- Japan

- /

- Healthtech

- /

- TSE:4480

3 Japanese Growth Stocks With Up To 35% Insider Ownership

Reviewed by Simply Wall St

Japan’s stock markets have recently experienced significant gains, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%, buoyed by optimism from China’s stimulus announcements and dovish commentary from the Bank of Japan. This positive backdrop creates an opportune environment to explore growth companies with high insider ownership, which can often signal strong confidence in a company's future prospects. In this article, we will examine three Japanese growth stocks that boast up to 35% insider ownership, highlighting their potential in these favorable market conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

| freee K.K (TSE:4478) | 23.9% | 74.1% |

Underneath we present a selection of stocks filtered out by our screen.

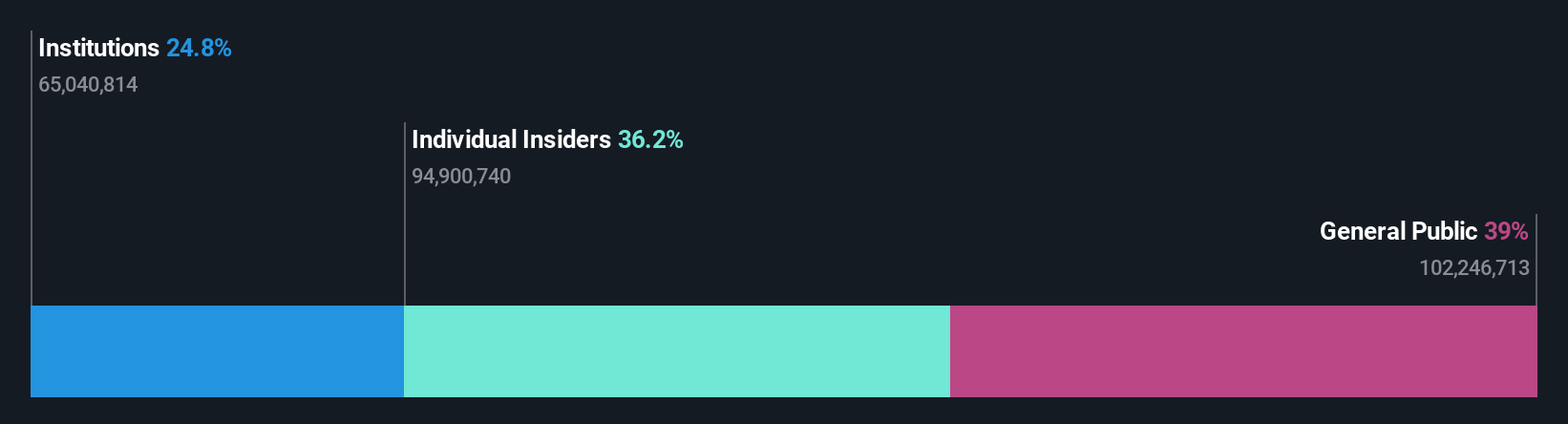

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

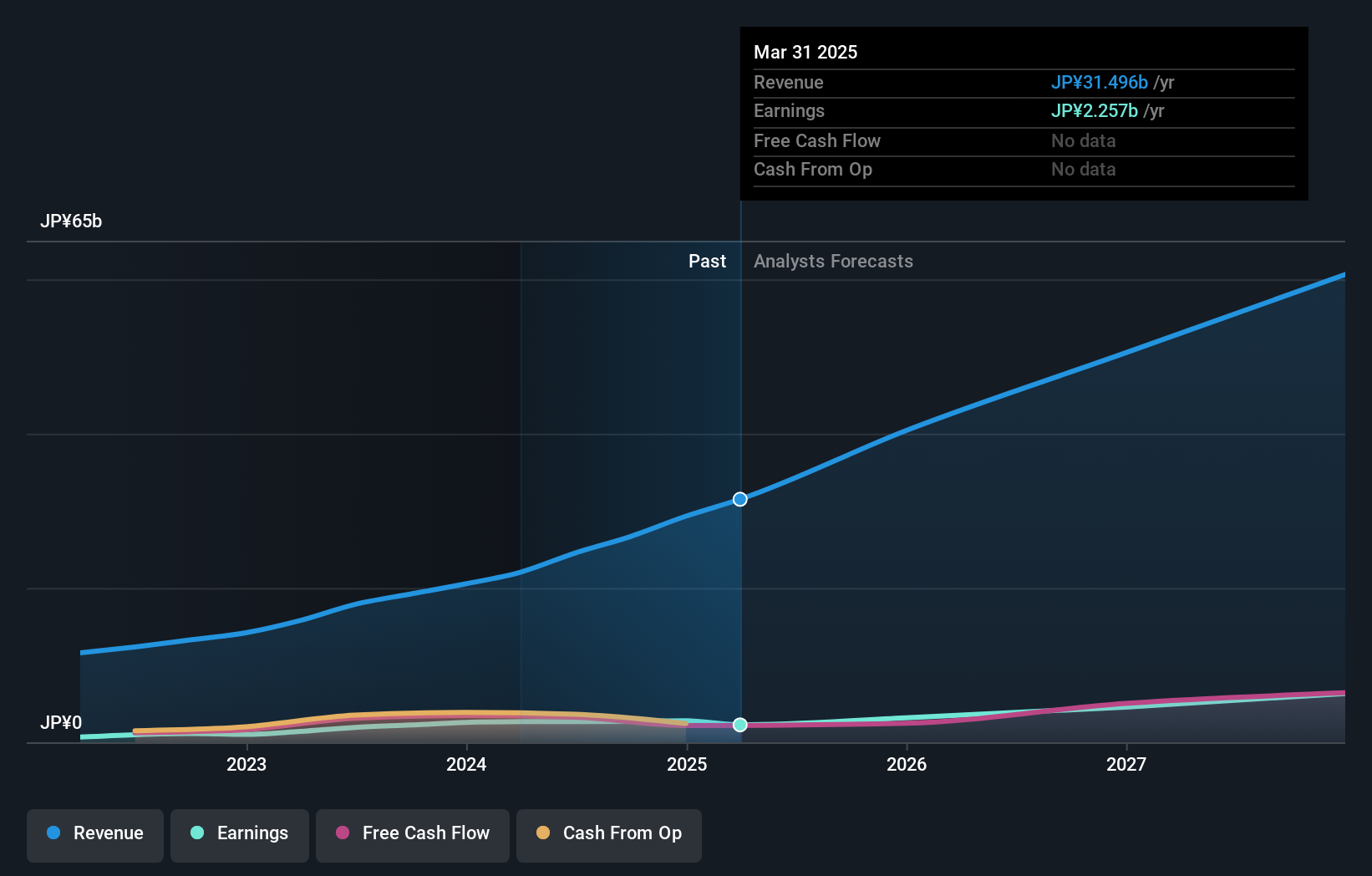

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market cap of ¥125.07 billion.

Operations: Medley generates revenue from its New Services segment (¥573 million), Medical Platform Business (¥6.09 billion), and Human Resource Platform Business (¥17.87 billion).

Insider Ownership: 34%

Medley, Inc. demonstrates promising growth potential with its earnings forecasted to rise 30.36% annually over the next three years, significantly outpacing the Japanese market's average. Despite a highly volatile share price recently, Medley trades at 51.2% below its estimated fair value, suggesting potential undervaluation opportunities for investors. Recent strategic expansions in the U.S., particularly through Jobley's healthcare recruitment services across 39 states, highlight Medley's focus on leveraging growth avenues amidst industry challenges.

- Dive into the specifics of Medley here with our thorough growth forecast report.

- According our valuation report, there's an indication that Medley's share price might be on the expensive side.

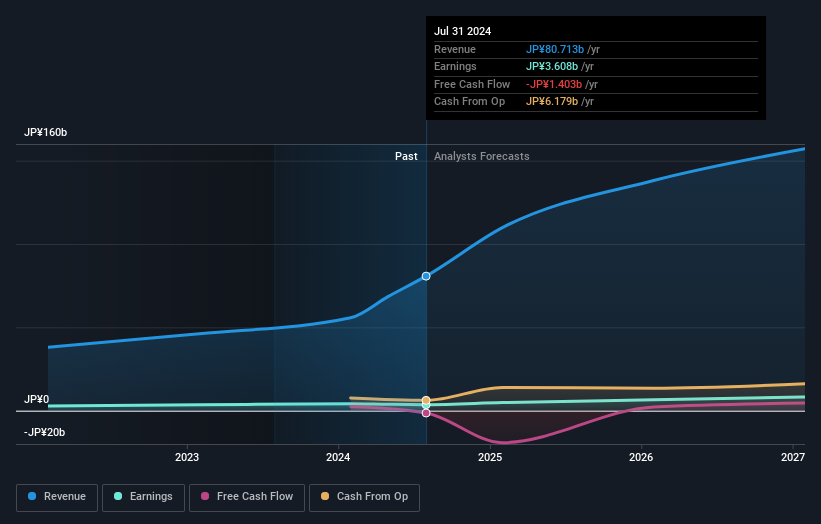

Round One (TSE:4680)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥291.88 billion.

Operations: The company generates revenue primarily from Japan (¥99.03 billion) and the United States of America (¥62.90 billion).

Insider Ownership: 35.2%

Round One Corporation exhibits growth potential with earnings projected to increase by 10.35% annually, surpassing the Japanese market average of 8.7%. Despite its volatile share price, it trades at 58.1% below estimated fair value, indicating possible undervaluation. Recent sales announcements reveal significant revenue from the U.S., with ¥191.79 billion year-to-date, underscoring its international market strength and expansion efforts amidst stable insider ownership levels over recent months.

- Take a closer look at Round One's potential here in our earnings growth report.

- Our valuation report unveils the possibility Round One's shares may be trading at a discount.

GENDA (TSE:9166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GENDA Inc., with a market cap of ¥210.36 billion, operates amusement arcades primarily under the GiGO brand in Japan through its subsidiaries.

Operations: The company's revenue segments include amusement arcades operated under the GiGO brand in Japan through its subsidiaries.

Insider Ownership: 19.3%

GENDA Inc. shows strong growth potential with earnings expected to rise by 20.9% annually, outpacing the Japanese market's 8.7%. However, its revenue growth forecast of 13.4% per year is slower than the ideal 20%. The company has experienced high share price volatility and lower profit margins (4.5%) compared to last year (7.5%). Recent events include a follow-on equity offering of 6,180,000 shares and an upcoming Q2 earnings report on September 09, 2024.

- Click here to discover the nuances of GENDA with our detailed analytical future growth report.

- Our expertly prepared valuation report GENDA implies its share price may be too high.

Turning Ideas Into Actions

- Explore the 100 names from our Fast Growing Japanese Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4480

Medley

Operates platforms for recruitment and medical businesses in Japan and the United States.

Exceptional growth potential with excellent balance sheet.