- Japan

- /

- Hospitality

- /

- TSE:3395

Asian Market's Top 3 Stocks Trading Below Estimated Value In April 2025

Reviewed by Simply Wall St

Amid heightened global trade tensions and economic uncertainty, Asian markets have not been immune to the volatility triggered by recent tariff announcements. As investors navigate these turbulent waters, identifying stocks trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Suzhou TFC Optical Communication (SZSE:300394) | CN¥63.56 | CN¥126.04 | 49.6% |

| Taiyo Yuden (TSE:6976) | ¥1794.00 | ¥3568.69 | 49.7% |

| Aoyama Zaisan Networks CompanyLimited (TSE:8929) | ¥1643.00 | ¥3255.20 | 49.5% |

| West Holdings (TSE:1407) | ¥1365.00 | ¥2687.44 | 49.2% |

| KeePer Technical Laboratory (TSE:6036) | ¥3335.00 | ¥6533.47 | 49% |

| Rockchip Electronics (SHSE:603893) | CN¥147.02 | CN¥291.40 | 49.5% |

| Maoyan Entertainment (SEHK:1896) | HK$6.28 | HK$12.35 | 49.1% |

| SpiderPlus (TSE:4192) | ¥374.00 | ¥744.47 | 49.8% |

| Qi An Xin Technology Group (SHSE:688561) | CN¥28.10 | CN¥55.04 | 48.9% |

| TORIDOLL Holdings (TSE:3397) | ¥3712.00 | ¥7306.03 | 49.2% |

We'll examine a selection from our screener results.

PI Advanced Materials (KOSE:A178920)

Overview: PI Advanced Materials Co., Ltd. manufactures and sells polyimide-based materials in South Korea, with a market cap of ₩458.41 billion.

Operations: PI Advanced Materials Co., Ltd. generates revenue through the manufacture and sale of polyimide-based materials in South Korea.

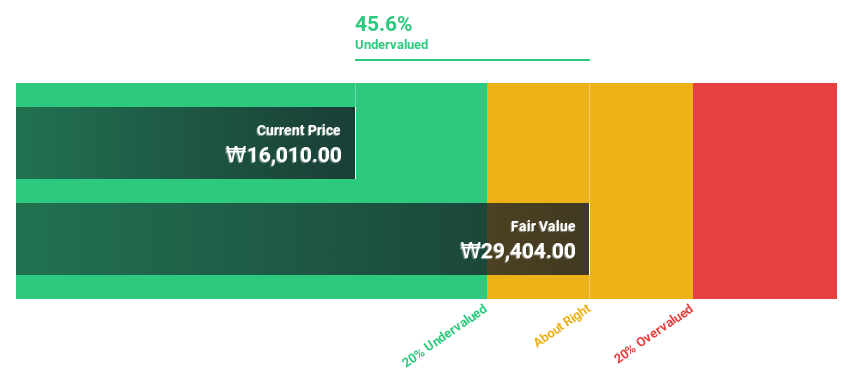

Estimated Discount To Fair Value: 46.9%

PI Advanced Materials is trading at 46.9% below its estimated fair value of ₩29,405.26, despite a profitable turnaround with net income of ₩23.38 billion for 2024 compared to a loss the previous year. Earnings are expected to grow significantly at 34.2% annually, outpacing the Korean market average of 22.4%. Although revenue growth is moderate at 10.5%, it exceeds market expectations and supports the stock's undervaluation based on cash flows analysis.

- Our growth report here indicates PI Advanced Materials may be poised for an improving outlook.

- Dive into the specifics of PI Advanced Materials here with our thorough financial health report.

Samart Aviation Solutions (SET:SAV)

Overview: Samart Aviation Solutions Public Company Limited is an investment holding company that offers air traffic control services in Cambodia, Laos, and Thailand, with a market cap of THB91.52 billion.

Operations: The company generates revenue from its Utilities and Transportations segment, amounting to THB1.76 billion.

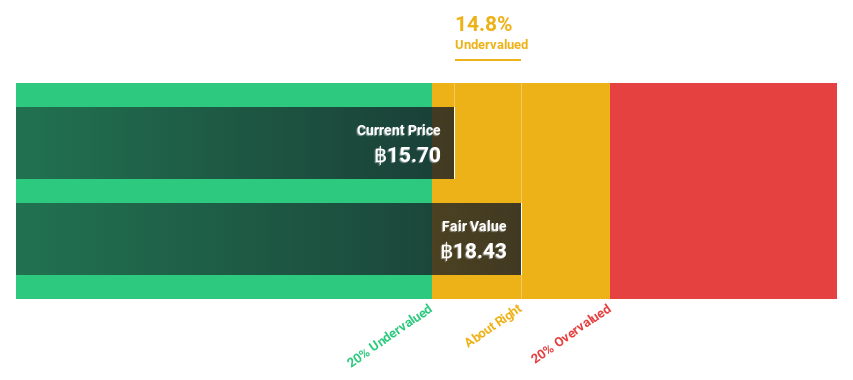

Estimated Discount To Fair Value: 15.7%

Samart Aviation Solutions is trading at THB 14.3, slightly below its fair value estimate of THB 16.97, indicating a modest undervaluation based on cash flows. Despite earnings growth of 71% last year and projected annual growth of 14.9%, the dividend yield of 7.69% isn't well covered by earnings or free cash flows. Recent financials show increased sales and net income for fiscal year 2024, with revenue reaching THB 1.76 billion from THB 1.65 billion previously.

- In light of our recent growth report, it seems possible that Samart Aviation Solutions' financial performance will exceed current levels.

- Take a closer look at Samart Aviation Solutions' balance sheet health here in our report.

Saint Marc Holdings (TSE:3395)

Overview: Saint Marc Holdings Co., Ltd. operates restaurant and cafe businesses in Japan, with a market cap of ¥37.33 billion.

Operations: The company generates revenue from its café segment amounting to ¥26.83 billion and its restaurant segment totaling ¥39.49 billion.

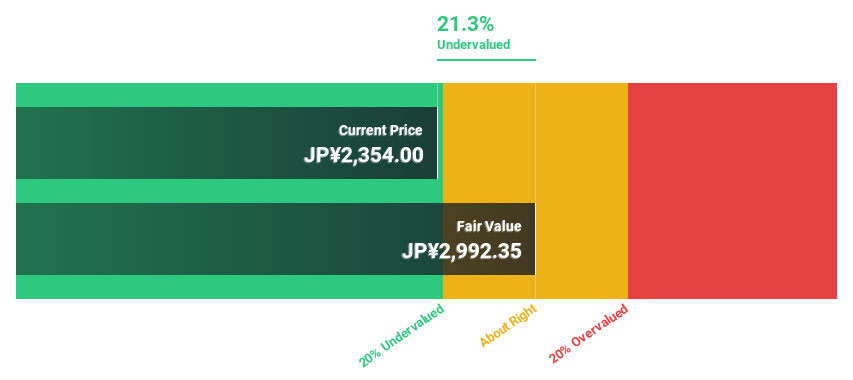

Estimated Discount To Fair Value: 38.6%

Saint Marc Holdings, currently trading at ¥2,177, is undervalued with a fair value estimate of ¥3,545.2. Its earnings are forecast to grow significantly at 32.3% annually over the next three years, outpacing the Japanese market's growth rate. The company has completed a share buyback program worth ¥6.5 billion to enhance capital efficiency and flexibility. Despite large one-off items impacting results, it maintains a reliable dividend yield of 2.39%.

- The analysis detailed in our Saint Marc Holdings growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Saint Marc Holdings.

Make It Happen

- Reveal the 266 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Saint Marc Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3395

Saint Marc Holdings

Through its subsidiaries, engages in the restaurant and cafe business in Japan.

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives