant discount versus peers (30.1x) and the broader industry average (24x). This could suggest the market is yet to fully price in its strong recent earnings momentum. Compared to the estimated fair P/E multiple of 25.7x, the market may have room to re-rate these shares if the company continues to deliver.

Explore the SWS fair ratio for Resorttrust

Result: Price-to-Earnings of 19.4x (UNDERVALUED)

However, slower revenue growth or a downturn in profits could quickly dampen enthusiasm and lead investors to reassess Resorttrust’s current valuation.

Find out about the key risks to this Resorttrust narrative.

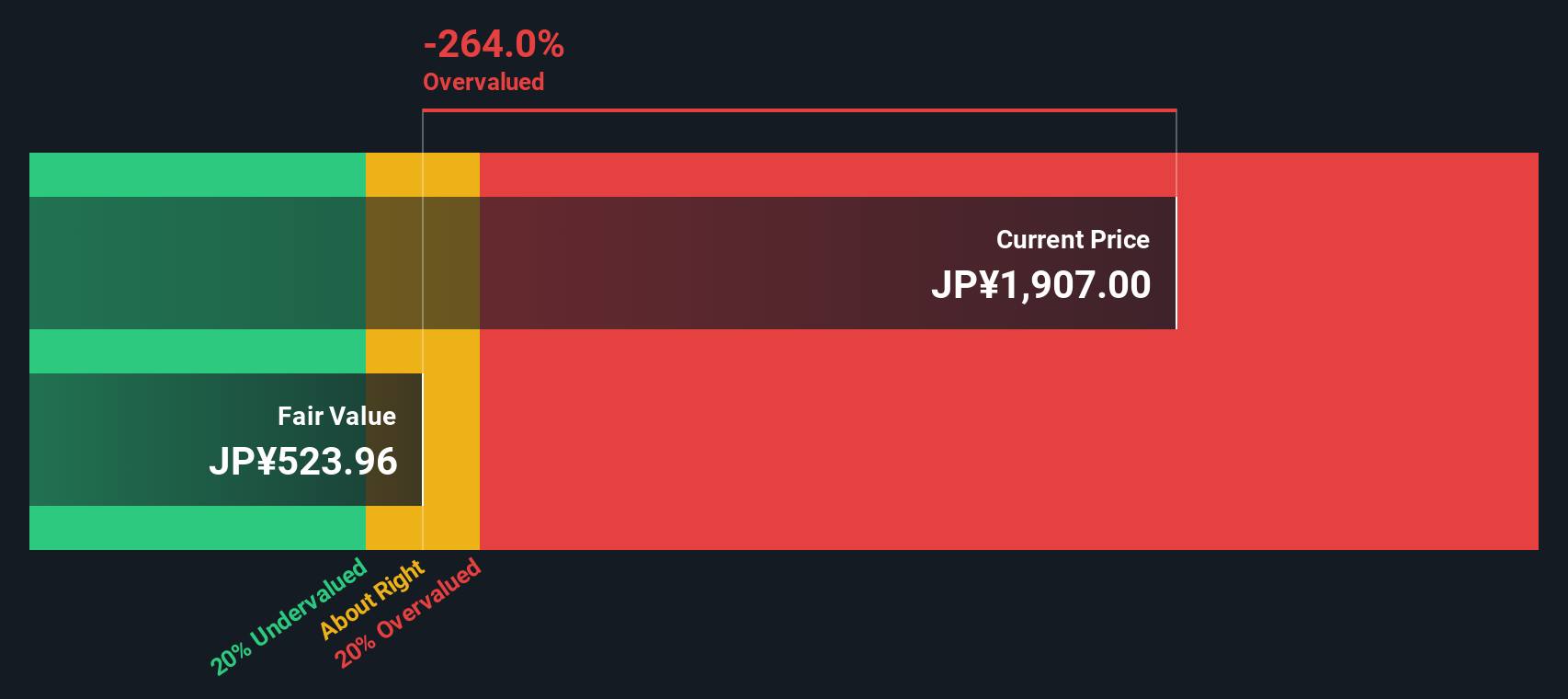

Another View: Discounted Cash Flow Suggests Overvaluation

While Resorttrust appears undervalued compared to peers and industry averages, our DCF model offers a different perspective. According to this cash flow calculation, the shares trade well above the model’s fair value estimate. Could the market be overlooking risks, or is the model too conservative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Resorttrust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Resorttrust Narrative

If you have a different perspective or want to independently examine the numbers, you can quickly assemble your own take on Resorttrust in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Resorttrust.

Looking for more investment ideas?

Don’t let your next big opportunity slip away. Tap into more smart investment moves with these unique stock ideas, curated by Simply Wall Street’s unbeatable screener tools.

- Capture consistent income and stability by reviewing these 16 dividend stocks with yields > 3%—with yields above 3%—that prove strong dividend-paying stocks are still going strong.

- Spot groundbreaking innovations before the mainstream catches on and review these 26 quantum computing stocks reshaping industries with cutting-edge quantum computing breakthroughs.

- Unlock potential returns in tomorrow’s technologies by scanning these 25 AI penny stocks fueling rapid growth in artificial intelligence advancements across the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4681

Flawless balance sheet with proven track record.

Market Insights

Community Narratives