- Japan

- /

- Hospitality

- /

- TSE:3395

Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amid escalating global trade tensions and heightened economic uncertainty, Asian markets are navigating a complex landscape influenced by U.S. tariff policies and their ripple effects. In such volatile times, growth companies with high insider ownership can offer unique insights into market confidence and potential resilience, as insiders often have a deeper understanding of their company's prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| UTour Group (SZSE:002707) | 23.5% | 32.7% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Shenzhen Anche Technologies (SZSE:300572)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Anche Technologies Co., Ltd. offers motor vehicle inspection solutions in China and has a market cap of CN¥4.04 billion.

Operations: Shenzhen Anche Technologies generates revenue through its motor vehicle inspection solutions in China.

Insider Ownership: 28.8%

Shenzhen Anche Technologies is trading at 53.8% below its estimated fair value, with earnings expected to grow significantly at 105.41% per year. Forecasts suggest revenue will increase by 43.3% annually, outpacing the Chinese market's growth rate of 12.5%. While profitability is anticipated within three years, return on equity remains low at an estimated 3.7%. No substantial insider trading activity has been reported in the past three months.

- Unlock comprehensive insights into our analysis of Shenzhen Anche Technologies stock in this growth report.

- Our valuation report unveils the possibility Shenzhen Anche Technologies' shares may be trading at a premium.

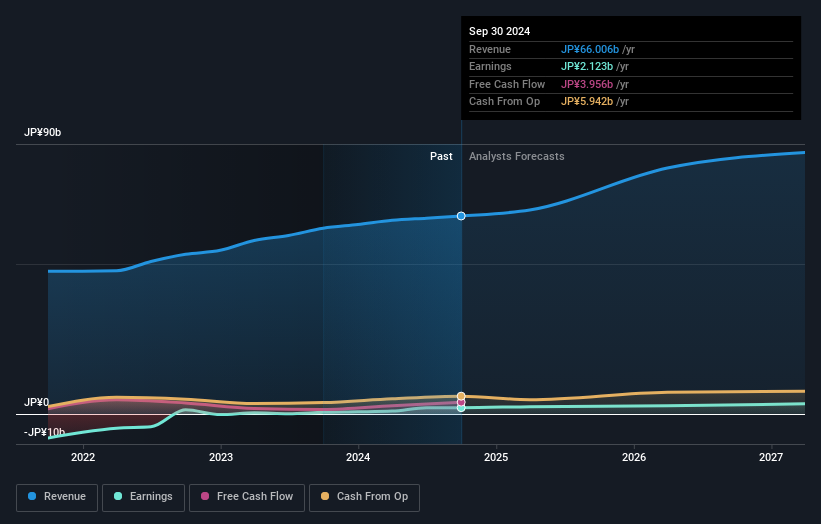

Saint Marc Holdings (TSE:3395)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saint Marc Holdings Co., Ltd. operates in the restaurant and cafe industry in Japan through its subsidiaries, with a market capitalization of ¥39.73 billion.

Operations: The company's revenue is primarily derived from its café segment, which generates ¥26.83 billion, and its restaurant segment, contributing ¥39.49 billion.

Insider Ownership: 31.3%

Saint Marc Holdings is trading at 35.1% below its estimated fair value, with earnings expected to grow significantly at 32.3% annually, surpassing the Japanese market's growth rate of 7.8%. Revenue is forecast to grow by 18.1% per year, outpacing the market's 4.3%. The company recently completed a share buyback program for ¥6.5 billion to enhance capital efficiency, though no substantial insider trading activity has been reported in recent months.

- Get an in-depth perspective on Saint Marc Holdings' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Saint Marc Holdings shares in the market.

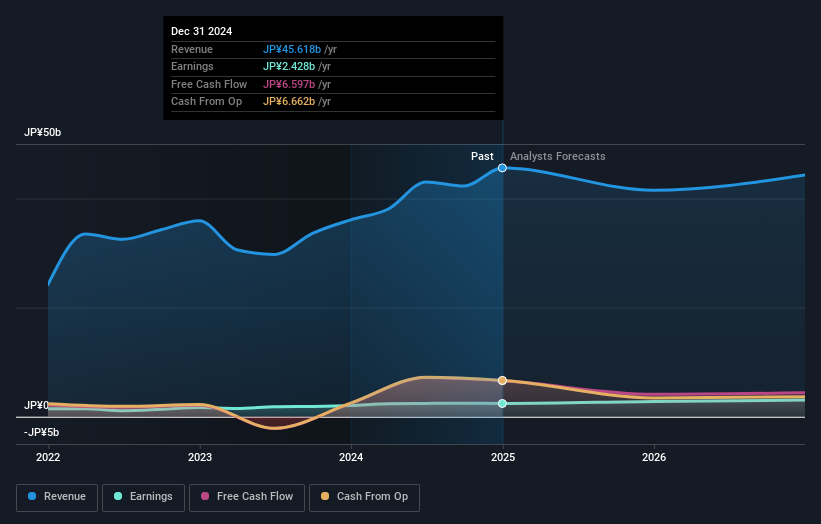

Aoyama Zaisan Networks CompanyLimited (TSE:8929)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aoyama Zaisan Networks Company, Limited offers property consulting solutions to individual and institutional asset owners in Japan, with a market cap of ¥43.51 billion.

Operations: The company generates revenue through property consulting solutions for both individual and institutional asset owners in Japan.

Insider Ownership: 13%

Aoyama Zaisan Networks Company Limited is trading at 44.8% below its estimated fair value, with earnings forecast to grow at 13.1% annually, outpacing the Japanese market's growth rate of 7.8%. Revenue is expected to increase by 5.6% per year, slightly above the market average of 4.3%. The company pays a reliable dividend yield of 2.81%, and there has been no substantial insider trading activity in recent months.

- Take a closer look at Aoyama Zaisan Networks CompanyLimited's potential here in our earnings growth report.

- The analysis detailed in our Aoyama Zaisan Networks CompanyLimited valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Discover the full array of 650 Fast Growing Asian Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3395

Saint Marc Holdings

Through its subsidiaries, engages in the restaurant and cafe business in Japan.

Good value with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives